UBS Upgrades Cohen & Steers Outlook Amid Price Target Adjustments

On October 17, 2024, UBS changed its rating for Cohen & Steers (NYSE:CNS) from Sell to Neutral.

Analysts Predict Price Decline Ahead

The average estimated price target for Cohen & Steers as of September 25, 2024, is $79.05 per share. Estimates vary, with a low of $63.63 and a high of $96.60. This average suggests a potential drop of 24.96% from its recent closing price of $105.35 per share.

Annual Revenue Expectations Rise

Cohen & Steers is projected to have annual revenue of $565 million, reflecting a 13.64% increase. Additionally, the forecast for annual non-GAAP earnings per share (EPS) stands at 3.10.

Institutional Interest on the Rise

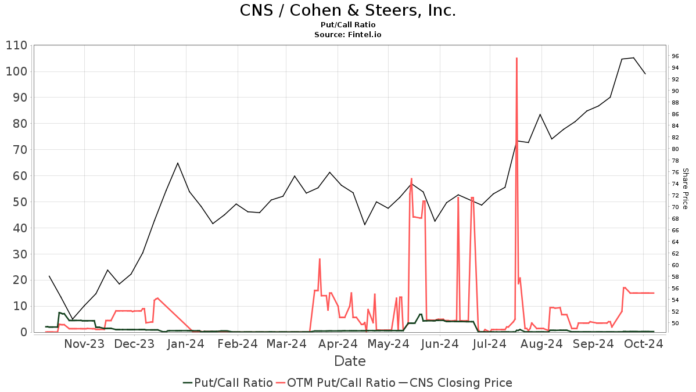

Currently, 506 funds or institutions hold positions in Cohen & Steers, marking an increase of 58 owners, or 12.95%, over the last quarter. The average portfolio allocation for these funds in CNS is 0.16%, up by 4.75%. Total institutional shares owned grew by 11.72% in the past three months to 39,760,000 shares. The put/call ratio for CNS is 0.63, which suggests a bullish sentiment among investors.

Wasatch Advisors now holds 3,114,000 shares, accounting for 6.16% ownership, down slightly from 3,125,000 shares, representing a decrease of 0.33%. Their portfolio allocation in CNS decreased by 3.80% this past quarter.

Bamco owns 2,043,000 shares, or 4.04% of the company, having reduced their stake from 2,143,000 shares, a drop of 4.89%. Similarly, Victory Capital Management holds 1,725,000 shares, a 3.41% stake, down from 1,733,000 shares, which is a 0.47% decrease.

The IJR – iShares Core S&P Small-Cap ETF holds 1,708,000 shares (3.38%), while the BARON GROWTH FUND, BGRFX, possesses 1,675,000 shares (3.31%), which reflects a decrease from 1,775,000 shares, or 5.97%. However, BGRFX increased its allocation in CNS by 1.24% over the quarter.

About Cohen & Steers

(Company description provided.)

Founded in 1986 and headquartered in New York City, Cohen & Steers is a global investment manager focused on liquid real assets. Their expertise includes real estate securities, listed infrastructure, and natural resource equities, in addition to preferred securities and other income solutions.

Fintel provides extensive investing research resources tailored for individual investors, traders, financial advisors, and smaller hedge funds.

Our platform comprises a comprehensive database that includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, and more. Our exclusive stock picks are driven by advanced, backtested quantitative models aimed at optimizing profits.

This story was originally published by Fintel.

The opinions expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.