Is Broadcom the Next AI Investment to Watch Over Nvidia?

Nvidia (NASDAQ: NVDA) has proven to be a popular choice for investors in recent years. The company, known for its work in artificial intelligence (AI) chips, has consistently posted enormous profits, leading to a significant rise in its stock price. Over the last five years, Nvidia’s shares have soared more than 2,500%, with expectations for over 160% growth in 2024.

Despite these impressive numbers, investors may wonder if Nvidia will maintain its momentum or if another company could present a more promising investment opportunity. One contender is Broadcom (NASDAQ: AVGO). This networking company may have more room for growth in the AI sector, making it an interesting option for your portfolio.

Broadcom’s Rapid AI Expansion

Broadcom is a major player in networking, providing a wide range of products in areas like data center networking, home connectivity, and smartphones. Recently, AI has become a significant growth area for the company. In its latest earnings report, Broadcom noted that AI revenue is “growing strongly.”

This past quarter, demand from hyperscalers—large-scale data centers—led to a remarkable 47% increase in overall revenue, reaching over $13 billion. Revenue from custom AI accelerators tripled year-over-year, while Ethernet switching revenue grew fourfold, and optical interconnects saw a threefold increase. Additionally, PCI Express switches more than doubled compared to last year.

Looking ahead, Broadcom anticipates a sequential increase of 10% in AI revenue, expecting to reach $3.5 billion in the fourth quarter. For the fiscal year, the forecast has been raised to $12 billion, up from the previous estimate of $11 billion. The overall AI market is projected to grow from $200 billion to $1 trillion by the end of the decade, which bodes well for Broadcom’s continued growth.

Moreover, Broadcom’s acquisition of VMWare has the potential to drive further growth. The VMWare Cloud Foundation (VCF) offers a complete software solution that virtualizes entire data centers. Recent bookings for VCF have pushed Broadcom’s annualized booking value to $2.5 billion for the quarter, marking a 32% increase from the last quarter.

Profitability of VMWare and Broader Impacts

In addition, Broadcom is on track to surpass its profitability goals set during the VMWare acquisition last year. The company aimed for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $8.5 billion in three years. Broadcom now expects to achieve this target as early as the 2025 fiscal year.

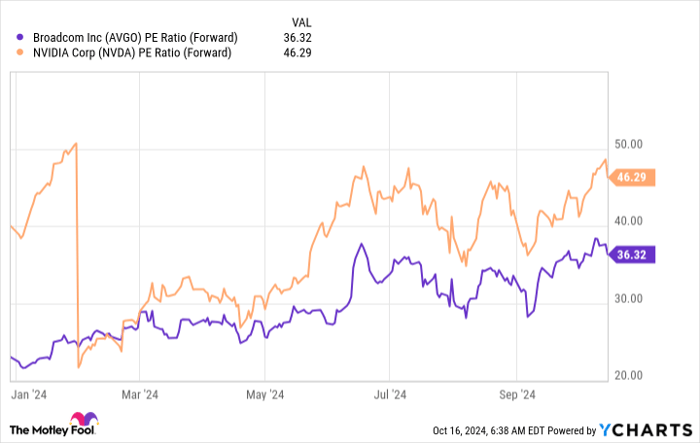

So, should investors overlook Nvidia and consider Broadcom instead? Nvidia continues to demonstrate impressive earnings, driven by a strong focus on innovation and robust growth projections in the AI sector. However, Nvidia’s stock may experience fluctuations, potentially stagnating at some point. While the stock currently trades at 46 times its forward earnings estimates, Broadcom offers a compelling growth story at a less steep valuation.

AVGO PE Ratio (Forward) data by YCharts.

While Broadcom’s stock has risen significantly in recent years, it still lags behind Nvidia’s performance. This gives Broadcom the potential for continued growth, making it an appealing option right now. While Nvidia shouldn’t be forgotten entirely, Broadcom may be the better buy for those looking to capitalize on its early strides in AI growth.

Should You Invest $1,000 in Broadcom Now?

Before investing in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they see as the 10 best stocks to buy now, and unfortunately, Broadcom isn’t included. The selected stocks have the potential for substantial returns in the coming years.

For example, if you had invested $1,000 in Nvidia upon its inclusion in the recommendation list on April 15, 2005, you would now have $831,707!*

The Stock Advisor service helps investors with portfolio organization, provides regular analyst updates, and introduces two new stock picks each month. Notably, since 2002, this service has more than quadrupled the return of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Adria Cimino has no positions in any of the mentioned stocks. The Motley Fool holds positions in and recommends Nvidia and Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.