Analysts Predict Growth for Health Care ETF XLV

Recent analysis of the Health Care Select Sector SPDR Fund ETF (Symbol: XLV) reveals positive expectations from analysts regarding its underlying holdings. By comparing the ETF’s trading price with the average 12-month target prices set by analysts, we find the implied target price for XLV is projected at $168.80 per unit.

Current Prices and Analyst Expectations

As XLV trades at approximately $152.39 per unit, this suggests a potential upside of 10.77% based on analyst targets for the ETF’s holdings. Notable stocks within XLV showing significant upside to their target prices include Molina Healthcare Inc (Symbol: MOH), Bio-Techne Corp (Symbol: TECH), and Becton, Dickinson & Co (Symbol: BDX). For instance, Molina Healthcare, currently priced at $289.46 per share, has a target price that is 28.64% higher at $372.36. Bio-Techne also holds promise with an 18.32% upside from its current price of $70.15 to a target of $83.00. Meanwhile, analysts anticipate Becton, Dickinson & Co to reach a target price of $278.67, reflecting a 15.95% increase from its recent price of $240.33.

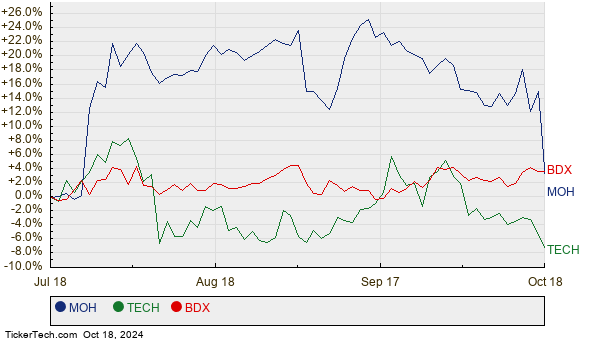

Below is a twelve-month price history chart comparing the stock performance of MOH, TECH, and BDX:

Analyst Target Price Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| The Health Care Select Sector SPDR Fund ETF | XLV | $152.39 | $168.80 | 10.77% |

| Molina Healthcare Inc | MOH | $289.46 | $372.36 | 28.64% |

| Bio-Techne Corp | TECH | $70.15 | $83.00 | 18.32% |

| Becton, Dickinson & Co | BDX | $240.33 | $278.67 | 15.95% |

Questions for Investors

Investors must consider whether the analysts’ lofty targets are justified or overly optimistic. Is there substantial reasoning behind these projections, or do they fail to account for recent developments in the industry? While a higher target price can indicate a positive outlook, it may also lead to downgrades if these targets do not reflect current market conditions. These considerations warrant further investigation by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding CC

• Funds Holding VMM

• JPM shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.