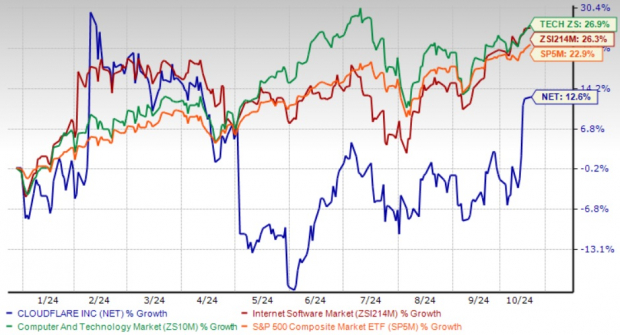

Cloudflare NET shares have risen by 12.6% this year. Nonetheless, NET’s performance lags behind the Zacks Internet Software industry, the Zacks Computer and Technology sector, and the S&P 500 index, which have posted returns of 26.3%, 26.9%, and 22.9%, respectively.

Given this, investors are considering whether this slower stock price growth indicates underlying weaknesses or if it’s a temporary pause that could present a buying opportunity.

Cloudflare’s Growth Slowdown Affects Stock Performance

The decline in NET’s stock performance is linked to the company’s slowing growth, raising questions about its near-term outlook. Since its IPO in 2019, Cloudflare has reported significant growth, although recent quarters show a noticeable reduction in growth rates. Revenue growth remains strong, yet it is not at the pace seen in earlier years.

During 2022, Cloudflare recorded nearly 50% year-over-year growth. In contrast, this growth rate has dipped to 33% in 2023, with projections for 2024 and 2025 estimating further declines to around 27%.

Moreover, Cloudflare turned profitable on a non-GAAP basis in 2022, achieving a remarkable 272% increase in earnings for 2023. However, earnings growth for the upcoming years is expected to drop to around 45% for 2024 and 18% for 2025.

Looking ahead, weak IT spending may impact Cloudflare’s prospects as companies scale back on major tech investments due to economic uncertainties and geopolitical issues, which contributes to concerns about the company’s immediate future.

Cloudflare Year-to-Date Performance

Image Source: Zacks Investment Research

Concerns Over Cloudflare’s High Valuation

From a price-to-earnings (P/E) standpoint, Cloudflare appears overvalued. Currently, NET stock trades at a forward 12-month P/E ratio of 116.13X, well above the Zacks Internet – Software industry average of 35.41X. This higher valuation raises alarms about the stock’s sustainability and suggests potential risks ahead.

Despite concerns regarding decelerating growth and valuation, there are positive aspects to consider. Cloudflare’s strong market position and ongoing efforts to strengthen its role in the AI sector offer promising long-term growth opportunities.

Strong Market Position Fuels Customer Growth

Cloudflare has established a strong reputation for its innovative products in content delivery, Internet security, and edge computing. The company’s commitment to creating a better Internet attracts a diverse clientele, from small companies to large corporations.

Its vast global network, coupled with a focus on performance and security, fosters customer growth. In the second quarter of 2024, Cloudflare reported a 21% year-over-year increase in total paying customers, reaching 210,200.

During this quarter, NET welcomed 168 new customers contributing over $100,000 in annual revenues, raising the total of such customers to 3,050. This growth is backed by a high net retention rate, reflecting strong customer loyalty and successful upselling of additional services.

Expansion in the AI Sector to Propel Cloudflare’s Growth

Cloudflare is making strides in the artificial intelligence (AI) field by introducing innovative products. This year, NET has unveiled security solutions for AI, including Firewall for AI and Defensive AI. The Firewall protects Large Language Models from cyber threats, while Defensive AI shields devices connected to the Internet from AI-related attacks.

Partnerships with companies like Hugging Face Hub, CrowdStrike CRWD, Microsoft MSFT, and NVIDIA NVDA further enhance Cloudflare’s presence in the AI market. The collaboration with Hugging Face allows developers to seamlessly create AI applications on NET’s global network.

Additionally, the partnership with CRWD integrates Cloudflare’s Zero Trust protection with CrowdStrike’s AI-driven cybersecurity tools to enhance security measures on a large scale. In 2024, Cloudflare is also joining forces with industry leaders to broaden its expertise in areas beyond AI.

The collaboration with Microsoft aims to enable enterprise clients to deploy AI models across various platforms using ONNX runtime. Furthermore, NET plans to utilize NVIDIA’s GPUs and Ethernet switches in its global network to bring AI capabilities closer to users.

What Should Investors Consider?

While Cloudflare’s strong market foundation and AI expansion are promising, the elevated valuation calls for caution. Slowing growth and macroeconomic pressures pose risks in the near term.

With these factors in mind, investors may want to hold off on purchasing this Zacks Rank #3 (Hold) stock until more favorable conditions arise. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

U.S. Infrastructure Investment Boom Ahead

Significant efforts to rebuild America’s aging infrastructure are about to commence. This initiative is driven by bipartisan support and urgency, with trillions projected to be spent, creating opportunities for substantial investment returns.

The key question is: “Will you invest in the right stocks early to maximize their growth potential?”

Zacks has released a Special Report aimed at helping you identify such opportunities. This report is free of charge and highlights five companies expected to benefit most from the large-scale spending on infrastructure, including road and bridge repair, construction, cargo transportation, and energy transformation.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

For the latest investment recommendations from Zacks Investment Research, download your free report on the 5 Stocks Set to Double.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

Cloudflare, Inc. (NET): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and not necessarily those of Nasdaq, Inc.