Why Billionaires are Doubling Down on Amazon Stock

Wall Street is often seen as a playground for the ultra-wealthy, and recent filings show some of the richest investors are betting on a familiar name: Amazon. This tech giant continues to be a staple in many investment portfolios, offering important clues for individual investors. Though personal investment decisions should be based on individual needs, it’s significant to note when billionaires put their money into a stock.

Amazon (NASDAQ: AMZN) may not be a flashy investment idea, yet billionaires are still buying it. Data from 13F filings disclosed that several prominent investors increased their stakes in Amazon during the quarter ending June 30, 2024:

| Name | Fund Managed | Net Worth | Amazon Shares Added |

|---|---|---|---|

| Ken Fisher | Fisher Asset Management | $11 billion | 1.21 million |

| Ray Dalio | Bridgewater Associates | $14 billion | 1.6 million |

| Paul Tudor Jones | Tudor Investment | $8 billion | 72,609 |

| Ken Griffin | Citadel Advisors | $43 billion | 1.11 million |

| John Overdeck | Two Sigma Advisers | $7 billion | 216,400 |

Source: 13F filings on Hedge Follow and net worth data from Forbes.

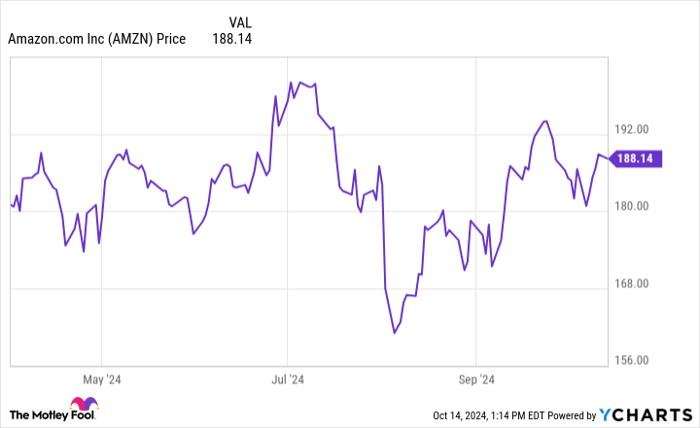

It’s crucial to note that 13F filings reflect past transactions, and the information may not be entirely current. Investors risk relying on outdated data; billionaires may have already adjusted their holdings. Although Amazon’s stock has fluctuated recently, the reasons for their initial investment merit attention.

AMZN data by YCharts

Looking Ahead: Amazon’s Growth Potential

Amazon is a household name, and though it might not generate the same hype as new tech startups, its performance has been impressive. Over the years, the company has transformed small investments into substantial wealth through consistent growth in e-commerce and cloud computing.

Today, Amazon holds a significant lead in both of its main businesses, capturing about 40% of the U.S. e-commerce market and 31% of the global cloud services market, where it vies against Microsoft‘s Azure and Alphabet‘s Google Cloud.

The appeal in Amazon’s core operations lies in their alignment with significant long-term growth trends. E-commerce currently amounts to just 16% of total retail spending in the U.S., and as companies continue moving to the cloud, opportunities are expanding. Goldman Sachs projects the cloud computing market could reach $2 trillion by 2030, not counting Amazon’s advertising division, which anticipates $50 billion in revenue this year with a growth rate of 20%.

Is Now the Time to Buy Amazon?

Investors evaluate stocks based on several criteria. Given Amazon’s reinvestment strategy, it’s insightful to examine its cash flow generated from operations.

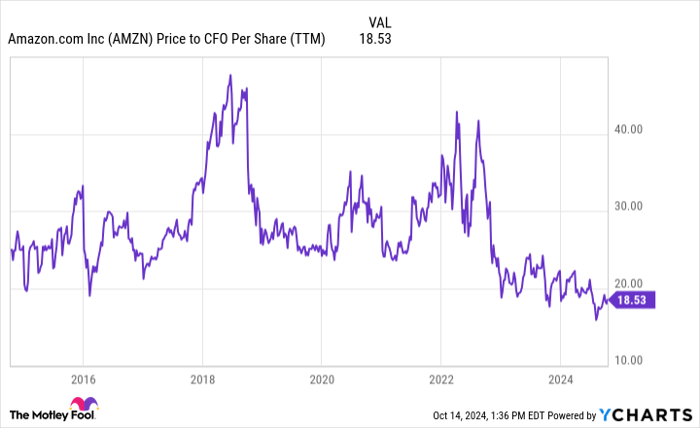

Below is Amazon’s price-to-operating cash flow ratio:

AMZN Price to CFO Per Share (TTM) data by YCharts

With a current ratio of 18.5 near its decade-low point, this presents an attractive buying opportunity. Amazon’s historical return on invested capital stands at an impressive 10.9%. Thus, when discussing Amazon’s investment potential, one could reason it’s a strong business at a favorable price.

Should You Invest $1,000 in Amazon Today?

Before deciding to purchase Amazon stock, consider this:

The Motley Fool Stock Advisor team has identified the 10 best stocks to invest in right now, and Amazon is not among them. The stocks that made the cut could yield impressive returns in the future.

For instance, when Nvidia appeared on this list back on April 15, 2005, an initial $1,000 investment would be worth $806,459 today!*

Stock Advisor offers investors straightforward strategies for success, including guidance on portfolio building and regular updates from analysts.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also on the board. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has investment positions in Alphabet, Amazon, Goldman Sachs Group, and Microsoft.