Bernstein Begins Coverage of Moderna with Positive Outlook

On October 17, 2024, Bernstein initiated its coverage of Moderna (XTRA:0QF), recommending a Market Perform rating.

Analysts Anticipate Significant Price Increase

As of September 25, 2024, analysts project an average one-year price target for Moderna at 94.99 €/share. These forecasts range from a low of 42.44 € to a high of 228.28 €. This average price target indicates an estimated increase of 80.55% from its latest reported closing price of 52.61 € per share.

Explore our leaderboard showcasing companies with the highest price target upside.

Revenue Projections Show Growth

Moderna’s anticipated annual revenue has been projected at 6,692MM EUR, marking an increase of 32.51%. Meanwhile, the expected annual non-GAAP earnings per share (EPS) stands at -3.39.

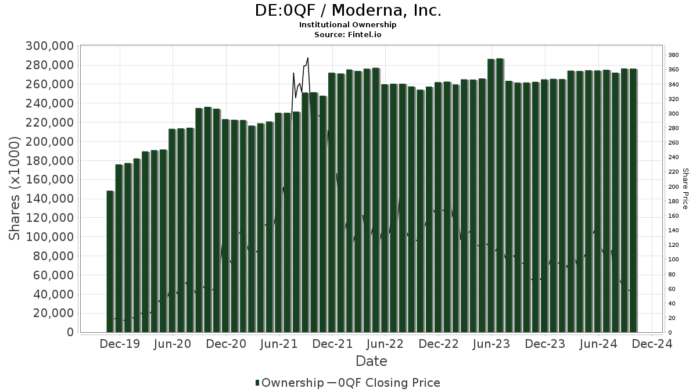

Fund Sentiment Shows Growing Interest

A total of 1,638 funds and institutions have reported their positions in Moderna, reflecting an increase of 33 owners or 2.06% in the previous quarter. The average portfolio weight of these funds dedicated to 0QF has risen to 0.28%, up 2.30%. Over the last three months, total shares held by institutions increased by 2.74%, reaching 276,199K shares.

Baillie Gifford holds 43,449K shares, accounting for 11.30% of the company. This represents a decrease of 2.78% from its previous filing of 44,656K shares, although the firm increased its investment in 0QF by 8.60% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 10,907K shares, or 2.84% of the company, showing a 0.98% increase from its earlier holding of 10,801K shares, with a portfolio allocation rise of 9.44% in the last quarter.

VWIGX – Vanguard International Growth Fund Investor Shares owns 9,029K shares, representing 2.35% ownership, reflecting a 1.35% decrease from the prior 9,151K shares. Notably, the firm increased its allocation in 0QF by 49.46% recently.

VFINX – Vanguard 500 Index Fund Investor Shares holds 8,558K shares, representing 2.23% ownership, with a 2.31% increase from its previous holding of 8,359K shares and an allocation rise of 7.99% last quarter.

VIMSX – Vanguard Mid-Cap Index Fund Investor Shares holds 7,388K shares, representing 1.92% ownership. This marks a 0.91% decrease from its earlier total of 7,456K shares, despite an overall portfolio allocation bump of 14.00% in 0QF over the last three months.

Fintel serves as a key research platform for individual investors, traders, financial advisors, and small hedge funds, providing access to a wide range of investment insights.

Discover more about investing and market trends.

This report initially appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.