Oppenheimer Initiates Coverage on Larimar Therapeutics with Strong Optimism

Analyst’s Price Target Indicates Significant Growth Potential

Fintel reports that on October 16, 2024, Oppenheimer initiated coverage of Larimar Therapeutics (NasdaqGM:LRMR) with a Outperform recommendation.

Analyst Price Forecast Suggests 193.32% Upside

As of September 25, 2024, the average one-year price target for Larimar Therapeutics stands at $22.59 per share. The estimates range from a low of $14.14 to a high of $37.80. This average price target represents a potential increase of 193.32% from the company’s last reported closing price of $7.70 per share.

For insights into other companies with high price target upside, check our leaderboard.

Financial Performance and Projections

The projected annual revenue for Larimar Therapeutics is $0 million, and the anticipated non-GAAP EPS is -$2.34.

Fund Sentiment on Larimar is Growing

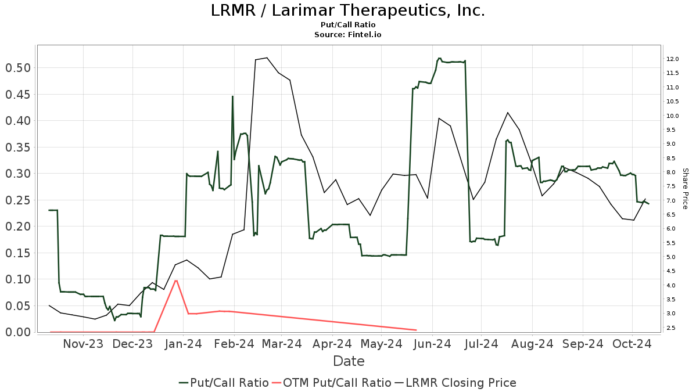

Currently, there are 231 funds or institutions reporting holdings in Larimar Therapeutics, reflecting an increase of 18 owners, or 8.45%, in the last quarter. The average portfolio weight for all funds invested in LRMR has risen by 10.50% to 0.11%. Over the past three months, total shares owned by institutions increased by 3.70% to 67,497K shares. The put/call ratio for LRMR is 0.26, which suggests a positive outlook among investors.

Deerfield Management Company, L.P. holds 21,232K shares, making up 33.28% of the company, with no change from the previous quarter.

Ra Capital Management retains 6,045K shares, representing 9.47% ownership, also unchanged from the last quarter.

Janus Henderson Group holds 4,377K shares or 6.86% ownership. This marks an increase from 4,021K shares previously, representing an 8.14% rise in their holdings. Additionally, their portfolio allocation in LRMR increased by 1.93% over the last quarter.

The Goldman Sachs Group owns 4,333K shares, accounting for 6.79% of the company. This shows a significant increase from 3,418K shares, a rise of 21.12%, although its portfolio allocation decreased by 71.67% over the quarter.

Blue Owl Capital Holdings holds 3,859K shares, or 6.05%. They previously owned 3,994K shares, indicating a decrease of 3.50%, while increasing their portfolio allocation in LRMR by 28.49% in the last quarter.

About Larimar Therapeutics

(This description is provided by the company.)

Larimar Therapeutics, Inc. is a clinical-stage biotechnology company focused on developing treatments for complex rare diseases. Its lead compound, CTI-1601, is currently undergoing a Phase 1 clinical program in the U.S. as a potential treatment for Friedreich’s Ataxia (FA). The company also plans to utilize its intracellular delivery platform to develop additional fusion proteins targeting other rare diseases that involve deficiencies in intracellular bioactive compounds.

Fintel serves as one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds. Our data encompasses a wide range of financial insights, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and more. We also provide exclusive stock picks based on advanced, backtested quantitative models designed to improve profitability.

This news article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.