Streaming Wars: Netflix Stays Ahead While Rivals Struggle

The battle for streaming dominance has seen major players like Amazon and Apple investing billions to capture viewers. Yet, the heavy financial outlay isn’t translating into profits for every company, highlighting the challenges of the industry.

Apple, known for its massive financial resources, is reportedly shifting its approach as it seeks to manage its extensive spending. Over the past five years, the tech giant has invested at least $20 billion in original content, not counting additional licensing fees. This includes a staggering $500 million dedicated to films from just three directors. Despite this expenditure, Apple’s share of total TV viewing in the US is merely 0.2%.

In contrast, Netflix (NASDAQ: NFLX) continues to thrive as a leading force in the streaming landscape. For nearly a decade, Netflix has been the trailblazer in this domain, and its recent performance solidifies its position. Let’s take a closer look at what makes Netflix successful.

Q3 Earnings Surprise Investors

On October 17, Netflix shared its third-quarter earnings results, which exceeded Wall Street’s expectations for both revenue and earnings per share (EPS). As a result, its stock price surged approximately 10% following the announcement. Although Netflix is not the sole profitable streaming service now, it remains the most consistent performer, with a Q3 operating income nearing $3 billion. For comparison, Walt Disney reported only $47 million for its streaming division in Q3 2024, which includes offerings like Disney+, Hulu, and ESPN+.

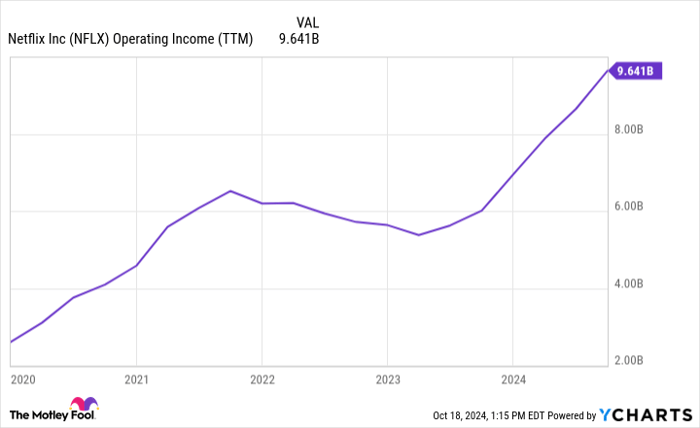

View the ongoing trend in Netflix’s operating income through the chart below.

NFLX Operating Income (TTM) data by YCharts

Ad-Supported Tier Boosts Growth

Initially, streaming promised consumers access to premium content at a fraction of cable costs and without ads. While this has changed, leading to ad-supported models, it has also created opportunities for investors. Hulu first introduced this concept, allowing users to choose between lower-cost, ad-supported tiers and premium options without ads. Netflix followed suit in late 2022, and this move significantly enhanced its revenue, as evident in earlier data.

The ad-supported tier made Netflix more accessible to users deterred by high subscription costs. Data shows that ad-supported subscriptions rose by 35% in the last quarter, and revenue from ads compensates for potential losses from the cheaper subscriptions.

Consistent Streaming Hits Set Netflix Apart

While rivals struggle to find successful shows, Netflix continues to deliver hits. Recent successes include Nobody Wants This and House of Ninjas, the latter attracting a larger American audience than Apple’s $250 million Masters of Air. The second season of the megahit Squid Game is also set to premiere soon, alongside additional popular titles. Netflix appears to be thriving amid strong competition.

Despite an image of market saturation, Netflix only accounts for 8.4% of TV viewership in the US, indicating room for further growth. Currently, the stock trades at a high valuation, with a price-to-earnings ratio (P/E) just below 40, yet the growth potential justifies this premium. While the competition remains fierce, Netflix seems to maintain a strong advantage.

Your Chance for a “Double Down” Investment Awaits

Ever feel like you missed the opportunity to invest in top-performing stocks? Here’s your chance.

Our analysts occasionally identify “Double Down” stocks—companies poised for significant growth. Don’t hesitate if you think you’ve missed your chance to invest; this could be the perfect time to jump in before it’s too late. Just look at the returns:

- Amazon: If you had invested $1,000 in 2010, you would have $21,285!*

- Apple: A $1,000 investment in 2008 would be worth $44,456!*

- Netflix: Investing $1,000 back in 2004 would now net you $411,959!*

Currently, we’re issuing “Double Down” alerts for three phenomenal companies, and this may be a rare opportunity.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Netflix, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.