Colgate-Palmolive Preps for Q3 Earnings: Analysts See Growth Ahead

With a market cap of $82.1 billion, Colgate-Palmolive Company (CL) stands as a leader in household, healthcare, and personal care products, especially in oral care hygiene. Based in New York, Colgate also offers pet food through its Hill’s Pet Nutrition subsidiary. The company plans to announce its fiscal Q3 earnings before the market opens on Friday, Oct. 25.

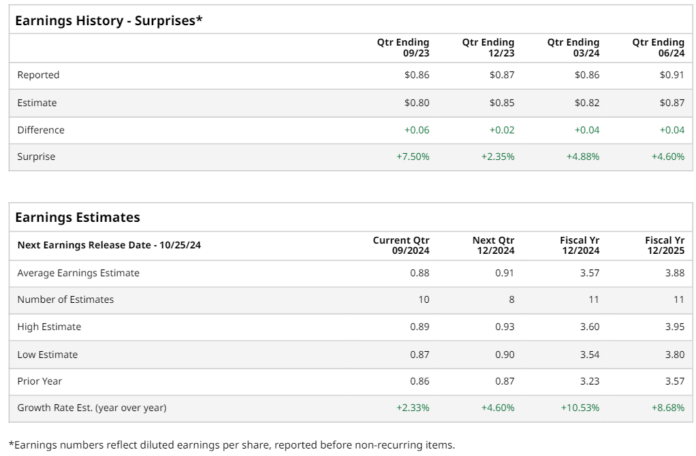

In anticipation of this announcement, analysts project that Colgate will report a profit of $0.88 per share, reflecting a 2.3% increase from $0.86 per share during the same quarter last year. Notably, Colgate has surpassed Wall Street’s earnings estimates for four consecutive quarters, reporting a 4.6% beat in Q2.

For the full fiscal 2024, expectations are set that CL will achieve an EPS of $3.57, which marks a 10.5% rise from the $3.23 reported in fiscal 2023. Looking further ahead, EPS forecasts indicate an 8.7% increase to $3.88 in fiscal 2025.

Over the last year, CL shares have surged 45.4%, significantly outpacing the S&P 500 Index’s 32.9% and the Consumer Staples Select Sector SPDR Fund’s (XLP) 21.9% gains.

CL’s strong performance can be linked to steady product demand, effective pricing strategies, and considerable margin improvements. As a key player in consumer staples, the company’s notable brand recognition, consumer trust, and extensive distribution capabilities further bolster its market position.

On July 26, Colgate-Palmolive shares climbed over 3% following its impressive Q2 results, which included revenues of $5.1 billion and adjusted earnings of $0.91 per share. These results were spurred by a 4.9% rise in net sales year-over-year and a substantial 9% growth in organic sales, a trend aided by increased volume in all operating divisions. Additionally, the adjusted EPS grew by 18% compared to the previous year, reinforcing investor confidence.

Overall, analysts hold a moderately optimistic view on CL’s stock, with a “Moderate Buy” rating. Out of 23 analysts covering the stock, 12 recommend a “Strong Buy”, two opt for “Moderate Buy”, eight advise a “Hold”, and one presents a “Strong Sell” rating. This perspective has become slightly less bullish compared to three months prior when 13 analysts favored a “Strong Buy”.

The average analyst price target for CL stands at $107.71, indicating a potential upside of 7.6% from current levels.

More Stock Market News from Barchart

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.