IQVIA Holdings Gets Buy Rating with Promising Price Target from Redburn Atlantic

Fintel reports that on October 14, 2024, Redburn Atlantic initiated coverage of IQVIA Holdings (LSE:0JDM) with a Buy recommendation.

16.89% Upside Projected for IQVIA Holdings

As of September 25, 2024, analysts project an average one-year price target of 282.47 GBX per share for IQVIA Holdings. The estimates vary, with a low forecast of 239.40 GBX and a high of 330.43 GBX. This average suggests a potential gain of 16.89% based on the company’s latest closing price of 241.65 GBX per share.

For those interested, more details can be found on our leaderboard of companies with the largest price target upsides.

Positive Revenue Growth Expected

The projected annual revenue for IQVIA Holdings stands at 16,863MM, reflecting an 11.27% increase. Furthermore, the expected annual non-GAAP EPS is 12.18.

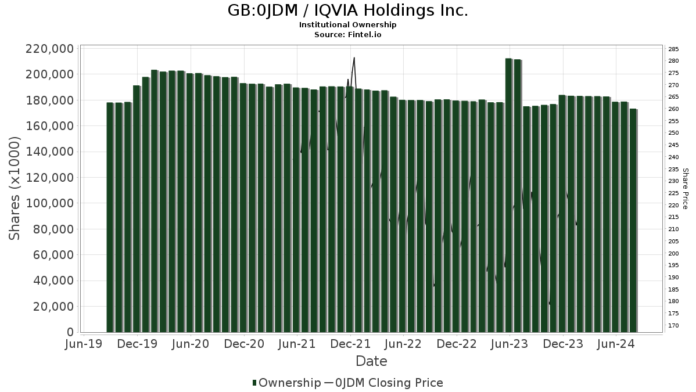

Investor Sentiment and Institutional Holdings

Currently, 1,827 funds or institutions hold positions in IQVIA Holdings, marking an increase of 27 owners (1.50%) over the last quarter. The average allocation of all funds to 0JDM is 0.32%, up by 11.32%. In total, institutional ownership rose by 2.46%, reaching 177,248K shares in the past three months.

Harris Associates L P owns 10,671K shares, which accounts for 5.85% of the company. Their previous report indicated ownership of 10,143K shares, marking a 4.95% increase, although they have reduced their portfolio allocation in 0JDM by 10.02% over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) decreased its holdings to 5,479K shares (3.01%), down from 5,715K shares, reflecting a 4.31% decline and a 22.06% drop in allocation to 0JDM.

The Vanguard 500 Index Fund (VFINX) increased its stake to 4,676K shares (2.57%), up from 4,599K shares, with a 1.65% growth, despite a 19.52% reduction in overall allocation. Meanwhile, Geode Capital Management reported a rise to 4,222K shares (2.32%), up 1.56% from their last filing, but with a significant 57.92% decrease in portfolio allocation.

AllianceBernstein currently holds 4,023K shares (2.21%), down from 4,224K shares, representing a 4.98% decrease and a drop of 21.51% in their allocation as well.

Fintel is a prominent investing research platform tailored for individual investors, traders, and financial advisors, providing detailed data on fundamentals, analyst reports, and ownership insights.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.