Nvidia Dominates the AI Chip Market, but AMD Fights Back with New Technology

The race for dominance in the artificial intelligence (AI) accelerator market is largely led by Nvidia (NASDAQ: NVDA), which currently holds a significant 85% market share. Competitors like Advanced Micro Devices (NASDAQ: AMD) and Intel are striving to secure their own footholds in this profitable arena. Recently, AMD introduced its new AI chip, the Instinct MI325X, claiming it outperforms Nvidia’s flagship H200 processor. Despite this bold assertion, AMD’s stock price dipped after the announcement.

Continue reading to uncover the reasons behind AMD’s stock dip and whether this new chip poses a threat to Nvidia investors.

AMD’s MI325X: Impressive Specs, But Perhaps Too Late

AMD’s MI325X data center accelerator boasts 256 gigabytes (GB) of HBM3E high-bandwidth memory and a bandwidth capacity of 6 terabytes (TB) per second. AMD asserts that its new chip offers 1.8 times more capacity and 1.3 times more bandwidth than Nvidia’s H200, which is built on the Hopper architecture.

This suggests that the MI325X might deliver 1.3 times greater compute performance, alongside similar advantages in AI inference when utilizing the Llama 3.1 and Mistral 7B large language models (LLMs). Production for the MI325X is slated to begin this quarter, with a wider availability expected by the first quarter of 2025.

While AMD’s claims appear promising, Nvidia’s H200 – announced nearly a year ago and started shipping in the second quarter of 2024 – offered 141GB of HBM3E memory with a bandwidth of 4.8TB per second, creating a competitive standard. Essentially, AMD’s offering is arriving about nine months later than Nvidia’s.

Additionally, Nvidia is preparing to release its advanced Blackwell processors. The upcoming B200 graphics processing unit (GPU) is set to feature 208 billion transistors, compared to the MI325X’s 153 billion. More critically, the B200 will likely utilize Taiwan Semiconductor Manufacturing’s 4-nanometer (nm) process, in contrast to the 5-nm process used for the MI325X.

Nvidia’s ability to fit more transistors into a smaller space indicates that the B200 will likely provide superior computing power and energy efficiency. Moreover, it is projected to offer a high memory bandwidth of 8TB/second. Nvidia anticipates earning several billion dollars in Blackwell revenue in the fourth quarter of its fiscal year, which spans from November 2024 to January 2025.

This timing means Nvidia could advance to a technological advantage by a generation before AMD’s latest chip hits the market. For this reason, Nvidia investors may not need to worry about AMD’s new offerings as they adjust to this competitive landscape. However, there is a silver lining for AMD investors.

AMD May Not Outperform Nvidia, But Growth is Possible

As Nvidia surges ahead in the AI chip market, it is projected to generate nearly $100 billion in data center revenues this fiscal year. AMD is forecasting its own AI data center GPU revenue to reach $4.5 billion in 2024, which is significantly lower than Nvidia’s estimates.

Nonetheless, AMD does not need to surpass Nvidia to achieve meaningful growth. The company aims to become the second-largest player in this potentially $500 billion AI chip market by 2028. Having started sales of its AI GPUs in late 2023, AMD reported $6.5 billion in data center chip sales, including the Epyc server processors, last year.

This year, AMD has already generated $5.2 billion in data center revenue within the first half of 2024, nearly double what it achieved during the same timeframe last year. If this trend continues, AMD could reach a total of approximately $10.5 billion in data center revenue this year, with $4.5 billion attributed to AI GPU sales. Capturing even 10% of the AI GPU market by 2028 could yield an impressive $50 billion in annual revenue from this segment.

Additionally, the demand for the MI325X may be strong, as Nvidia indicated in its last earnings call that shipments of their H200 chips are expected to continue to rise in the latter half of this fiscal year. This suggests a healthy market for AMD’s offering alongside Nvidia’s more powerful processors.

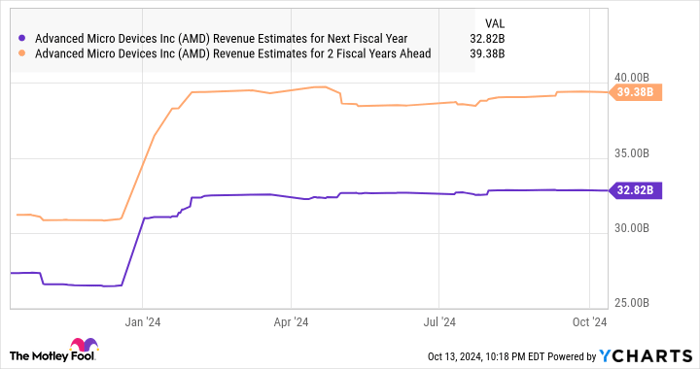

Moreover, AMD’s increasing presence in the AI GPU market is poised to contribute to its growth starting next year. The company anticipates a 13% revenue increase in 2024, reaching $25.6 billion, with even more promising forecasts for the following years.

AMD Revenue Estimates for Next Fiscal Year data by YCharts.

If AMD cannot surpass Nvidia in the AI chip market, it may still emerge as a solid long-term investment if it secures a niche for itself. It’s also vital to remember that AMD has opportunities in other AI-related sectors, including AI-enabled PCs and server processors.

Despite AMD stock only delivering modest gains of 14% in 2024, investors would be wise to keep an eye on the company, as it faces significant potential for growth in AI GPUs and other markets.

Is Investing $1,000 in Advanced Micro Devices Smart Right Now?

Before investing in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to buy right now, and Advanced Micro Devices did not make the list. The selected stocks could provide impressive returns in the coming years.

For context, when Nvidia was featured on this list on April 15, 2005, a $1,000 investment at that time would now be worth $806,459!*

Stock Advisor offers investors a straightforward approach to success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. Since 2002, this service has more than quadrupled the S&P 500’s returns.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and suggests the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.