American International Group Set to Announce Q3 Earnings: A Closer Look

American International Group, Inc. (AIG), based in New York, provides a variety of insurance products to customers ranging from businesses to individuals, both in North America and around the globe. The company, with a market capitalization of $52.1 billion, operates through three main segments: General Insurance, Life and Retirement, and Other Operations. Investors are eagerly awaiting AIG’s Q3 earnings report, scheduled for release after the market closes on Monday, Nov. 4.

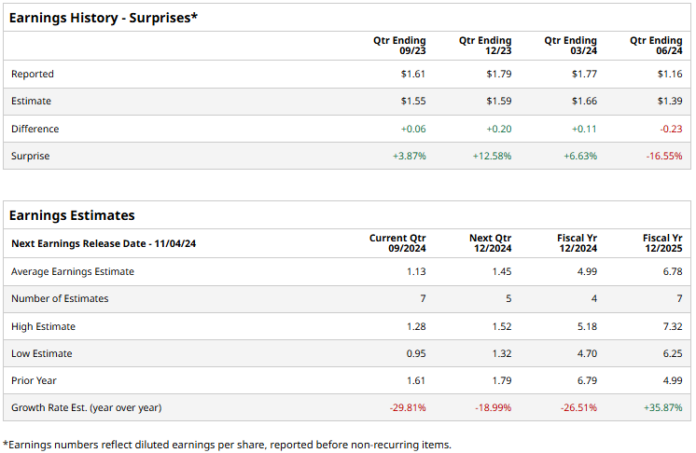

Analysts project AIG will report a profit of $1.13 per share, representing a significant decline of 29.8% from the $1.61 per share achieved in the same quarter last year. Over the past four quarters, AIG has exceeded Wall Street’s adjusted earnings per share (EPS) forecasts three times, but fell short once. Last quarter, the adjusted EPS dropped by 33.7% year-over-year to $1.16, missing predictions by 16.6%.

Looking ahead to fiscal 2024, analysts estimate adjusted EPS for AIG will be $4.99, down by 26.5% from $6.79 in fiscal 2023. However, a rebound is expected in fiscal 2025, with an anticipated adjusted EPS growth of 35.9%, reaching $6.78.

This year, AIG stock has risen by 15.9%. However, this performance lags behind the S&P 500 Index, which has seen a rise of 23%, and the Financial Select Sector SPDR Fund, up 26.7%, in the same period.

AIG shares declined 5.5% and continued to slide for two more trading sessions following the release of Q2 earnings on July 31. The company faced challenges during a strategic repositioning, leading to the deconsolidation of CoreBridge Financial. This resulted in a considerable $4.7 billion loss associated with the transaction, contributing to a net loss of $4 billion for shareholders, a stark contrast to the $1.5 billion net income reported in the previous year.

While some of the loss was anticipated by the market, AIG still missed analysts’ adjusted earnings expectations by a notable margin. Additionally, total revenues of $6.6 billion fell short of Wall Street’s forecasts, exacerbating the decline in stock prices.

The general sentiment around AIG stock remains cautiously optimistic, with a “Moderate Buy” rating among analysts. Of the 18 analysts monitoring the stock, 10 recommend a “Strong Buy,” two suggest a “Moderate Buy,” and six advise holding the stock. The average price target of $84.72 indicates a potential upside of 7.9% from current prices.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.