Bio-Techne Corporation Set to Release Earnings Amid Analyst Optimism

Upcoming Q1 Earnings Report and Analyst Predictions

Based in Minneapolis, Minnesota, Bio-Techne Corporation (TECH) develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets. With a market cap of $11.6 billion, the company has a vast catalog of over 500,000 biotechnology products and scientific tools. It is set to announce its fiscal Q1 earnings results before the market opens on Wednesday, Oct. 30.

Expectations for Profit and Revenue Growth

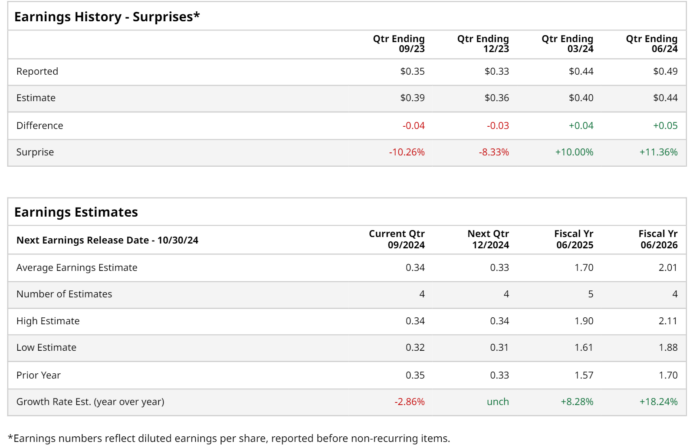

Analysts predict that Bio-Techne will report a profit of $0.34 per share, down 2.9% from $0.35 per share in the same quarter last year. The company has exceeded Wall Street’s earnings estimates in two of the last four quarters while falling short in the other two. In Q4 2024, Bio-Techne posted an EPS of $0.49, which surpassed consensus expectations by 11.4%. This positive outcome was mainly due to a 15% year-over-year revenue increase in its diagnostics and genomics segment, contributing to an overall 2% revenue growth for the quarter.

Looking ahead to fiscal 2025, analysts expect TECH to report an EPS of $1.70, an increase of 8.3% from $1.57 in fiscal 2024. For fiscal 2026, EPS is projected to rise by 18.2% year-over-year to $2.01.

Stock Performance and Market Comparisons

This year, shares of TECH have fallen by 4.6%, notably underperforming compared to the S&P 500 Index’s ($SPX) surge of 21.9% and the Health Care Select Sector SPDR Fund’s (XLV) growth of 12.1% during the same period.

Recent Challenges and Investor Sentiment

On Aug. 7, shares of TECH dropped by 9.5% following its Q4 and fiscal 2024 earnings report. The revenue for the quarter was $306.1 million, falling short of the expected $308.1 million. Additionally, the company reported a 10.9% annual decline in Q4 adjusted EPS to $0.49, and a full-year adjusted EPS dropped 11% to $1.77. These results, along with decreased revenues from its protein sciences segment, have raised concerns among investors.

Analysts Remain Bullish

Despite the recent decline, the overall sentiment among analysts towards Bio-Techne Corporation’s stock is positive, with a “Strong Buy” rating. Out of 13 analysts covering the stock, 10 recommend a “Strong Buy” while 3 suggest a “Hold.”

The average analyst price target for TECH stands at $83.00, indicating a potential upside of 12.8% from current levels.

More Stock Market News from Barchart

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.