Zebra Technologies Poised for Strong Q3 Earnings Report

Market analysts anticipate a significant profit surge for Zebra Technologies Corporation (ZBRA) as the company prepares to release its Q3 earnings on Tuesday, October 29.

Sharp Increase in Expected Profits

Zebra Technologies, valued at a market cap of $19.3 billion, operates in the automatic identification and data capture (AIDC) sector. The company creates a range of products, including barcode scanners, RFID readers, mobile computers, and special printers, along with providing software and services to various industries. Analysts predict that ZBRA will report a profit of $2.89 per share for the upcoming quarter. This marks a remarkable 407% increase from last year’s profit of $0.57 per share.

Positive Trajectory for Future Earnings

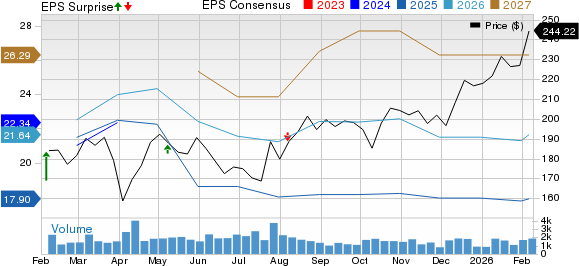

The company has demonstrated strong past performance, with ZBRA exceeding Wall Street’s earnings estimates in three of the last four quarters. In the most recent quarter, ZBRA surpassed the consensus estimate by 6.9%. Looking ahead, analysts project earnings per share (EPS) of $11.09 for fiscal 2024, reflecting a 25.9% increase from $8.81 in fiscal 2023. By fiscal 2025, EPS is expected to rise further by 24.4% year-over-year to reach $13.80.

Year-to-Date Performance Exceeds Expectations

So far in 2024, ZBRA has increased by 37.3%, outperforming the S&P 500 Index’s 21.9% rise and the Technology Select Sector SPDR Fund’s (XLK) 18.8% gain.

Investors Respond to Positive Earnings Outlook

On July 30, Zebra Technologies’ stock surged by 3.9% following the announcement of Q2 adjusted earnings of $3.18 per share on revenue of $1.2 billion, which beat Wall Street’s expectations. This jump in profitability was attributed to a 50 basis point increase in gross margin to 48.4%, thanks to cost-reduction initiatives and the company’s strategic exit from less profitable sectors. Zebra also raised its full-year adjusted earnings forecast, projecting earnings between $12.30 and $12.90 per share, significantly above analysts’ consensus, igniting further investor enthusiasm.

Analyst Recommendations Reflect Cautious Optimism

Among the 15 analysts tracking Zebra Technologies, the consensus rating is a “Moderate Buy.” This includes eight analysts recommending “Strong Buys,” one “Moderate Buy,” five “Holds,” and one “Strong Sell.” This analysis shows an improvement from three months prior, when only six analysts had rated it as a “Strong Buy.” Currently, ZBRA trades slightly above the average analyst price target of $375.15.

More Stock Market News from Barchart

On the date of publication, Sohini Mondal did not hold any positions in the securities mentioned in this article. All information and data is provided for informational purposes only. Please review the Barchart Disclosure Policy for more details.

The views expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.