MeiraGTx Holdings‘ MGTX announced promising results from its clinical study on the gene therapy candidate AAV-GAD, aimed at treating Parkinson’s disease (PD). Following the announcement, the stock surged by 14.9%.

AAV-GAD Outperforms Sham Treatment in Clinical Study

The MGT-GAD-025 study revealed that AAV-GAD significantly improved key measures of efficacy for patients with PD after 26 weeks of treatment.

The data indicated that patients receiving the high-dose treatment experienced an average improvement of 18 points in the UPDRS Part 3 (motor examination) “off” medication score by week 26. In contrast, no significant changes were observed in the sham or low-dose groups.

Moreover, MeiraGTx noted significant improvements in the patient-reported quality of life, measured by the PDQ-39 score, among both high and low-dose groups, while the sham group showed no significant change at 26 weeks.

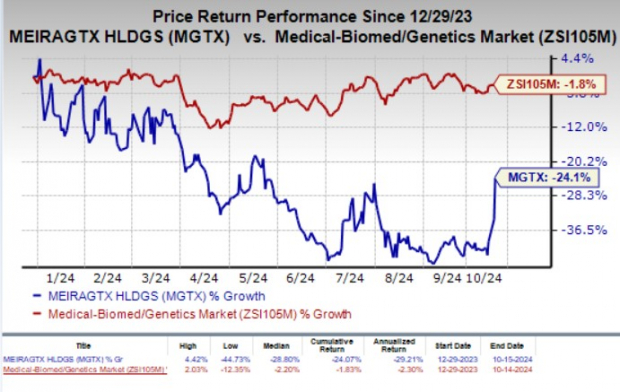

Despite the recent positive results, shares of MeiraGTx have decreased by 24.1% year to date, in contrast to a smaller 1.8% drop for the broader industry.

Image Source: Zacks Investment Research

The investigational therapy was generally found to be safe and well-tolerated, with no serious treatment-related adverse events reported.

MeiraGTx highlighted that Parkinson’s disease is the second most common neurodegenerative disorder after Alzheimer’s, affecting nearly one million individuals in the U.S., with approximately 90,000 new cases diagnosed each year. Globally, the disease impacts more than 10 million people. While many patients initially benefit from dopamine replacement therapy, its effectiveness can decline over time, leading to significant challenges in daily life. This highlights a considerable unmet medical need.

The exact cause of PD is mostly unknown, although it can have a genetic component in some cases. All instances involve disruptions in the brain’s movement control circuits.

AAV-GAD uses an innovative method to address the faulty circuitry that occurs due to dopamine depletion in patients with idiopathic PD. It is delivered via a one-time infusion into the subthalamic nucleus, a crucial area for regulating normal movement.

Next Steps for AAV-GAD Following Positive Trial Results

In light of the encouraging outcomes from the MGT-GAD-025 study, MeiraGTx plans to engage with regulatory authorities in the U.S., EU, and Japan. The aim is to initiate a phase III study that could pave the way for global approval of this potential disease-modifying treatment.

Besides AAV-GAD, MeiraGTx has several other clinical programs in progress, including a phase III study of Lumeos for X-linked retinitis pigmentosa and phase I/II studies for conditions like achromatopsia and RPE65-deficiency. Additionally, they are conducting a phase II study for radiation-induced xerostomia and another mid-stage trial for Sjogren’s syndrome.

MGTX’s Stock Ranking and Comparable Biotech Stocks

MeiraGTx currently holds a Zacks Rank of #3 (Hold).

In the biotech sector, better-ranked stocks include ANI Pharmaceuticals ANIP, Alnylam Pharmaceuticals ALNY, and Amicus Therapeutics FOLD, each with a Zacks Rank of #1 (Strong Buy) currently.

In the last 60 days, ANI Pharmaceuticals’ 2024 earnings per share estimates revised up from $4.69 to $4.81, and estimates for 2025 increased from $5.37 to $5.86. Their shares have risen by 6.3% this year.

ANI Pharmaceuticals has consistently beaten earnings estimates over the last four quarters, averaging a surprise of 31.32%.

Over the same time frame, Alnylam’s loss per share estimates for 2024 improved from $1.20 to 63 cents. For 2025, estimates decreased from 34 cents to 26 cents. The company’s shares increased by 50.1% year to date.

Alnylam has also beaten estimates in its last four quarters, achieving an average surprise of 108.53%.

Amicus’ 2024 EPS estimates have remained stable at 20 cents, while 2025 estimates climbed from 48 cents to 50 cents. However, their shares have seen a decline of 27.3% this year.

Amicus has managed to exceed earnings expectations in three of the last four quarters, with an average surprise of 23.96%.

To read this article on Zacks.com click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.