Costco Thrives But Is It Worth the High Price? Growth Stocks to Consider Instead

Recent stock performance reveals Costco’s impressive 54% increase over the past year. However, this surge is mainly attributed to a heightened price-to-earnings (P/E) ratio rather than substantial earnings growth.

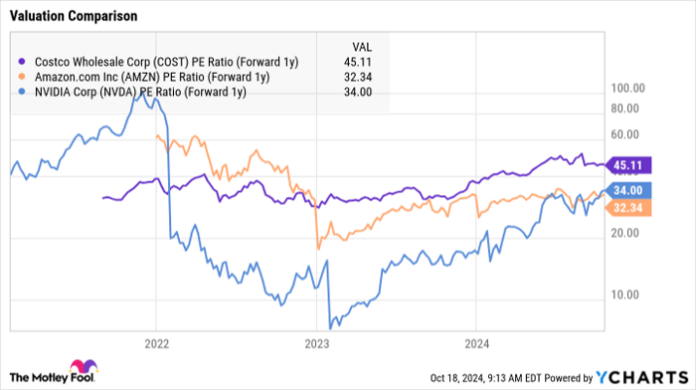

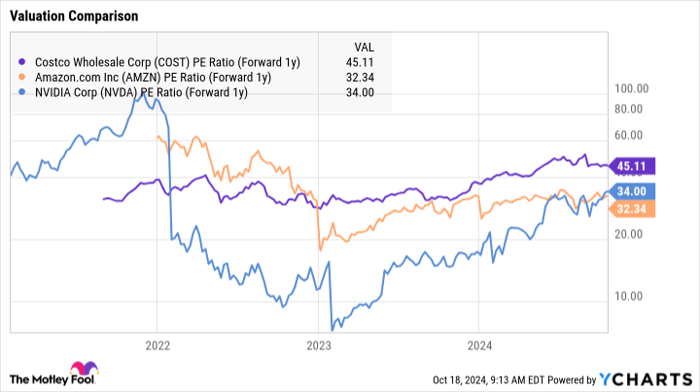

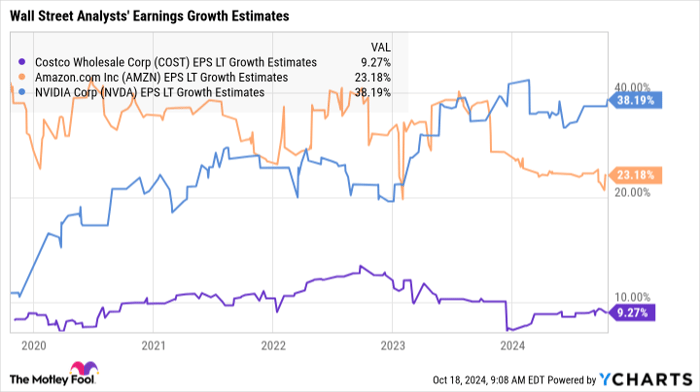

Forecasts suggest Costco will see annual earnings growth of about 9% in the long term. Yet, the company’s current forward P/E ratio stands at 45, a valuation often associated with top-growth stocks. This figure exceeds that of major tech players like Amazon (NASDAQ: AMZN) and Nvidia (NASDAQ: NVDA), which are expected to grow earnings at a faster pace while trading at lower P/E ratios.

P/E Ratio (Forward 1y) data by YCharts.

Costco’s high valuation echoes past market trends where companies like Coca-Cola and Walmart traded at similarly inflated earnings multiples in the late 1990s. Unfortunately, their following decade was marred by disappointing returns due to insufficient earnings growth.

Smart investing emphasizes choosing strong businesses with attractive growth prospects at reasonable valuations. Given current options, investors may want to hold off on Costco, as there are superior growth stocks available. The Magnificent Seven include some excellent alternatives.

1. Amazon

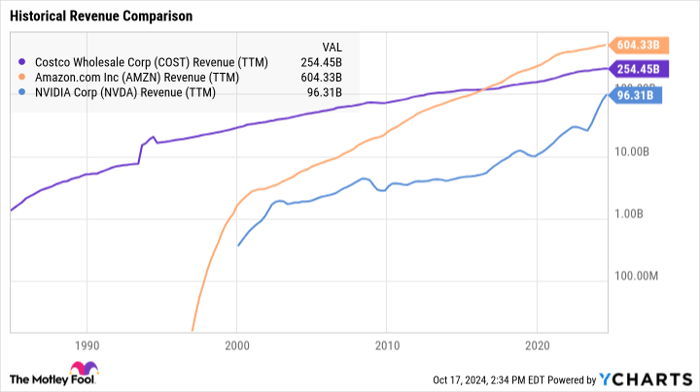

Amazon emerges as a key competitor for Costco in the e-commerce space. Impressively, Costco’s online sales growth outpaces Amazon’s, registering a 19% increase year-over-year, while Amazon experienced only single-digit growth.

