Netflix Soars After Impressive Earnings Report

Netflix (NFLX) shares hit record highs due to a robust quarterly earnings report. The company reported earnings per share of $5.40, exceeding estimates of $5.12, and revenue of $9.83 billion, surpassing predictions of $9.77 billion. Remarkably, Netflix added 5.07 million subscribers last quarter, well above the expected 4 million.

Currently, Netflix and Amazon (AMZN) Prime Video are in a tight race for market leadership, each holding a 22% market share. Their business strategies differ significantly; Prime Video is part of Amazon’s larger ecosystem, while Netflix operates independently. Despite this, Netflix has transformed into a highly profitable venture with promising earnings growth outlooks and a sustainable valuation.

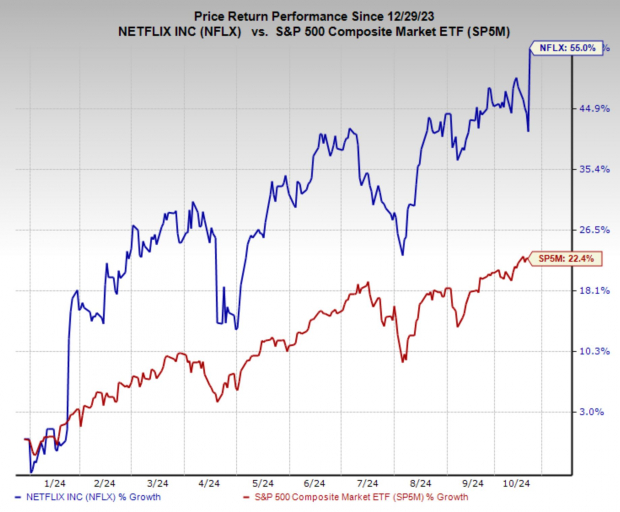

Today, Netflix stock surged nearly 10%, outperforming the broader market and reflecting strong performance year-to-date. The company enjoys a Zacks Rank #2 (Buy) rating, signaling positive revisions in earnings expectations.

Image Source: Zacks Investment Research

Strong Growth and Expanded Offerings Ahead for Netflix

In the third quarter of 2024, Netflix’s revenue grew by 15% year-over-year, with operating margins increasing to 30% from 22% last year. The outlook remains optimistic: Netflix anticipates 15% revenue growth and a 27% operating margin for the entirety of the year. A variety of new content has contributed to this success, as viewer engagement, measured in hours per member, has risen significantly.

The advertising sector also experienced notable growth, witnessing a 35% increase in ad memberships quarter-on-quarter and plans to expand its ad tech platform into Canada and beyond. Netflix is set to maintain its growth trajectory by broadening its content strategy, now including live events like NFL games and high-profile boxing matches.

Over the next three to five years, analysts expect earnings to grow by an annual rate of 26.4%.

Who Will Win the Streaming Wars: NFLX, AMZN, or DIS?

The competition in streaming is heating up, with Netflix, Disney (DIS), and Amazon Prime Video striving for dominance. As the longest-standing leader, Netflix faces increasing rivalry from newer platforms that leverage their extensive content libraries. Since its launch in late 2019, Disney+ has rapidly grown its subscriber base, bolstered by its popular franchises like Marvel and Star Wars. Bundling Disney+, Hulu, and ESPN has enhanced its appeal.

Amazon Prime Video, closely tied to Amazon’s broader membership, also focuses on original programming and live events. Its investments in high-profile shows like The Lord of the Rings: The Rings of Power and exclusive sports content such as Thursday Night Football significantly strengthen its competitive edge. To counter increasing competition, Netflix is evolving its strategy to incorporate live events alongside traditional programming.

Despite the challenges, Netflix maintains its leadership with approximately 280 million global subscribers, surpassing Amazon Prime Video’s 200 million and Disney’s 150 million. Additionally, Netflix’s profitability stands out against its competitors as it generates substantial operating profits.

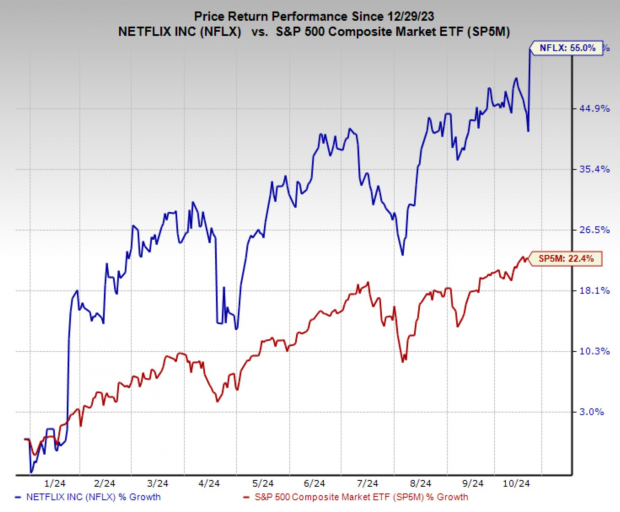

Analyzing Netflix’s Valuation

Currently, Netflix is trading at a forward earnings multiple of 36x, slightly below its 10-year average of 37.8x. Just a year ago, in 2022, the stock was trading as low as 15.3x. While this valuation exceeds the broad market average, it remains reasonable for a market leader like Netflix, experiencing rapid growth.

Image Source: Zacks Investment Research

Investing in Netflix: A Good Move?

Netflix’s recent earnings report confirms its stature as a leader in streaming, showing impressive growth and profitability in a competitive environment. Gaining 5.07 million subscribers last quarter highlights the strong demand for its offerings.

Amidst the ongoing streaming wars, Netflix’s pivot to live content reflects its desire to capture new audiences. While Disney+ and Amazon Prime continue to pose stiff competition, each with unique advantages, Netflix’s strength lies in its brand recognition, profitability, and large subscriber base.

Although its current valuation is above the market average, it is backed by an innovative management team and significant growth potential. With the overall stock market in a bullish phase, investors seeking bargains may need to exercise patience during the next bear market. For those looking to invest in technology and streaming stocks, this could be a favorable time to purchase Netflix shares.

7 Best Stocks for the Next 30 Days

Just released: Experts highlight 7 elite stocks from a list of 220 Zacks Rank #1 Strong Buys. These stocks are deemed “Most Likely for Early Price Pops.”

Since 1988, this full list has outperformed the market more than twice over, averaging a gain of +23.7% per year. Take note of these 7 stocks.

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.