EssilorLuxottica Reports Q3 Revenue Decline Amid Weakened Demand in China

French-Italian eyewear powerhouse EssilorLuxottica SA (FR:EL) fell short of sales predictions for Q3 2023, largely due to declining demand in its significant market, China. The company reported revenue of €6.44 billion, below the expected €6.58 billion as per Visible Alpha consensus. However, this figure represents a 4% increase year-over-year when adjusted for constant currency. Following the announcement, shares of EssilorLuxottica rose 0.19% on Thursday.

Recognized for its popular eyewear lines such as Ray-Ban, Oakley, Crizal, and Persol, EssilorLuxottica has established itself as a leader in the optical industry.

Luxury Brands Face Challenges as Chinese Demand Slumps

China, once a significant growth engine for luxury brands, is now exhibiting signs of decreasing demand alongside broader economic and social changes.

In line with these trends, the French luxury giant LVMH (FR:MC) also fell below expectations in Q3, citing similar weaknesses in the Chinese market. Additionally, Kering (FR:KER), another key player in luxury goods, anticipates a staggering 30% revenue decline year-over-year in the latter half of 2024, with its Q3 results scheduled for release on October 23.

This recent downturn faced by notable brands showcases the increasing difficulties confronting the entire luxury sector, reflecting a shift in the shopping behaviors of Chinese consumers.

Ray-Ban Meta Wearables Drive Sales Amid Weakness in China

Despite challenges, EssilorLuxottica reported a 1.6% sales rise in North America, thanks largely to the strong performance of Ray-Ban Meta wearables, a key growth area for the quarter. In September, the company unveiled a long-term partnership with Meta Platforms (META), aimed at enhancing its AI-enabled smart eyewear offerings. Nevertheless, the overall growth in North America was dampened by lackluster sales in the sunglasses category, reflecting the prevailing economic uncertainties.

In the Asia-Pacific region, this quarter saw EssilorLuxottica’s revenue grow by 5% at constant exchange rates, a slowdown compared to the 9.8% growth from the previous quarter. The firm noted weak customer engagement in China, where it licenses high-end brands such as Chanel, Prada, and Armani.

Moreover, the Direct-to-Consumer segment in China faced negative comparable-store sales, further highlighting challenging market conditions.

Analysts Weigh In: Target Price for EssilorLuxottica

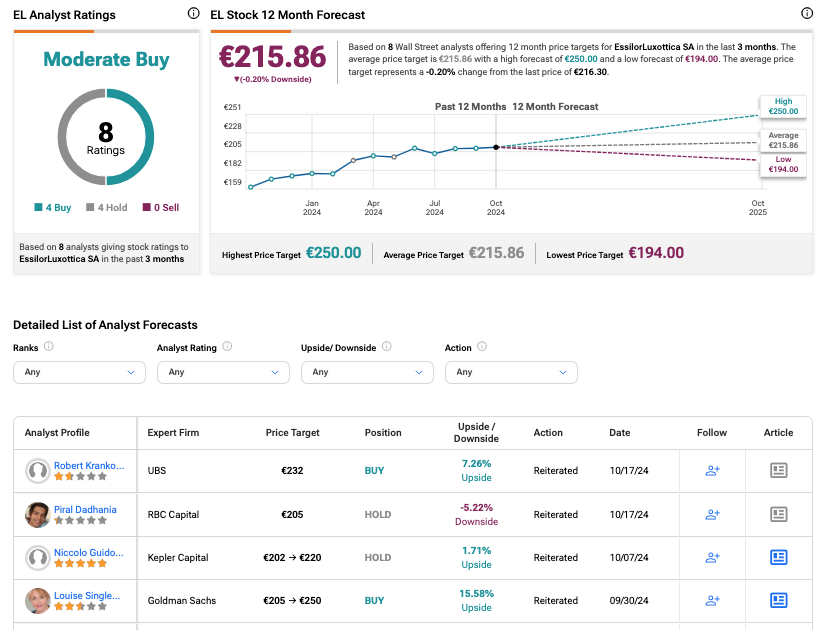

Currently, EssilorLuxottica has a Moderate Buy rating on TipRanks, based on four Buy and four Hold recommendations. The target share price is set at €215.86, closely aligning with the stock’s current trading level.

See more EL analyst ratings.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.