Assessing Cathie Wood’s Strategy: A Close Look at Amazon and Meta

Cathie Wood, the CEO of Ark Investment Management, is renowned for her investment strategy that focuses on small- and mid-cap technology stocks. She gained significant attention when the Ark Innovation ETF (ARKK) achieved a stunning 73% return in 2020.

Performance of ARKK: A Mixed Bag

Despite this impressive performance in 2020, the long-term success of her strategies has been less favorable. Currently, ARKK, which manages $5.5 billion in assets, has registered a 25.7% return over the past year and a mere 12.2% over five years. In comparison, the S&P 500 has returned 35% over the past year and 95.4% over the last five years.

Wood’s Investments in Tech Giants: Amazon and Meta

Wood remains active in the market, making significant investments recently. On October 8, 2024, the Ark Innovation ETF acquired 76,505 shares of Amazon, totaling approximately $14 million. Although Amazon’s stock rose 18% since August 5, it did experience a drop of 9.8% from September 24 to October 8.

Morningstar analyst Dan Romanoff has a positive outlook on Amazon, assigning it a wide moat due to its strong presence in e-commerce and cloud services and setting a fair value at $195.

Additionally, Ark’s Next Generation Internet ETF bought 2,365 shares of Meta Platforms, valued at $1.4 million based on October 8, 2024, prices. Meta’s stock has shown a remarkable 16% increase over the past month. While Morningstar analyst Malik Ahmed Khan considers Meta slightly overvalued, he acknowledges its wide moat, attributed to its dominance in social media platforms like Facebook, Instagram, WhatsApp, and Messenger.

Investment Potential: Should You Engage with Amazon Stock?

Amazon has a Zacks Rank of #3 (Hold) and boasts a top VGM Score of “A.” It stands out as part of the top 18% of the Internet – Commerce industry. The company benefits from solid Prime momentum with its ultra-fast delivery services and extensive content offerings.

Often regarded as a wide-moat stock, Amazon leads in e-commerce, leveraging cost advantages and network effects to attract buyers and sellers. This edge has allowed Amazon to disrupt the retail industry for over 20 years, making it a compelling pick as the holiday season approaches.

Moreover, the increasing adoption of Amazon Web Services (AWS) reinforces its position in the cloud market. According to recent data, Amazon and Google increased their cloud market share, with Amazon being 35% larger than Microsoft and Google outpacing the next four largest competitors.

Amazon’s focus on generative AI also promises to bolster its competitive edge in tech. The company is developing proprietary processors to reduce dependence on expensive NVIDIA chips. Efforts led by Annapurna Labs, acquired in 2015, aim to fulfill the growing demand for affordable alternatives to NVIDIA’s products.

Analyzing Amazon’s Valuation

As per current evaluations, Amazon’s stock trades at a price-to-earnings (P/E) ratio of 44.29X compared to the industry average of 57.54X. However, the Price/Book ratio of 8.30X overshadows the industry average of 2.02X, while its price/cash flow ratio sits at 24.74X against an industry average of 14.28X.

For growth rates, Amazon’s projected growth is 63.45% this year versus the industry’s 13.20% and the S&P 500’s 15.67%. Looking ahead, Amazon anticipates a growth rate of 23.21% next year, slightly outpacing the industry’s 23.10% and far exceeding the S&P 500’s 11.34%.

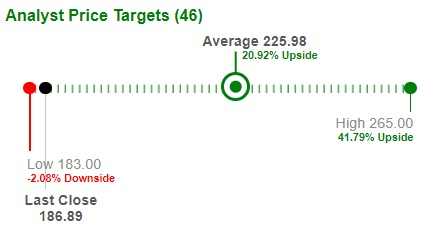

Analysts’ Price Targets for Amazon

According to forecasts from 46 analysts, the average price target for Amazon stands at $225.98, projecting a potential increase of 20.92% from its closing price of $186.89 on October 16, 2024. These targets range from a low of $183.00 to a high of $265.00.

Image Source: Zacks Investment Research

ETFs with Significant Amazon Exposure

Given the uncertainties surrounding competition in the cloud and AI sectors, an ETF approach may be favorable. This strategy can help reduce risks tied to individual stocks. Noteworthy Amazon-heavy ETFs include the Consumer Discretionary Select Sector SPDR Fund (XLY) with a weight of 22.52%, the ProShares Online Retail ETF (ONLN) with 22.33%, and the Fidelity MSCI Consumer Discretionary Index ETF (FDIS) holding a 22.25% stake.

Stay Informed with ETF Insights

Zacks’ free Fund Newsletter provides weekly updates on top news, analysis, and high-performing ETFs.

Consumer Discretionary Select Sector SPDR ETF (XLY): ETF Research Reports

Fidelity MSCI Consumer Discretionary Index ETF (FDIS): ETF Research Reports

ARK Innovation ETF (ARKK): ETF Research Reports

ProShares Online Retail ETF (ONLN): ETF Research Reports

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.