Bernstein Boosts Eli Lilly with Outperform Rating, Targeting Significant Upside

Fintel reports that on October 17, 2024, Bernstein initiated coverage of Eli Lilly and (LSE:0Q1G) with a Outperform recommendation.

Analyst Predicts Substantial Growth Potential

As of April 3, 2023, the average one-year price target for Eli Lilly is 350.00 GBX per share. Price forecasts vary, with estimates ranging from a low of 270.68 GBX to a high of 415.80 GBX. This average price target indicates a potential increase of 42.88% from its recent closing price of 244.96 GBX per share.

For additional insights, check out our leaderboard of companies with the highest price target upside.

Revenue Projections and Earnings

Eli Lilly’s projected annual revenue stands at 28,875MM, reflecting a notable decrease of 25.81%. The estimated annual non-GAAP EPS is 7.73.

Recent Fund Sentiment Trends

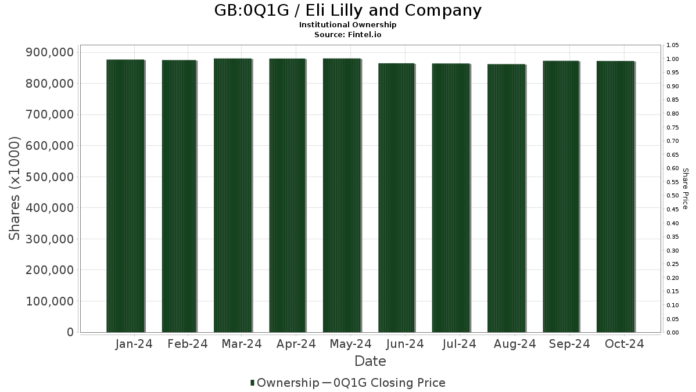

Currently, 5,162 funds or institutions report holdings in Eli Lilly, marking an increase of 140 owners, or 2.79%, from the last quarter. The average portfolio allocation to 0Q1G among these funds is 1.28%, up by 4.86%. In the past three months, total institutional shares owned grew by 2.77% to 872,253K shares.

Lilly Endowment currently holds 96,892K shares, translating to 10.76% ownership of the company. Their previous filing indicated ownership of 97,367K shares, showing a decrease of 0.49%.

Pnc Financial Services Group holds 51,405K shares, accounting for 5.71% ownership. Their earlier filing reported 51,438K shares, reflecting a slight decrease of 0.06%. However, the firm has increased its portfolio allocation to 0Q1G by 11.40% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares own 27,024K shares, representing 3.00% ownership. Their prior report showed 26,883K shares, indicating an increase of 0.52%. This fund also raised its allocation in 0Q1G by 13.76% recently.

Capital World Investors hold 21,814K shares, which is 2.42% ownership. In the last filing, they reported 24,536K shares, reflecting a decrease of 12.48% despite a 1.94% increase in their portfolio allocation to 0Q1G last quarter.

Price T Rowe Associates owns 20,652K shares, making up 2.29% of their holdings. Their previous number was 20,613K shares, showing a slight increase of 0.19%. They have also raised their portfolio allocation by 13.83% in the last quarter.

Fintel is a leading investment research platform catering to individual investors, traders, financial advisors, and small hedge funds. Our extensive data includes fundamentals, analyst reports, ownership info, fund sentiment, insider trading, and more, enhanced by advanced quantitative models for better financial outcomes.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.