Assurant, Inc. Preview: Anticipated Earnings Show Mixed Signals

Atlanta-based Assurant, Inc. (AIZ) is a global provider of risk management solutions in the auto, housing, and lifestyle markets, protecting where people live and the goods they buy. With a market cap of $10.1 billion, Assurant’s operations span the Americas, Indo-Pacific, and Europe. The company is set to release its Q3 earnings after the market closes on Tuesday, Nov. 5.

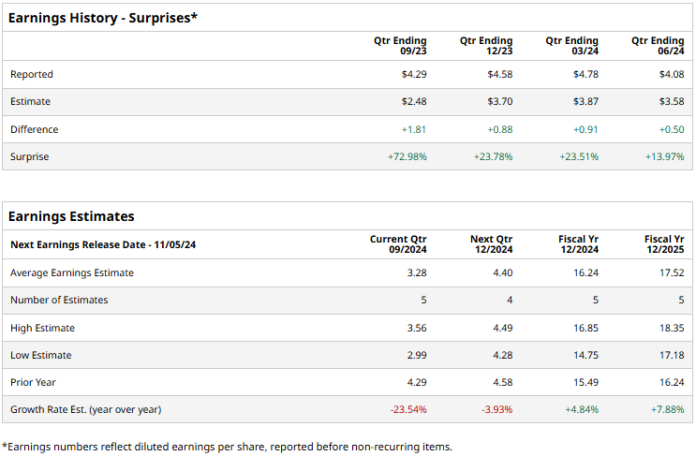

Analysts Predict Earnings Drop

Ahead of the earnings announcement, analysts predict Assurant will report a profit of $3.28 per share, which represents a decline of 23.5% from the $4.29 per share earned during the same period last year. Historically, Assurant has consistently exceeded Wall Street’s EPS estimates; its adjusted EPS for the last reported quarter rose by 4.9% year-over-year to $4.08, beating consensus estimates by 14%.

Forecast for Future Earnings

For fiscal 2024, analysts expect AIZ to report an adjusted EPS of $16.24, reflecting a 4.8% increase from $15.49 in fiscal 2023. Looking ahead to fiscal 2025, the adjusted EPS is anticipated to grow by 7.9% to $17.52.

Performance Compared to the Market

So far this year, AIZ has climbed 15.6%, although this still lags behind the S&P 500 Index’s gain of 21.9% and the Financial Select Sector SPDR Fund’s 24.7% returns.

Market Reaction to Past Results

After reporting better-than-expected Q2 earnings on August 6, shares of Assurant saw modest gains and maintained a positive trend for six trading sessions. The company’s revenue grew by an impressive 7.1% year-over-year, reaching $2.9 billion, largely due to increased net earned premiums and fees. Net income also improved significantly, up 20.7% year-over-year to $188.7 million, supported by a 73 basis point expansion in net margin to 6.5%.

Analysts’ Recommendations

The consensus view on AIZ stock is moderately bullish, holding an overall “Moderate Buy” rating. Among the seven analysts covering the stock, four recommend a “Strong Buy,” while three suggest a “Hold.” The average price target of $218.80 implies a potential upside of 12.3% from the current price levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.