Super Micro Computer: Tapping into the AI Infrastructure Boom

Dan Ives, an equity research analyst at Wedbush Securities, focuses on the major players in the tech sector and is keenly aware of upcoming trends.

Currently, artificial intelligence (AI) is at the forefront of tech discussions. One crucial aspect of AI that may not receive enough attention is information technology (IT) infrastructure. But what does that involve?

This article explores how infrastructure is crucial to AI’s development and why Super Micro Computer (NASDAQ: SMCI) stands out as a strong investment opportunity.

Unlocking Opportunities in IT Infrastructure

Building AI systems necessitates advanced protocols that integrate both hardware and software solutions. A key component in this process is a type of chip called a graphics processing unit (GPU).

Nvidia and Advanced Micro Devices are currently the leading developers of GPUs. Major tech companies such as Microsoft, Amazon, and Meta Platforms are also eager to enter this growing market.

Funds directed towards these technologies fall under capital expenditures (capex). In a recent CNBC interview, Ives projected that AI-related capex could reach $1 trillion within three years.

This leads to a pivotal question: why do I believe that Supermicro is an excellent investment choice?

Image source: Getty Images.

The Competitive Edge of Supermicro

Merely selling GPUs and related software isn’t the whole story; these essential AI technologies are housed in large data centers. These facilities contain vast storage racks designed to accommodate GPUs in specific configurations. This is where Supermicro shines.

Specializing in IT architecture, Supermicro crafts the necessary designs for managing GPU storage. The company collaborates closely with Nvidia and AMD, benefiting from upcoming catalysts.

Nvidia’s newly-released Blackwell series GPUs are projected to generate billions in sales by year-end, according to company and industry forecasts. I expect Supermicro to play a significant role in optimizing the functionality of these new products within data centers. This trend could serve as a substantial boost for Supermicro.

Moreover, as major tech companies roll out their own chipsets, Supermicro may expand its influence in the IT infrastructure sector. The rising capex in this area is likely to support Supermicro’s growth for years ahead.

Spotting Value in Supermicro’s Stock

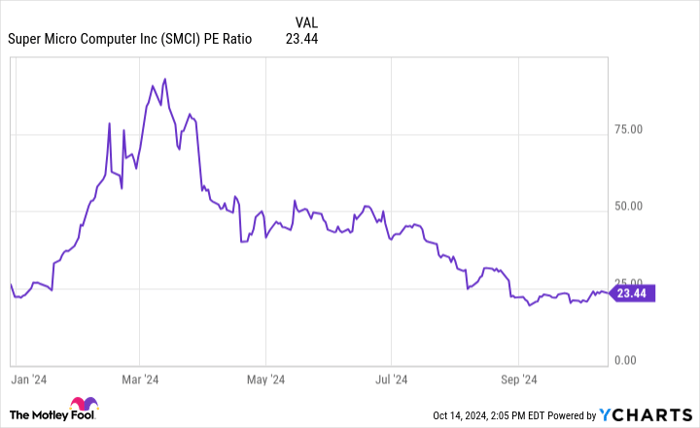

Supermicro’s price-to-earnings (P/E) ratio has been declining throughout 2024, as illustrated in the chart below.

SMCI PE Ratio data by YCharts

The stock faced two major setbacks leading to a sell-off. First, Supermicro’s early August earnings report revealed considerable volatility in its gross margin. Growth investors typically seek continual revenue growth, higher margins, and increasing profits. However, the nature of Supermicro’s business can be complex.

IT infrastructure companies usually have lower margins compared to software firms. It appears that investors had to adjust to the reality that Supermicro’s profit margins will likely fluctuate.

Secondly, a report from short-seller Hindenburg Research in late August raised concerns about accounting practices at Supermicro. While short-seller reports can create negative perceptions, it’s important to note that their interests are aligned with driving share prices down.

Supermicro did postpone its annual report following Hindenburg’s claims, but the fallout has mostly involved speculation and a significant drop in stock value.

Investing in Supermicro presents risks at present. However, when looking at the long-term horizon, the anticipated increase in capex and growth in IT infrastructure should benefit Supermicro’s business over time.

For these reasons, I consider Supermicro to be well-positioned to capitalize on the growth opportunities in AI IT infrastructure.

A Second Chance for Investors

Do you ever feel like you’ve lost the chance to invest in top-performing stocks? If so, you’ll want to consider this opportunity.

Our analysts occasionally issue a “Double Down” stock recommendation for firms they believe are on the verge of substantial gains. If you’re worried about having missed the ideal moment to invest, this may be the perfect time to act before it’s too late. The success rates speak volumes:

- Amazon: Investing $1,000 when we recommended it in 2010 would yield $21,049!*

- Apple: A $1,000 investment from our 2008 alert would be worth $43,847!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, you would have $378,583!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and this opportunity may not present itself again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on the board of directors for The Motley Fool. Randi Zuckerberg, former director of market development and spokeswoman for Facebook, and sister to Meta Platforms CEO Mark Zuckerberg, also holds a board position at The Motley Fool. Adam Spatacco has interests in Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool holds the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. For more details, see The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.