Jefferies Initiates Coverage of FirstEnergy with Cautious Outlook

Fintel reports that on October 14, 2024, Jefferies began covering FirstEnergy (LSE:0IPB) with a Hold recommendation.

Market Analysis and Revenue Forecast

As of September 25, 2024, analysts set the average one-year price target for FirstEnergy at 46.44 GBX/share. These forecasts range from a low of 40.39 GBX to a high of 52.49 GBX. This average price indicates a potential growth of 8.61% from its latest closing price of 42.76 GBX/share.

Projected annual revenue for FirstEnergy stands at 13,093MM, marking a slight increase of 0.60%. Additionally, the estimated annual non-GAAP EPS is 2.76.

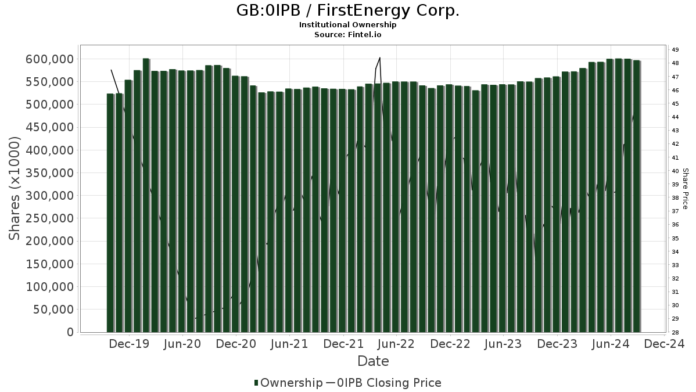

Institutional Ownership Trends

Sentiment among funds and institutions regarding FirstEnergy appears positive, with 1,385 institutions reporting their positions. This represents an increase of 34 owners or 2.52% in the last quarter. Funds have increased their average portfolio weight in 0IPB to 0.22%, a rise of 5.40%. Furthermore, total shares owned by institutions rose by 0.88% over the last three months, totaling 596,595K shares.

Capital World Investors is the largest holder with 78,040K shares, accounting for 13.55% of the company. Their holdings increased from 77,929K shares, reflecting a modest growth of 0.14%. However, they have reduced their portfolio allocation in 0IPB by 2.23% over the last quarter.

Blackstone Group maintains stable holdings with 28,832K shares, representing 5.01% ownership, with no changes reported in the last quarter.

Meanwhile, the WASHINGTON MUTUAL INVESTORS FUND (AWSHX) oversees 23,653K shares or 4.11% of the company. This is a slight decrease from their previous ownership of 23,662K shares, though they have increased their investment in 0IPB by 2.06% recently.

AMERICAN FUNDS FUNDAMENTAL INVESTORS (ANCFX) holds 20,834K shares, which is 3.62% of the total. Their holdings have slightly decreased by 0.05% from the last quarter. Similarly, the INCOME FUND OF AMERICA (AMECX) retains 20,673K shares, also maintaining its position without changes.

Fintel is a leading investment research platform, offering in-depth data for individual investors and small hedge funds. Their analysis includes fundamentals, ownership data, and fund sentiments, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.