Exploring the Future of Tesla’s Cybercab and Its Stock Outlook

Elon Musk has recently introduced Tesla’s (TSLA) Cybercab, as the company intensifies its commitment to autonomous vehicles. Although these Cybercabs are not expected on the roads until 2026 at the earliest, they hold significant promise. While other companies are also pursuing automated taxi services, few have the recognition or influence of Tesla and its founder. Despite Musk’s impressive track record, the current state of TSLA stock has led me to a neutral stance on investment in the company.

Evaluating the Potential of the Cybercab

Establishing a fleet of Tesla robotaxis could enable the company to gain market share from industry leaders such as Uber (UBER) and Lyft (LYFT). This shift could potentially add billions to Tesla’s yearly revenue, ultimately improving profit margins. However, it would inspire more confidence in Tesla stock if more concrete details about the robotaxi plans were available, rather than relying heavily on speculation. Thus, my view on TSLA remains neutral.

The future of the robotaxi initiative is shrouded in uncertainty. To better understand the market for autonomous vehicles, investors might consider looking at Uber and Lyft, while keeping in mind competitors like Waymo, Cruise, and Zoox, who are also entering this space.

Moreover, vehicle owners might choose to rent out their Tesla Cybercabs, akin to platforms like Turo, a $2.7 billion privately-held car rental service. If Cybercabs become widely used, they could significantly increase demand within this sector, with Tesla securing a substantial portion of the market.

Concerns About Tesla’s Stock Valuation

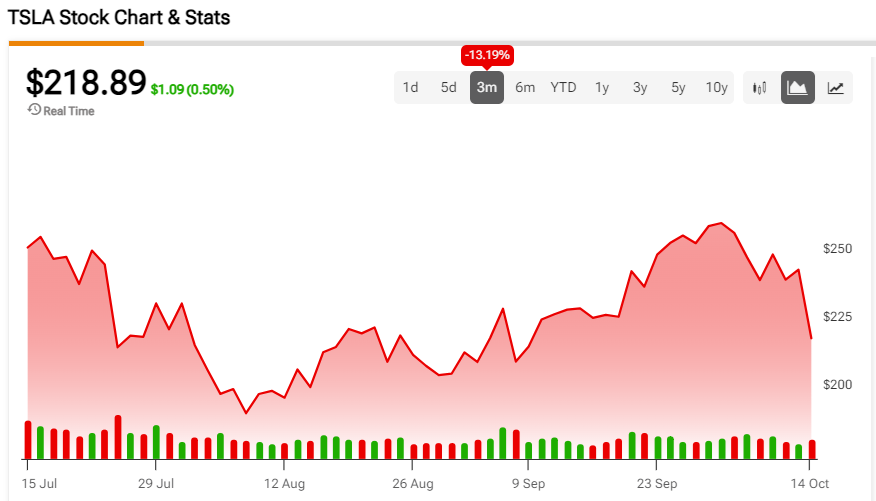

The valuation of Tesla stock is not particularly appealing, leading to my neutral stance rather than a bullish one. Shares have declined by 12% this year, including a 9% drop following the recent robotaxi announcement. Many investors were expecting more detailed insights from Tesla, prompting some to sell their shares after the news. Presently, TSLA stock boasts a high trailing GAAP P/E ratio of 61x, while Ford (F) stands at just 11x.

While Tesla enthusiasts may not pay much attention to this comparison, both companies have demonstrated minimal revenue growth in recent quarters. Profit margins have been slim, with Tesla and Ford reporting net profit margins of 5.8% and 3.8%, respectively, for their latest quarters. In fact, Ford outpaced Tesla in year-over-year revenue growth for the most recent quarter.

Automobile companies can have high P/E ratios, generally reserved for luxury brands experiencing significant growth and profit margins. For example, Ferrari (RACE) has a 54x P/E ratio but achieved a 16.2% rise in year-over-year revenue in the second quarter. With a notable 24% improvement in net income, Ferrari’s net profit margin stands at 24.1%. Tesla currently does not match these growth rates or margins, yet maintains a higher valuation.

Sales Challenges in the Automobile Sector

The emergence of robotaxis could potentially kickstart growth, yet this change may not happen soon enough. Tesla reported a 7% decrease in total automotive revenue year-over-year during the second quarter.

Though revenue from energy generation and storage doubled over the same period, the bulk of Tesla’s revenue—78%—still derives from automotive sales. Furthermore, as competition from Chinese electric vehicle manufacturers increases, Tesla may need to lower prices to stay competitive, which could further squeeze profit margins.

If car sales continue to falter, Tesla’s ability to report meaningful revenue growth will be compromised, risking investor patience and resulting in potential stock sell-offs.

The Case for Investing in Musk

An “Elon Musk premium” has long influenced Tesla’s stock pricing. Musk’s leadership inspires a level of confidence among some investors that may not be warranted otherwise. While TSLA stock does not currently present a buying opportunity for me, betting against Musk in the long run feels risky. Tesla has paved the way for electric vehicles, and Musk has spearheaded several remarkable initiatives, including SpaceX and xAI.

SpaceX marked a historical milestone by becoming the first private entity to successfully launch and return a spacecraft from orbit. In addition, Musk has showcased that Twitter, now X, can remain functional even after massive workforce reductions. While Musk is recognized as one of this generation’s top entrepreneurs, this alone does not encourage me to invest in Tesla stock. However, it may be prudent to keep TSLA on a watchlist for potential price dips or major advancements in robotaxi developments.

Current Analyst Ratings for Tesla

Currently, Tesla holds a “Hold” rating on TipRanks based on the evaluations of 35 Wall Street analysts. Among them, there are 11 Buy ratings, 16 Hold ratings, and 8 Sell ratings. The average price target for TSLA is $207.83, approximately 6% lower than its recent trading price.

Final Thoughts on Tesla Stock

Tesla’s automotive sales growth has stalled while competition intensifies. Although robotaxis could offer a promising long-term opportunity, it may take years for that sector to find its footing.

The high valuation of Tesla’s stock largely reflects Elon Musk’s influence as CEO. Although some investors remain optimistic despite slowing sales growth, monitoring Tesla stock for a more appealing entry price and waiting for significant advancements in the robotaxi project seems advisable. However, achieving full development in that area will likely be a lengthy process, warranting a cautious approach.

I maintain a neutral rating on TSLA stock.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.