Tesla’s Latest Event Leaves Investors Questioning Future Growth

Tesla (NASDAQ: TSLA) recently hosted the “We, Robot” event, showcasing its autonomous vehicle prototypes and humanoid robots. However, investor reactions were less than enthusiastic. As a result, Tesla shares have dropped 10% over the past five trading days (as of this writing), as skepticism grows on the financial impact of the “Cybercab” and Tesla Optimus Bots in the near term.

Musk’s Optimistic Vision versus Reality

Tesla’s journey with self-driving technology spans over a decade, with CEO Elon Musk frequently promising breakthroughs that have yet to materialize. Notably, in 2019, he claimed there would be 1 million robotaxis operating by the end of 2020—a goal missed by a long shot.

At the recent event, Musk presented a “Cybercab,” described as a futuristic taxi with vertically opening doors, along with a prototype for a self-driving van. Production for the Cybercab is set for 2026, but no timeline exists for the van. Tesla aims to create a ridesharing network to compete with Uber, targeting cost reductions for users by utilizing a fleet of fully autonomous vehicles.

Additionally, Musk pushed the narrative around the Tesla Optimus Bot, a humanoid robot that he envisions could revolutionize productivity, potentially adding up to $25 trillion in market value. Nevertheless, it remains unclear how he arrived at this figure, leading to skepticism among analysts.

Concerns Regarding Practicality

Tesla often shares lofty projections involving millions of robotaxis and enormous market valuations. However, tangible products are still absent from consumer markets.

For investors, it’s understandable to worry that these announcements may be more about long-term aspirations than imminent realities. Tesla’s future hinges on artificial intelligence, robotics, and self-driving tech—yet they currently have only prototypes. Its full self-driving software continues to require human supervision. Unlike Waymo, which operates licensed robotaxi fleets, Tesla’s self-driving network is still largely theoretical.

Furthermore, recent reports indicate that the Optimus Bot was being manually controlled during its demonstration, adding to concerns about the bot’s actual capabilities and potentially misleading investors.

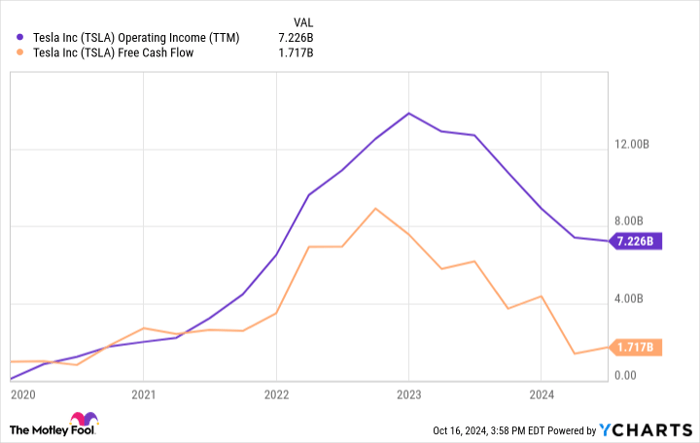

TSLA Operating Income (TTM) data by YCharts

Is Now a Good Time to Buy Tesla Stock?

Historically, Tesla stock has performed well. However, it has also dropped 47% from its all-time high in late 2021. With the recent hype surrounding AI and robotics, some might think it’s wise to invest now, but this could be a miscalculated move.

Based on current evidence, the Cybercab and Optimus Bot are unlikely to significantly enhance Tesla’s business in the next five years, if at all. Investors would be left with the existing electric vehicle and battery-storage segments.

There are valid concerns here as well. Due to oversupply and reduced profit margins, Tesla’s operating income and free cash flow have greatly decreased in recent quarters, generating only $1.7 billion in free cash flow over the past year, a stark contrast to its $686 billion market cap.

With no new products imminent and uncertain technology, Tesla stock may remain overvalued since the “We, Robot” event.

A Second Chance at a Notable Investment Opportunity

Have you ever felt that you missed your chance to invest in high-performing stocks? If so, you might be interested in hearing about rare “Double Down” recommendations from our expert team of analysts for companies that are poised for a significant rise in value. Take note of these compelling statistics:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $21,121!*

- Apple: A $1,000 investment from 2008 would now be valued at $43,917!*

- Netflix: If you invested $1,000 in 2004, it would have grown to $370,844!*

Currently, we’re launching “Double Down” alerts for three standout companies. Don’t miss this possible opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla and Uber Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.