F.N.B. Corporation Sees Earnings Drop, Stock Takes Hit

Shares of F.N.B. Corporation (FNB) fell 5.7% in after-market trading after the bank reported disappointing third-quarter 2024 results. The adjusted earnings per share came in at 34 cents, falling short of the Zacks Consensus Estimate of 36 cents. This marks a 15% decline compared to the same quarter last year.

Stay informed with all quarterly releases: See Zacks Earnings Calendar.

The downturn in earnings was mainly due to rising expenses and decreasing net interest income (NII). However, a boost in non-interest income, lower provisions, and increases in loan and deposit balances provided some relief.

When accounting for significant items, net income for common stockholders was reported at $110.1 million, a 23.2% decrease year over year. This is lower than our expected figure of $127.8 million.

Revenue Gains Offset by Rising Costs

F.N.B. Corporation reported quarterly net revenues of $413 million, a 1.2% increase from the previous year. This figure exceeded the Zacks Consensus Estimate of $409.8 million.

NII was recorded at $323.3 million, down 1% from the year-ago quarter. The decline is largely attributed to higher deposit costs, which were partially offset by growth in earning assets and improved yields. Our forecast for NII was $319.7 million.

On a non-GAAP basis, the net interest margin contracted by 18 basis points year over year, arriving at 3.08%.

Non-interest income rose to $89.7 million, a 10% year-over-year increase. This growth stemmed from gains in almost all fee income areas, though it was tempered by a $2.8 million impairment in mortgage servicing rights, along with declines in interchange fees, capital markets income, and other income sources. Our estimate for non-interest income was slightly lower at $89.2 million.

Non-interest expenses totaled $249.4 million, rising 14.4% year over year, which was above our estimate of $223.4 million. Excluding significant impacts on earnings, adjusted expenses increased 7.4%, reaching $234.2 million.

As of September 30, 2024, the common equity Tier 1 (CET1) ratio stood at 10.4%, a slight increase from 10.2% in the same quarter of the previous year.

Average loans and leases were reported at $33.8 billion, reflecting a 1.6% increase sequentially, while average deposits totaled $35.6 billion, up 2.9%.

Improving Credit Quality at F.N.B.

The provision for credit losses at FNB was $23.4 million, which is a 9.7% decrease from the same quarter last year. This is slightly above our forecast of $22.4 million.

The ratio of non-performing loans and other real estate owned (OREO) to total loans and OREO decreased by 3 basis points to 0.39%. The net charge-offs as a percentage of total average loans were reported at 0.25%, down 22 basis points from the prior year.

However, total delinquency did rise by 16 basis points, reaching 0.79%.

Outlook for F.N.B. Corporation

FNB’s robust liquidity position suggests a positive outlook going forward. The bank is expected to enhance its revenue from increased fee income, diverse revenue streams, and selective acquisitions. Nevertheless, ongoing hikes in expenses and substantial commercial loan exposures amid an anticipated economic slowdown may impact profits in the near term.

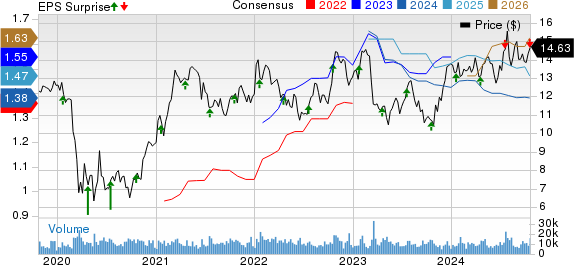

F.N.B. Corporation Price, Consensus, and EPS Surprise

F.N.B. Corporation price-consensus-eps-surprise-chart | F.N.B. Corporation Quote

Currently, FNB holds a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comparative Performance of Other Banks

First Horizon Corporation (FHN) reported third-quarter adjusted earnings per share of 42 cents, exceeding the Zacks Consensus Estimate of 38 cents and marking a 55.6% year-over-year increase.

FHN’s positive results were driven by growth in NII and non-interest income, along with an increase in deposits and lower provisions. However, rising expenses and declining loan balances posed challenges.

Hancock Whitney Corp. (HWC) reported third-quarter 2024 earnings per share of $1.33, slightly above the Zacks Consensus Estimate of $1.31 and up from $1.12 per share in the previous year.

This outcome was supported by an increase in both non-interest income and NII, alongside lower expenses and provisions. Nonetheless, HWC faced some pressure due to decreased total loans and deposits.

(This article has been reissued to correct a previous error. The original article, published on October 18, 2024, should not be relied upon.)

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which skyrocketed over +800% since our recommendation. While NVIDIA remains strong, our new top chip pick has much more potential for growth.

With solid earnings growth and an expanding customer base, this stock is well-positioned to meet the rapidly increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is projected to grow from $452 billion in 2021 to $803 billion by 2028.

See this stock now for free >>

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free.

First Horizon Corporation (FHN): Free Stock Analysis Report

F.N.B. Corporation (FNB): Free Stock Analysis Report

Hancock Whitney Corporation (HWC): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.