Tesla Moves Most of Its Bitcoin Holdings, Raising Eyebrows in the Crypto World

Elon Musk’s Tesla (TSLA), a leading corporate holder of Bitcoin (BTC-USD), has stirred curiosity by transferring nearly all of its $760 million worth of Bitcoin to unmarked wallets, according to a report by CoinDesk. A cryptocurrency wallet is a device or service that holds the keys needed for crypto transactions.

The report references information from crypto data firm Arkham Intelligence, indicating that over 11,500 Bitcoins were moved from wallets associated with Tesla to untraceable locations. This left the company’s wallets with a mere $6.65 in Bitcoin.

TSLA Ranks as the Fourth-Largest Bitcoin Holder

This development is notable because Tesla is the fourth-largest Bitcoin holder among publicly traded U.S. companies, as per data from BitcoinTreasuries. TSLA’s rankings follow MicroStrategy (MSTR), Marathon Holdings (MARA), and Riot Platforms (RIOT).

Records from Arkham Intelligence show Tesla made its initial investment of $1.5 billion in Bitcoin back in February 2021, which later peaked at $2.5 billion. Nevertheless, in early 2022, the company sold off 75% of its Bitcoin holdings at a loss, demonstrating the cryptocurrency market’s volatility. As of March, Tesla’s holdings totaled 11,509 Bitcoins, which were valued at about $770 million.

When Tesla first entered the Bitcoin sphere, Musk expressed intentions to allow Bitcoin as a payment method for its vehicles. Those plans, however, were quickly abandoned due to environmental issues surrounding Bitcoin mining’s carbon emissions.

Current Outlook on Tesla Stock: Buy, Sell, or Hold?

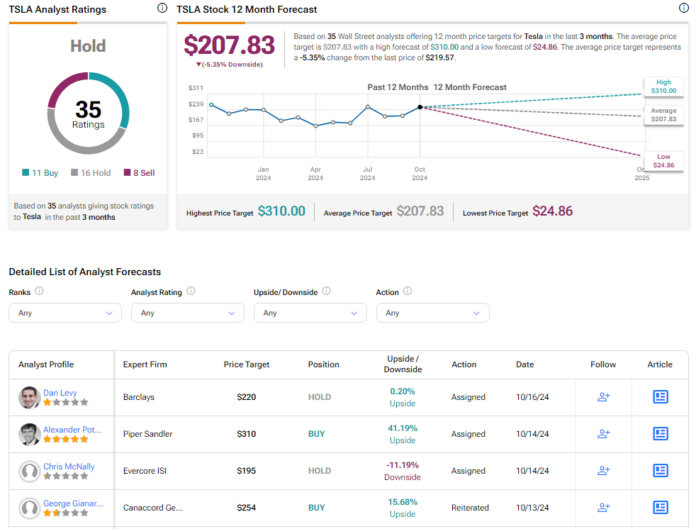

Market analysts display caution over Tesla stock, maintaining a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sell recommendations. In the past year, TSLA stock has fallen by over 10%, and the average price target for TSLA stands at $207.83, indicating a potential downside of 5.4% from current trading levels.

See more TSLA analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.