Bank of America Gets Boost from Phillip Securities Upgrade

On October 18, 2024, Phillip Securities changed their rating for Bank of America (XTRA:NCB) from Neutral to Accumulate.

Analyst Predictions Indicate Positive Upside

According to data from September 25, 2024, the average price target for Bank of America is set at 41.96 €/share. Predictions vary, with a low of 35.37 € and a high of 49.03 €. This average suggests a potential increase of 7.15% compared to the latest closing price of 39.16 € per share.

Projected Financial Growth on the Horizon

The expected annual revenue for Bank of America is 104,156 million euros, reflecting a growth rate of 10.07%. Additionally, the projected non-GAAP earnings per share (EPS) stands at 3.72.

Fund Sentiment Shows Optimism

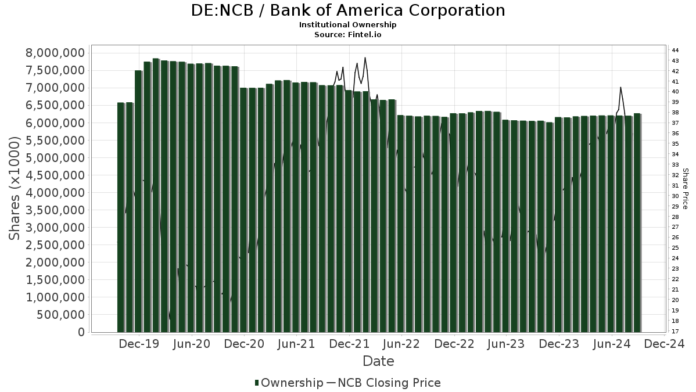

Currently, 4,235 funds and institutions hold positions in Bank of America, an increase of 45 (or 1.07%) from the previous quarter. The average portfolio weight allocated to NCB by all funds is 0.67%, which is a rise of 2.51%. Over the past three months, total institutional ownership has grown by 2.94%, now amounting to 6,280,126,000 shares.

Institutional Investors’ Moves

Berkshire Hathaway remains steady, holding 1,032,852K shares, which accounts for 13.43% of the company, with no changes reported in the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares holds 209,897K shares, about 2.73% ownership, showing a slight decline of 0.17% from the previous count of 210,263K shares while increasing its portfolio allocation in NCB by 1.81% over the past quarter.

Vanguard 500 Index Fund Investor Shares increased its stake to 174,622K shares, or 2.27%. This is up from 173,507K shares, indicating a growth of 0.64%, though it slightly reduced its allocation by 0.08% in the previous quarter.

JPMorgan Chase holds 147,816K shares, representing 1.92% ownership, up from 146,885K shares, reflecting an increase of 0.63% and a 2.49% rise in allocation in the last quarter.

Geode Capital Management also reported an increase in shares held, now owning 138,556K shares (1.80%), up from 137,026K shares, marking a 1.10% jump along with a 0.63% increase in its allocation.

Fintel serves as a vital research platform for individual investors and small hedge funds, providing comprehensive data including analytics, ownership statistics, and insights into fund sentiment.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.