Advanced Micro Devices (NASDAQ: AMD) has recently launched its latest artificial intelligence (AI) chip, aiming to capture some of Nvidia‘s (NASDAQ: NVDA) substantial market share. Despite a significant increase in AI-related revenue this year, AMD’s earnings remain a small portion compared to Nvidia’s graphic processing units (GPUs).

This raises an intriguing question: will this new chip enable AMD to become a major player in the AI market?

Can AMD Compete in the AI Arena?

AMD’s revenue from data center GPUs has risen this year from an initial estimate of over $3.5 billion to $4.5 billion. However, this pales in comparison to Nvidia’s impressive $26.3 billion in data center revenue generated just last quarter.

To address this gap, AMD has unveiled its new chip, the Instinct MI325X, which boasts leading memory capacity, bandwidth, and superior compute power compared to Nvidia’s H200 chip. It’s worth noting, though, that this comparison is made against Nvidia’s Hopper architecture, not its latest Blackwell architecture. Nvidia claims that Blackwell can achieve up to 30 times the inference performance of Hopper.

Production for the new chip is expected to commence in Q4, with distribution anticipated in early 2025. AMD stated that these chips will be available through key platform providers like Dell, Super Micro Computer, and Hewlett Packard Enterprise. Following Nvidia’s lead, AMD is also accelerating its AI chip development to a yearly routine.

Image source: Getty Images.

The company has also launched new networking solutions, including a network interface card (NIC) and a data processing unit (DPU). NICs connect devices to networks, while DPUs manage tasks like data transfers and compression. Furthermore, AMD introduced the EPYC 5th Gen central processing units (CPUs), designed to enhance performance for data centers, cloud computing, and AI workloads.

Aiming to compete with Nvidia’s long-established CUDA software, AMD is making enhancements to its ROCm open software stack. Nvidia’s CUDA has provided a significant advantage, as many developers are trained to use it, thereby creating a barrier for other companies like AMD.

While AMD did not announce new customers for its latest products, representatives from notable companies such as Alphabet, Meta Platforms, Microsoft, and OpenAI shared their usage of AMD technologies during the event. Notably, Meta indicated it is “working on several training workloads with AMD.”

Should You Invest in AMD Stock?

The recent announcements from AMD do not indicate an immediate shift in market share from Nvidia. However, given the rapid expansion of the AI infrastructure market and Nvidia’s limited supply capacity, opportunities still exist for AMD to grow its AI chip business. Moreover, businesses are likely to seek alternatives to Nvidia to avoid monopolistic scenarios.

Feedback from customers highlights that AMD’s GPUs are now being allocated more critical workloads than before. This trend, along with the overall strong market for GPUs, suggests that AMD could experience solid revenue growth in AI, albeit from a lower starting point than Nvidia. Importantly, AMD doesn’t need to capture a massive share from Nvidia; even moving from a 4% market share to 7% in a growing market would signal substantial growth.

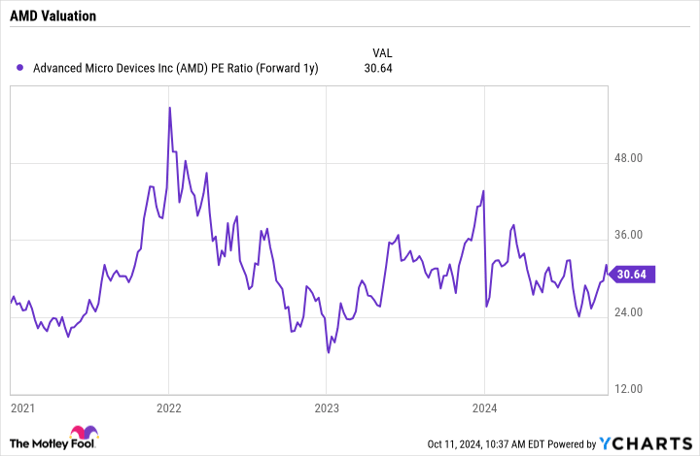

From a valuation perspective, AMD’s forward price-to-earnings (P/E) ratio stands at about 30, based on 2025 analyst projections. This valuation seems reasonable considering the potential growth the company could achieve in the AI sector.

AMD PE Ratio (Forward 1y) data by YCharts

Although AMD may not rival Nvidia directly, it stands as a strong secondary option for investors seeking to diversify within the AI space. As long as demand for AI infrastructure remains robust, the stock is positioned for solid performance.

A Second Chance at a Potentially Lucrative Investment

Have you ever felt that you missed out on investing in successful stocks? This could be your opportunity.

On rare occasions, our team of analysts issues a “Double Down” stock recommendation for companies poised for growth. If you believe you’ve already missed your chance, now is the ideal time to invest before it’s too late. Consider the following results:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,122!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,756!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $384,515!*

Right now, we’re issuing “Double Down” alerts for three exceptional companies, and this may be a unique opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Randi Zuckerberg, a former director of market development and spokesperson for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.