Exploring Top Dividend Stocks: UPS and Kinder Morgan in Focus

For investors seeking reliable income, high dividend yields can offer stability regardless of broader stock market shifts. The critical factor is ensuring that the companies can sustain these payouts, as a dividend holds value only if the paying company remains healthy.

Conversely, companies without a clear path for future earnings growth may struggle to increase their dividends without risking financial stability. Here, we present an analysis of two standout options: United Parcel Service (NYSE: UPS) and Kinder Morgan (NYSE: KMI) as compelling dividend stocks to consider now.

Image source: Getty Images.

UPS Faces Challenges Ahead of Earnings Report

United Parcel Service is set to announce its third-quarter earnings for 2024 on Oct. 24. Currently, its stock is trading less than 9% above a recent four-year low, making this earnings report a pivotal moment for the company.

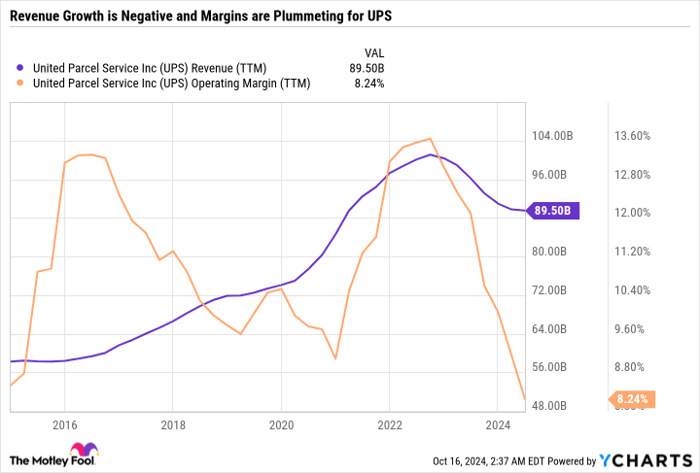

In the latest quarterly update, UPS projected full-year revenue at $93 billion, with an operating margin of 9.4% and capital expenditures amounting to $4 billion. To improve its financial health, UPS has reduced spending, attempting to recover margins that fell sharply from a decade high to a low in under two years.

UPS Revenue (TTM) data by YCharts

This past March, UPS laid out its three-year goals, targeting consolidated revenue between $108 billion and $114 billion by 2026, with an adjusted operating margin above 13% and free cash flow of $17 billion to $18 billion. The outlined plan emphasizes volume and operating profit growth in the earlier year, while subsequent years will focus on maintaining margins.

Recently, UPS reported its first increase in domestic volume in nine quarters, a hopeful sign for its 2024 ambitions. Nonetheless, based on current performance, achieving the three-year targets may extend into 2027.

The company needs to adopt concrete strategies to revitalize sales growth as we head into next year. Meanwhile, UPS currently offers an appealing yield of 4.9%, and management is committed to maintaining this payout.

Kinder Morgan Shows Resilience Despite Past Performance

From 2016 to the end of 2023, Kinder Morgan’s stock price rose less than 20%, lagging significantly behind the 133% increase in the S&P 500 index. However, factoring in dividends, Kinder Morgan returned a much higher 77%, yet it still pales in comparison to the S&P 500’s total return of 170% in the same period.

Heading into 2024, expectations for Kinder Morgan’s performance were somewhat subdued, with the primary attraction being its dividend. However, the company’s stock has rebounded, climbing over 40% this year while still holding a yield of approximately 4.6%, underscoring how much higher its yield was when the stock faced downward pressure.

Pipeline and infrastructure firms like Kinder Morgan have gained traction in 2023, driven by increasing domestic natural gas demand and the growing potential for exports. Enhanced demand plays a crucial role in justifying new investments, which Kinder Morgan relies on to generate steady cash flow and support additional dividends.

Despite its mediocre performance over the last decade, concerns related to its infrastructure assets have diminished somewhat. Analysts suggest that natural gas may remain relevant in the energy sector for the foreseeable future, as it fulfills growing demands in various sectors, including data centers and artificial intelligence.

With solid cash flow generation, Kinder Morgan is well-positioned to reinvest in its business and support its dividend, making it a worthy high-yield consideration in the current market.

Is Now the Right Time to Invest $1,000 in UPS?

Before deciding to purchase shares of United Parcel Service, enthusiasts should ponder whether it’s the best choice. The Motley Fool Stock Advisor team recently identified ten stocks they deem more promising at this time, with UPS notably absent from this list.

For context, consider that when Nvidia featured on this list on April 15, 2005, a $1,000 investment then would be worth approximately $845,679 today!

Stock Advisor equips investors with a straightforward strategy for success, offering portfolio guidance, regular analyst updates, and two new stock recommendations each month. Since its inception in 2002, the Stock Advisor service has achieved returns more than quadruple that of the S&P 500.

Discover the 10 recommended stocks »

*Stock Advisor returns calculated as of October 14, 2024

Daniel Foelber has no positions in any of the stocks mentioned. The Motley Fool holds positions in and recommends Kinder Morgan and United Parcel Service. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.