Nvidia Faces New Competition as AMD Steps Up in the AI GPU Race

Developing artificial intelligence (AI) software is closely tied to the performance of data centers and the powerful graphics processing units (GPUs) housed within them. Over the last 18 months, Nvidia (NASDAQ: NVDA) has captured an impressive 98% share of the GPU market.

However, with the rise of competition, Advanced Micro Devices (NASDAQ: AMD) is working diligently to make its mark. The company’s “Advancing AI” event on October 10 showcased its plans for next-generation GPUs, as CEO Lisa Su updated investors on developments.

While AMD is still playing catch-up in the AI GPU sector, Su’s remarks indicate that the company is quickly closing the gap. This progress is certainly of interest to investors.

Image source: Getty Images.

AMD Lags Behind Nvidia in the AI GPU Race

Nvidia’s H100 GPU has set a high standard for AI training and inference. Although it began full production in September 2022, significant sales did not occur until 2023, when AI technologies surged in popularity. The H100 continues to be a sought-after product, with Nvidia grappling with supply issues due to high demand from major AI players such as OpenAI, Amazon, Microsoft, and others.

These supply challenges have paved the way for AMD to capture some market share. The company introduced its MI300X data center GPU at the end of 2023, aiming directly at the H100 competitor. Notably, AMD has secured some of Nvidia’s major clients, including Microsoft, Oracle, and Meta Platforms.

AMD reports that these customers are experiencing performance and cost benefits from using the MI300X compared to the H100. Even though its launch was delayed by over a year, AMD appears to have delivered a solid product. The company anticipates that the MI300 series will drive its GPU revenue to a historic $4.5 billion in 2024, a target that has already been revised upward twice.

Despite AMD’s momentum, Nvidia remains in the lead. Earlier this year, it began shipping its new H200 GPU, which boasts nearly double the AI inference speed of the H100. This means AMD still has work to do. However, at the Advancing AI event, Lisa Su revealed details of the upcoming MI325X, which promises 80% more high-bandwidth memory than the H200 along with a 30% boost in inference performance.

The MI325X is not expected to launch until the first quarter of 2025, leaving AMD trailing behind Nvidia’s offerings.

Meanwhile, Nvidia is investing in its new Blackwell chip architecture, which promises significant performance improvements. The new GB200 NVL72 system can perform AI inference at 30 times the speed of an H100 setup, and individual GPUs will be priced similarly to the initial H100 launch, enhancing cost efficiency.

Thus, while AMD’s MI325X may surpass the H200, it will still lag behind Nvidia’s next-gen hardware.

AMD’s Newest Competitor is Coming Soon

Excitingly, at the same event, Lisa Su announced plans for another new GPU, the MI350X, set to launch next year. This GPU will use the new CDNA (compute DNA) 4 architecture, offering a remarkable 35 times performance increase over previous CDNA 3 chips, such as the original MI300X.

Amd has stated that the MI350X is designed to directly compete with Nvidia’s Blackwell chips. Nvidia intends to begin Blackwell GPU shipments during its fiscal 2025 fourth quarter, which spans from November to January. In contrast, AMD is set to ship the MI350X in the latter half of calendar 2025. This timeline gives AMD a chance to shorten its gap behind Nvidia from over a year to merely a few months.

AMD’s Financial Results Are Just Around the Corner

Investors may receive further updates on AMD’s new chips with its upcoming financial report for the third quarter of 2024, expected around October 29. In the second quarter, AMD reported a record $2.8 billion in data center revenue, an impressive 114% increase compared to the previous year. A strong performance in the next quarter could lead management to raise its full-year GPU sales estimate beyond $4.5 billion, a likely scenario given AMD’s recent track record.

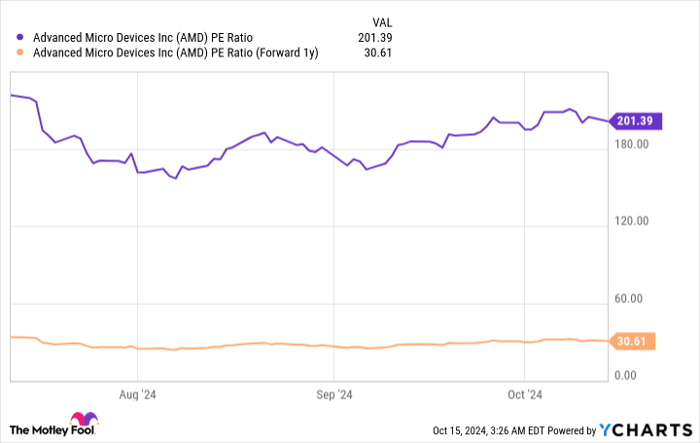

Currently, AMD’s stock is trading at a high price-to-earnings ratio (P/E) of 200.3, reflecting its modest earnings per share (EPS) of $0.82 in the last four quarters. In contrast, the Nasdaq-100 technology index has a P/E of 32.1.

Nevertheless, analysts expect that AMD can achieve an EPS of $5.43 by 2025, suggesting a more reasonable forward P/E of 30.6:

Advanced Micro Devices P/E Ratio data by YCharts.

This scenario indicates that AMD stock may be an appealing investment for those willing to hold on for a couple of years, particularly with the MI325X and MI350X poised for release in 2025.

Is Now the Right Time to Invest $1,000 in AMD?

Before considering an investment in AMD, it’s essential to take the following into account:

The Motley Fool Stock Advisor team has recently identified their picks for the 10 best stocks to buy, and AMD did not make the list. The chosen stocks have the potential for substantial returns in the years to come.

For context, consider when Nvidia appeared on this list on April 15, 2005… a $1,000 investment at that time would now be worth $831,707!

Stock Advisor gives investors a straightforward plan for success, which includes guidance on portfolio building, regular analyst updates, and two new stock picks every month. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500, generating more than quadruple the returns.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokesperson for Facebook, as well as sister to Meta Platforms CEO Mark Zuckerberg, also serves on The Motley Fool’s board. Anthony Di Pizio has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. They also recommend long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.