Costco’s e-commerce segment remains relatively small when compared to Amazon, which commanded 37% of the U.S. e-commerce market in 2023, while Costco held just 1.5%. However, Amazon benefits from diverse revenue streams, including advertising, cloud services, and subscriptions, positioning it for better returns. Amazon’s total revenues grew by 10% over the past year, with sales increasing at a compound annual rate of 22% over the last decade, significantly outpacing Costco’s 8%.

Amazon is now implementing cost-reduction strategies that boost profits. Operating income surged by 91% year-over-year last quarter, aided by shorter delivery routes from fulfillment centers to customers. On the other hand, Costco’s operating profit increased by only 9% in the same period.

A significant portion of Amazon’s operating income stems from its cloud services—notably Amazon Web Services, which leads the $297 billion market that grew by 22% in Q2, according to Synergy Research. These lucrative revenues from non-retail sectors grant Amazon an advantage over traditional retailers by providing the funds necessary to enhance e-commerce infrastructure.

Long-term, analysts predict a remarkable 23% annualized growth in Amazon’s earnings per share (EPS), with a forward P/E ratio of 39 on 2024 earnings estimates, which is comparatively cheaper than Costco’s valuation.

EPS LT Growth Estimates data by YCharts.

2. Nvidia

In the past five years, Nvidia’s shares have soared over 2,700%. Although some investors may perceive this rapid growth as a sign of overvaluation, the semiconductor giant is capitalizing on strong trends in artificial intelligence (AI) and data center expansions that promise to enhance profitability.

Nvidia’s role in the GPU market, which initially served only gaming and graphics needs, has transformed considerably. Recently, Nvidia’s chips have powered some of the world’s most advanced supercomputers.

The company estimates a significant shift within a $1 trillion data center market moving from dated hardware to modern GPUs essential for AI tasks. Consequently, Nvidia’s revenues have accelerated as data centers update systems to manage substantial AI workloads.

Data by YCharts.

Despite its cyclical nature, Nvidia’s investors enjoy significant rewards for weathering the industry’s ups and downs. Analysts expect Nvidia to achieve an impressive 38% annualized growth in earnings over the next several years, with the most recent quarter reflecting a 168% year-over-year increase in earnings attributed to high demand for AI chips. Over the past decade, Nvidia’s earnings have grown at an average annual rate of 51%. Future opportunities from data center expansions are poised to sustain robust growth, outshining Costco’s prospects.

Currently, Nvidia trades at a forward P/E of 49. However, employing next year’s earnings forecast, its P/E ratio adjusts to 34, making it more cost-effective than Costco’s 45.

Evaluate High P/Es Against Growth Potential

Timing plays a crucial role in justifying elevated valuations. Companies must demonstrate substantial earnings growth to merit a high P/E ratio. While Amazon and Nvidia meet these standards, cautious investors might reconsider investing in Costco, which currently exhibits only modest growth in sales and earnings.

There may be several high-priced growth stocks that have outperformed standard market returns, but Costco cannot be regarded as one of them, especially given its lackluster earnings compared to average firms within the S&P 500.

Seize This Re-emerging Investment Opportunity

Ever feel like you missed your chance to buy stocks that skyrocket in value? You might want to listen up.

At rare intervals, our expert analysts recommend a “Double Down” stock for companies they believe are on the verge of significant growth. If you’re concerned about missing the boat, now might be the perfect moment to invest.

- Amazon: if you had invested $1,000 when we doubled down in 2010, you’d now hold $21,285!*

- Apple: if you’d put in $1,000 when we doubled down in 2008, you’d have $44,456!*

- Netflix: if you dumped $1,000 when we doubled down in 2004, your investment would be worth $411,959!*

We are currently issuing “Double Down” alerts for three fantastic companies, with opportunities that may not come again soon.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, which is under Amazon, is a member of The Motley Fool’s board of directors. John Ballard has shares in Nvidia. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Nvidia, and Walmart. Full disclosure link available.

The views expressed in this article represent the author’s opinion and do not necessarily reflect those of Nasdaq, Inc.