CBRE Group Set to Release Q3 Earnings Amid Strong Growth Trends

CBRE Group, Inc. (CBRE), based in Dallas, Texas, is the largest commercial real estate services and investment firm in the world, with a market capitalisation of $37.4 billion. The company provides a wide range of services including property management, valuation, real estate investment, and advisory services across various sectors such as offices, data centers, multi-family housing, hotels, gaming, and retail. Investors are keenly awaiting CBRE’s fiscal third-quarter earnings report for 2024, which is scheduled for release before market hours on Thursday, October 24.

Analysts Anticipate Strong Earnings Growth

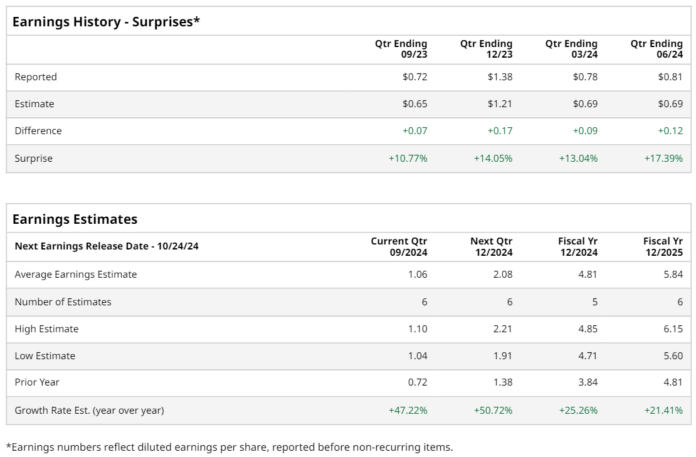

As the earnings announcement nears, analysts predict CBRE will report earnings of $1.06 per share on a diluted basis. This would represent a remarkable increase of 47.2% compared to last year’s $0.72 per share. Historically, CBRE has exceeded Wall Street’s earnings per share (EPS) estimates over the last four quarters, cementing a pattern of robust performance.

Long-Term Projections Show Continued Growth

For the entire fiscal year, analysts project CBRE’s EPS to reach $4.81, reflecting a 25.3% increase from $3.84 in 2023. Looking ahead, the EPS is expected to grow by 21.4% year-over-year to $5.84 in fiscal 2025, suggesting a sustained positive trajectory.

Stock Performance Exceeds Market Benchmarks

Over the past year, CBRE’s stock has significantly outperformed the S&P 500, which has seen a 32.9% gain. CBRE shares have surged by 65.1%, highlighting its resilient market presence. The stock has also outpaced the Real Estate Select Sector SPDR Fund (XLRE), which increased by 24.8% during the same period.

Strong Business Growth Drives Performance

CBRE has witnessed impressive growth in its Global Workplace Solutions (GWS) and leasing segments. The GWS sector particularly benefitted from substantial new client acquisitions and expansions. Additionally, demand for U.S. office leasing, particularly in New York, contributed positively to revenue growth.

Recent Earnings Report Highlights

On July 25, after announcing its Q2 results, CBRE shares jumped over 9%. The firm’s adjusted EPS of $0.81 surpassed Wall Street’s expectations of $0.69, even though revenue of $8.4 billion fell slightly below the forecast of $8.5 billion. For the full year, CBRE projects its adjusted EPS to lie between $4.70 and $4.90.

Analysts’ Outlook Remains Positive

The consensus view among analysts regarding CBRE’s stock is notably optimistic, generally rated as a “Moderate Buy.” Of the ten analysts that cover the stock, five recommend a “Strong Buy,” while the remaining five suggest a “Hold.” While CBRE is currently trading above its average price target of $118.67, the highest target of $132 indicates a potential upside of 8.3%.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.