Nvidia Continues to Dominate Amidst Concerns of Future Growth

Nvidia (NASDAQ:NVDA) shares have experienced tremendous demand from investors in recent years, helping the chip company reach the ranks of the largest firms globally. This excitement is reflected in customers eagerly purchasing Nvidia’s AI-ready products at a remarkable pace.

Can Nvidia Maintain Its Growth Momentum?

However, questions linger about how long Nvidia can sustain this growth. Analyst Joshua Buchalter from Cowen notes that investors are beginning to evaluate potential risks as they approach the January quarter, especially concerning possible setbacks from previous delays in the production of its Blackwell platform.

No Immediate Cause for Alarm, Says Analyst

Despite these concerns, Buchalter does not believe investors should be alarmed. He emphasized, “All eyes on the JanQ guide, but we see Hopper demand sufficiently bridging any gap as Blackwell ramps.” Although timing the production ramp-up is challenging, he asserts that overall demand for AI investments continues to outweigh risks from underinvestment.

Hopper Volumes Show Positive Signs

Buchalter has observed a rise in Hopper volumes for the latter half of 2024, suggesting this trend could support ongoing robust growth. This uptick may also benefit Nvidia’s gross margins, especially since the less developed Blackwell supply chain is expected to create short-term challenges for margins.

Uninterrupted Demand for Blackwell Platforms

He believes that the demand for Blackwell platforms remains strong, suggesting that any production delays will merely shift expected gains from the January quarter to the April and July quarters. Additionally, he pointed out that Blackwell platforms are now in “full production,” indicating that earlier production issues have likely been resolved.

Investment Environment in AI

Buchalter highlights a significant dilemma facing major AI companies, noting they are incentivized to continue investing. He explained, “the costs of not doing so are (potentially) devastating.” This creates a unique investment climate within the industry.

Analyst Recommendations and Market Outlook

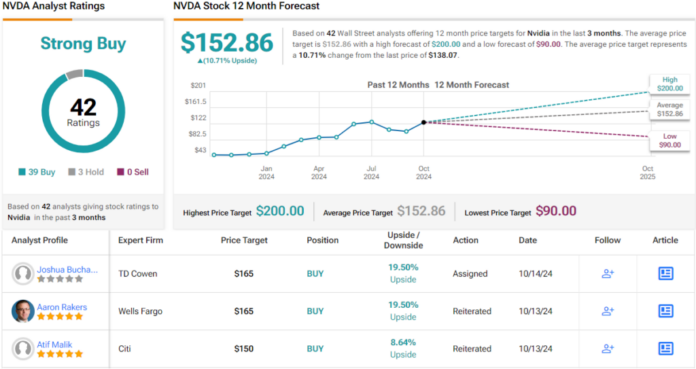

Ultimately, Buchalter rates NVDA as a Top Pick, maintaining a Buy rating with a price target of $165, suggesting a 22% upside from the current price. This opinion is well-received on Wall Street, as 38 analysts share his bullish outlook, leading to a Strong Buy consensus. Analysts predict an average 12-month return of approximately 11%, based on a price target of $152.86.

For stock trading ideas at appealing valuations, consider visiting TipRanks’ Best Stocks to Buy, which combines all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended for informational purposes only. It is essential to conduct your own analysis before making any investment.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.