Understanding Potential Stock Splits Among Top Tech Stocks

The stock market has shown remarkable performance this year. As of now, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Index have risen by 21.9%, 22.2%, and 13.7% year-to-date, respectively.

With many stock prices climbing, stock splits could be on the horizon. Here are three tech stocks to watch for potential splits.

Image source: Getty Images.

1. Netflix

Currently priced above $700, it’s apparent that Netflix (NASDAQ: NFLX) may be due for a stock split. The last split occurred in 2015, and with its shares nearing an all-time high, a split could be announced soon.

Even if Netflix’s board opts against a split, investors should think about adding its shares to their portfolios. The company has managed to thrive despite strong competition from Amazon, Apple, and Disney.

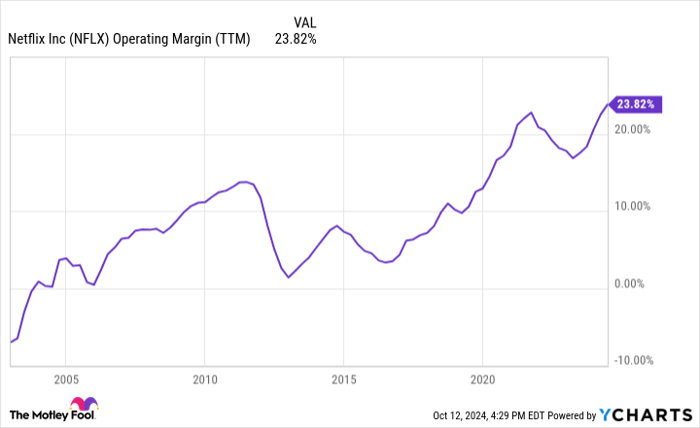

In the past three years, Netflix has achieved a 22% increase in revenue. Its operating margin now stands at 24%, marking a company record.

NFLX Operating Margin (TTM) data by YCharts.

This success is attributed to strategic decisions, like addressing password sharing and launching an advertising-supported subscription tier.

Ultimately, Netflix has faced significant challenges and emerged stronger. Investors should pay attention.

2. Spotify Technology

Spotify Technology (NYSE: SPOT) has not yet split its stock since its initial public offering (IPO) in 2018. However, with shares nearly doubling this year to over $360, a split could be around the corner.

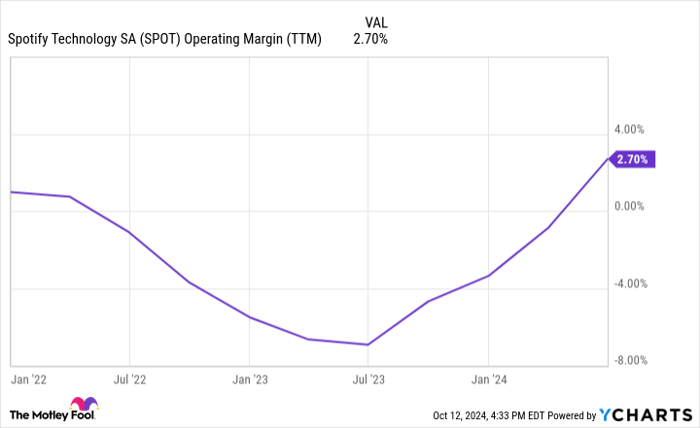

One factor that might prompt a stock split is Spotify’s recent turn to profitability. CEO Daniel Ek’s cost-cutting measures have helped lift its operating margin from a low of negative 6.9% to a positive 2.7%. This was accomplished through initiatives like raising subscription fees and laying off employees.

SPOT Operating Margin (TTM) data by YCharts.

Regardless of whether Spotify opts for a stock split, it remains an attractive investment option for potential buyers.

3. Meta Platforms

Meta Platforms (NASDAQ: META) is one of the best-performing stocks of 2024. Meta’s shares have surged 68% this year to nearly $600, approaching their all-time high.

However, the company may not proceed with a stock split, despite investor interest. Notably, Meta is the only stock from the “Magnificent Seven” that has never split its shares.

While a split isn’t guaranteed in the future, Meta’s strong growth and profitability make it a noteworthy investment opportunity. In Q2, the company’s revenue increased by 22%, and net income rose by 73%. Meta’s extensive reach positions it as a major player in the fast-growing digital advertising market. Thus, adding Meta shares could benefit many portfolios, regardless of a share split.

Consider This Investment Opportunity

If you’ve ever felt like you’ve missed out on investing in successful stocks, this could be your chance.

Our analysts occasionally issue a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you worry you’ve missed your opportunity, now could be the ideal time to invest before prices rise. Here are some impressive stats:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $21,122!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $43,756!*

- Netflix: A $1,000 investment when we doubled down in 2004 would be worth $384,515!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this could be a unique opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and the sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, which is an Amazon subsidiary, is also a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, Nvidia, Spotify Technology, Tesla, and Walt Disney. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Spotify Technology, Tesla, and Walt Disney. The Motley Fool also recommends options for Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.