Wedbush Upgrades Zoom Video Communications to Outperform, Anticipates Price Growth

Analyst Price Forecast Indicates Potential Gains

On October 17, 2024, Wedbush raised its outlook for Zoom Video Communications (XTRA:5ZM) from Neutral to Outperform. As of September 25, 2024, analysts project a one-year price target for Zoom at 68.83 €/share. This target reflects a potential upside of 9.97% from the most recent closing price of 62.59 € per share, with estimates varying between a low of 54.31 € and a high of 89.40 €.

Zoom’s Projected Revenue Sees Positive Growth

For the upcoming year, Zoom Video Communications is expected to report annual revenues of €4,855 million, representing a growth rate of 5.84%. Analysts also forecast a non-GAAP earnings per share (EPS) of 4.46.

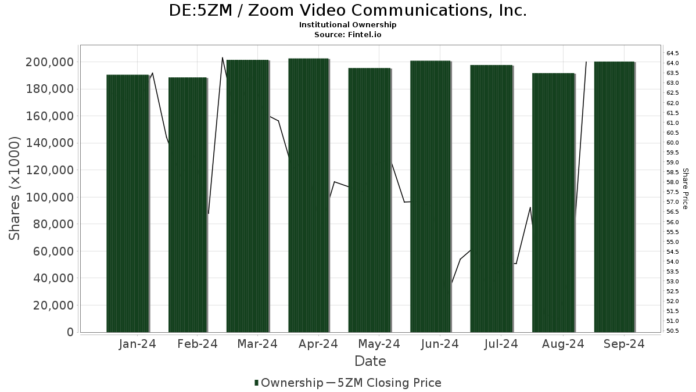

Fund Participation and Ownership Trends

Currently, there are 1,160 funds or institutions holding positions in Zoom Video Communications. This marks a decrease of 17 owners, or 1.44%, compared to the previous quarter. The average portfolio allocation to 5ZM across all funds stands at 0.21%, which is an increase of 0.41%. Over the last three months, institutional ownership rose by 2.91%, reaching a total of 199,743K shares.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 7,489K shares, giving it a 2.86% stake in the company. In its last filing, it reported ownership of 7,302K shares, indicating an increase of 2.50%. However, VTSMX has reduced its portfolio allocation to 5ZM by 9.69% in the last quarter.

Newlands Management Operations retains 5,786K shares, equating to 2.21% ownership, showing no change from the previous quarter.

Aqr Capital Management has significantly increased its stake, now holding 5,731K shares, or 2.19% ownership. This represents a substantial increase from the previous 3,210K shares, a gain of 43.99%. Its allocation to 5ZM has risen by 44.66% over the past quarter.

UBS Asset Management Americas owns 5,670K shares (2.16% of the company), which has seen a slight increase of 0.86% from 5,622K shares in the prior filing. Nonetheless, it has decreased its overall allocation in Zoom by 90.48% in the last quarter.

Pacer US Cash Cows 100 ETF (COWZ) holds a total of 5,331K shares, representing 2.03% ownership, which is an impressive increase from 2,823K shares, a spike of 47.05%. This firm has raised its portfolio share in 5ZM by 68.66% during the last quarter.

Fintel serves as a valuable resource for investors, offering comprehensive data and research tools for informed decision-making.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.