Scotiabank Boosts Outlook on Liquidia with a Positive Review

Analyst Predicts Significant Price Increase

On October 16, 2024, Scotiabank began covering Liquidia (MUN:LT4) with a Sector Outperform rating. As of December 21, 2023, analysts estimate the average one-year price target for Liquidia at 13.55 €/share, suggesting a potential upside of 30.05% from the most recent closing price of 10.42 € / share. The price targets vary, with a low of 3.03 € and a high of 21.00 €.

Projected Revenue Shows Strong Growth

Liquidia’s anticipated annual revenue stands at 37 million euros, marking an impressive increase of 148.32%. However, their projected annual non-GAAP earnings per share (EPS) is expected to be -1.19.

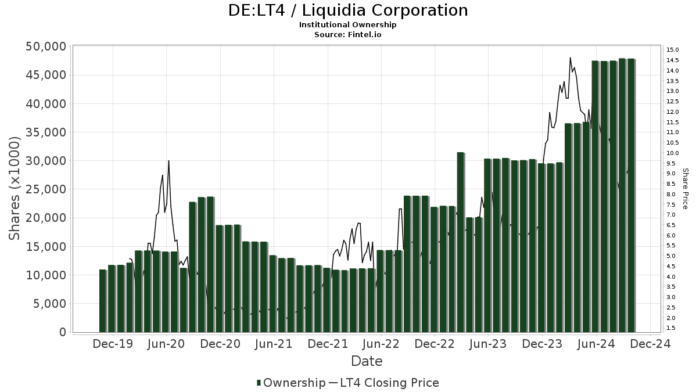

Investor Interest Increases

A total of 268 funds or institutions hold shares in Liquidia, reflecting an increase of three investors, or 1.13%, from the previous quarter. The average portfolio weight of all funds invested in LT4 is 0.40%, which has risen by 20.24%. Over the last three months, the total shares owned by institutions grew by 2.35% to reach 47,881K shares.

Key Institutional Shareholders

Caligan Partners remains a significant shareholder, holding 10,361K shares, which accounts for 12.28% ownership. Patient Square Capital also retains a strong position with 7,183K shares, or 8.51% ownership, stable from the last quarter.

Findell Capital Management has increased its holdings to 2,400K shares, representing 2.84% ownership, up from 2,105K shares previously, reflecting a 12.29% increase. In contrast, their overall allocation to LT4 has declined by 14.66% this quarter.

Farallon Capital Management has maintained its holdings at 2,055K shares, representing 2.44% ownership, while VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has increased its holdings to 1,883K shares, or 2.23% ownership, up from 1,533K shares, showing an 18.58% rise, despite a slight decrease in portfolio allocation by 2.83% over the last quarter.

Fintel is a leading investing research platform that provides insights and analysis to individual investors and small funds.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.