Analysts Anticipate Growth for QQQM ETF and Key Holdings

In our analysis of ETFs at ETF Channel, we have compared the trading prices of each holding against the average analyst 12-month target prices. This allows us to calculate an implied analyst target price for the Invesco NASDAQ 100 ETF (Symbol: QQQM), which stands at $224.45 per unit.

Potential Upside vs. Current Trading Price

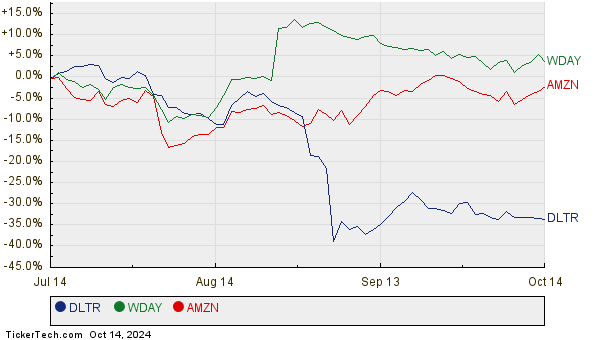

As QQQM trades around $203.03 per unit, analysts predict a potential upside of 10.55%, based on the average targets of its underlying holdings. Notably, three underlying stocks show significant upside potential: Dollar Tree Inc (Symbol: DLTR), Workday Inc (Symbol: WDAY), and Amazon.com Inc (Symbol: AMZN). Currently, DLTR’s share price is $68.94, with an average target of $82.88, suggesting a 20.21% increase. Workday is sitting at $240.90, and analysts project it could rise 20.08% to $289.28. For Amazon, which trades at $188.82, the target price of $225.22 indicates a potential increase of 19.28%. Below is a price history chart reflecting the performance of DLTR, WDAY, and AMZN:

Breakdown of Analyst Target Prices

Together, DLTR, WDAY, and AMZN constitute 5.41% of the Invesco NASDAQ 100 ETF. The following table summarizes their recent prices and analyst targets:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco NASDAQ 100 ETF | QQQM | $203.03 | $224.45 | 10.55% |

| Dollar Tree Inc | DLTR | $68.94 | $82.88 | 20.21% |

| Workday Inc | WDAY | $240.90 | $289.28 | 20.08% |

| Amazon.com Inc | AMZN | $188.82 | $225.22 | 19.28% |

Investor Insights Needed

Investors may wonder if analysts’ targets are justified or overly optimistic concerning these stocks. Understanding if recent company developments support these predictions is crucial. A high target price relative to a stock’s current trading price can indicate optimism. However, this may also lead to target price downgrades if the estimates do not align with market realities. Further research is essential to inform investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Oversold Dividend Stocks

• Institutional Holders of SRSC

• BCM market cap history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.