BTIG Begins Coverage of InMode with Positive Outlook

On October 17, 2024, BTIG initiated coverage of InMode (NasdaqGS:INMD), giving the company a strong Buy recommendation.

Analysts Predict 24.46% Growth Potential

According to data from September 25, 2024, InMode has an average one-year price target of $21.42 per share. Predictions vary, with a low of $16.16 and a high of $30.45. The average target suggests the stock could rise by 24.46%, considering its latest closing price of $17.21 per share.

For those interested in market trends, check out our leaderboard of companies with the greatest price target upside.

InMode’s projected annual revenue stands at $614 million, reflecting a significant increase of 47.26%. Additionally, the estimated annual non-GAAP EPS is expected to be 3.07.

Institutional Investor Sentiment

Data shows that 485 funds or institutions have reported investments in InMode, down by 23 owners or 4.53% in the last quarter. On average, these funds hold 0.16% of their portfolios in INMD, marking a rise of 5.07%.

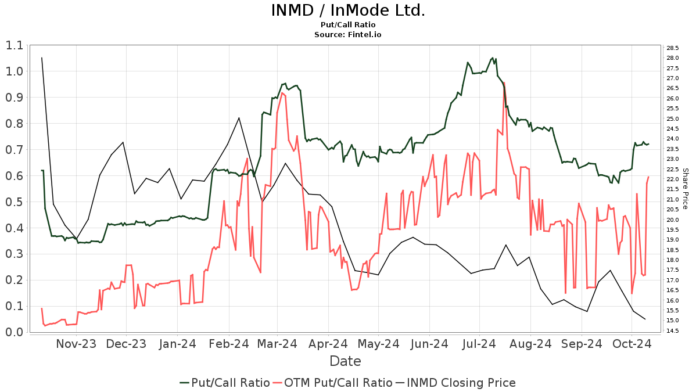

Over the past three months, total institutional shares owned decreased by 3.26% to 60,582,000 shares. The put/call ratio for INMD is currently 0.74, signifying a bullish outlook.

Recent Activity Among Major Shareholders

FIL holds 2,845,000 shares, amounting to 3.36% ownership. Previously, they owned 3,403,000 shares, indicating a 19.61% decrease in holdings and a significant drop of 60.61% in their portfolio allocation over the last quarter.

Renaissance Technologies reported holding 2,068,000 shares (2.44% ownership), increasing from 1,854,000 shares—a change of 10.36%. Their portfolio allocation in INMD rose by 1.61% in the same period.

Doma Perpetual Capital Management’s holdings jumped to 2,011,000 shares (2.38% ownership) from 647,000 shares, reflecting a substantial increase of 67.81% and an impressive 82.82% rise in allocation.

Lsv Asset Management holds 1,857,000 shares (2.19% ownership), down from 1,880,000—a 1.23% decrease with an 11.71% reduction in portfolio allocation.

The IWM – iShares Russell 2000 ETF owns 1,804,000 shares (2.13% ownership), also showing a decrease from 1,898,000 shares—a decline of 5.21% and a 12.47% reduction in allocation.

Company Overview

(This description is provided by the company.)

InMode is a top-tier global provider of advanced medical technologies. They develop, manufacture, and market devices utilizing innovative radiofrequency (‘RF’) technology. Their goal is to facilitate new surgical procedures and enhance existing treatments. InMode’s minimally-invasive RF technologies have allowed them to offer a wide range of products in categories such as plastic surgery, gynecology, dermatology, otolaryngology, and ophthalmology.

Fintel serves as a comprehensive research platform for individual investors, traders, financial advisors, and smaller hedge funds. Our extensive data includes fundamentals, analyst reports, ownership data, fund sentiment, and insider trading, among others. We also offer exclusive stock picks based on advanced, backtested quantitative models aimed at maximizing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.