Dominion Energy Set to Release Q3 Earnings Amid Positive Growth Trends

Dominion Energy, Inc. (D), based in Richmond, specializes in both regulated and non-regulated electricity distribution, generation, and transmission. With a market capitalization of $50.7 billion, the company operates through its Dominion Energy Virginia, Dominion Energy South Carolina, and Contracted Energy segments. On Friday, November 1, before the market opens, Dominion Energy will announce its Q3 earnings.

Analysts Predict a Strong Profit for Q3

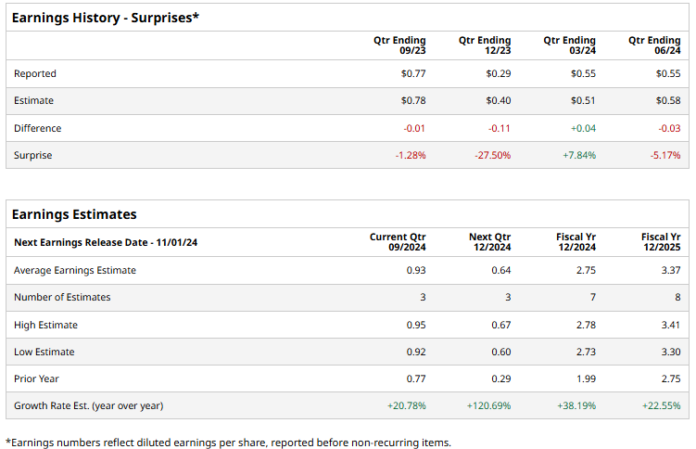

Leading up to the announcement, analysts anticipate that Dominion Energy will report earnings of $0.93 per share, marking a 20.8% increase from $0.77 per share reported in the same quarter last year. Over the past year, the company has struggled to meet Wall Street’s adjusted EPS forecasts, falling short three times out of four. In its most recent quarter, adjusted EPS grew 3.8% year-over-year to $0.55, but this was still 5.2% below analyst estimates.

Bright Forecasts for Future Earnings

Looking ahead to fiscal 2024, analysts project that Dominion Energy will achieve an adjusted EPS of $2.75, a significant increase of 38.2% from $1.99 in fiscal 2023. For fiscal 2025, the growth is expected to continue, with adjusted EPS anticipated to reach $3.37, representing a 22.6% year-over-year increase.

Dominion’s Strong Performance Outshines the S&P 500

Year-to-date, Dominion Energy’s shares have risen an impressive 28.8%, outpacing the S&P 500 Index’s gains of 22.5%. However, they have slightly trailed the Utilities Select Sector SPDR Fund’s (XLU) 29.8% returns during the same period.

Q2 Results Fuel Trust in the Stock

After releasing its strong Q2 earnings on August 1, Dominion Energy’s shares surged 3.7%. The company reported a notable 10.1% increase in operating revenues from the previous year, totaling $3.5 billion—a result largely due to growth in its Virginia segment. Efficient management kept operating expenses low, leading to a remarkable 35.5% rise in income from operations, reaching $805 million. Although net income dipped slightly due to reduced income from discontinued operations, net income from continuing operations climbed 18.3%, amounting to $491 million.

Following these results, shares of Dominion Energy rose 5.1% to hit a 52-week high after Barclays PLC (BCS) raised its price target for the stock from $54 to $58, maintaining an “Overweight” rating.

Analyst Sentiment and Market Outlook

Currently, the consensus rating for Dominion Energy stock is neutral, categorizing it with an overall “Hold” rating. Out of 16 analysts covering the stock, three recommend a “Strong Buy,” while 13 advise holding onto shares. At present, the stock trades above its average price target of $56.85.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.