Phillips 66 Faces Tough Q3 Earnings Ahead

Phillips 66 (PSX), headquartered in Houston, Texas, operates as an energy manufacturing and logistics company. With a market cap of $57.4 billion, the company’s operations span oil refining, marketing, and transportation, along with chemical manufacturing and power generation. The leading integrated downstream energy provider is set to announce its fiscal third-quarter earnings for 2024 before the market opens on Tuesday, Oct. 29.

Analysts Brace for Lower Profits

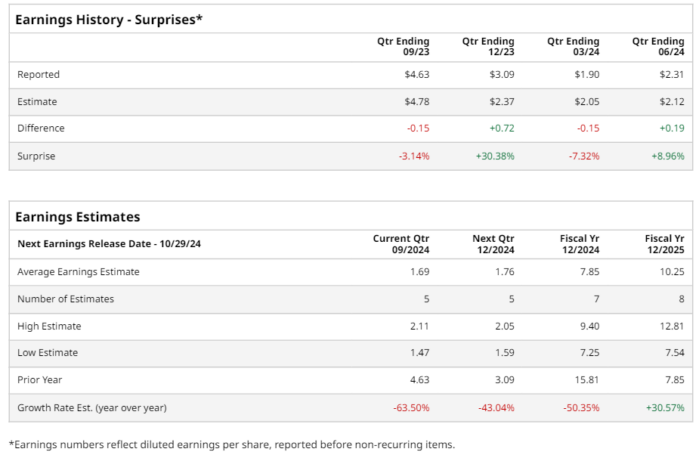

Ahead of the event, analysts expect PSX to report a profit of $1.69 per share on a diluted basis, marking a 63.5% drop from $4.63 per share in the same quarter last year. The company managed to exceed consensus estimates in two of the last four quarters but fell short in two others.

Yearly Earnings Projections

For the full year, analysts predict PSX will report EPS of $7.85, a 50.4% decline from $15.81 in fiscal 2023. However, projections for fiscal 2025 indicate a rebound, with EPS expected to rise 30.6% year over year to $10.25.

Stock Performance Lags Behind Industry

Over the past 52 weeks, PSX stock has underperformed compared to the S&P 500’s ($SPX) 34.4% gains, rising only 18.8% during this time. Still, it outperformed the Energy Select Sector SPDR Fund’s (XLE) marginal gains in the same period.

Challenges in the Refining Sector

PSX’s underperformance is largely attributed to the challenging oil pricing environment, which has reduced investor interest in energy companies. The refining business is particularly sensitive to fluctuations in commodity prices, making it dependent on raw crude oil. Rising input costs have negatively affected the refining segment, and new refinery capacities could further pressure refining margins soon.

Recent Earnings Beat Expectations

On July 30, PSX shares rose more than 4% following the release of its Q2 results. The adjusted EPS of $2.31 surpassed Wall Street’s expectations of $2.12, while the company’s adjusted EBITDA reached $2.2 billion, marking a 12.4% increase from the previous quarter.

Analyst Outlook

Analysts generally hold a positive view on PSX stock, giving it a “Moderate Buy” rating overall. Out of 18 analysts covering the stock, 10 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and seven advise a “Hold” strategy. The average analyst price target stands at $146.81, suggesting a potential upside of 11.7% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.