“`html

Warning Signs for High-Momentum Stocks in Consumer Discretionary Sector

As of Oct. 21, 2024, four stocks in the consumer discretionary sector raise caution flags for investors focused on momentum trading.

The Relative Strength Index (RSI) serves as a crucial momentum indicator. It gauges a stock’s performance on days when prices rise against days when they fall. An RSI above 70 typically signals that a stock may be overbought, a term well recognized among traders, as outlined by Benzinga Pro.

Below is the current list of notable overbought stocks in this sector.

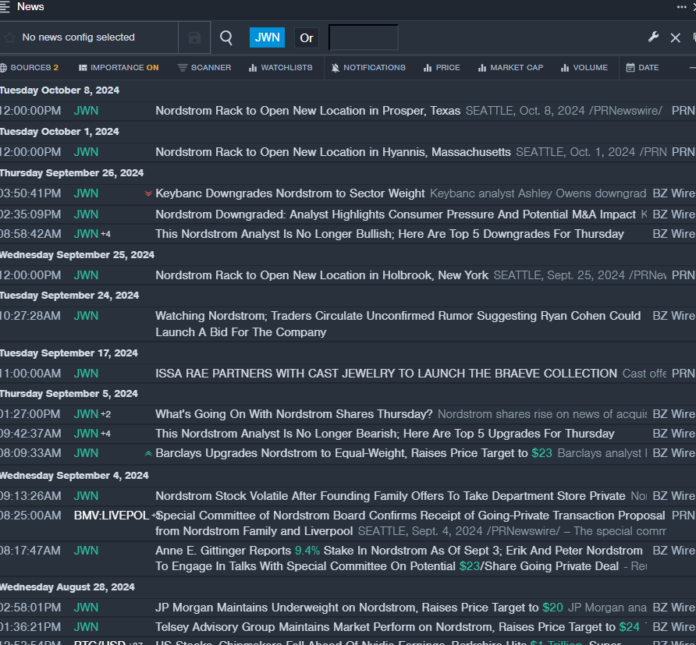

Nordstrom Inc JWN

- On Sept. 26, Keybanc analyst Ashley Owens downgraded Nordstrom from Overweight to Sector Weight. The stock has seen a 10% increase over the past five days, reaching a 52-week high of $24.93.

- RSI Value: 76.29

- Current Price Action: Nordstrom shares closed at $24.67 on Friday, up by 0.9%.

- Benzinga Pro’s real-time newsfeed reported the latest developments for JWN.

Toll Brothers Inc TOL

- On Oct. 2, Oppenheimer analyst Tyler Batory reaffirmed an Outperform rating for Toll Brothers and raised the price target from $168 to $189. The stock gained approximately 6% in the past week, attaining a 52-week high of $160.12.

- RSI Value: 72.41

- Current Price Action: TOL shares closed at $159.58 on Friday, rising by 1.9%.

- Benzinga Pro’s data was instrumental in tracking TOL’s upward trend.

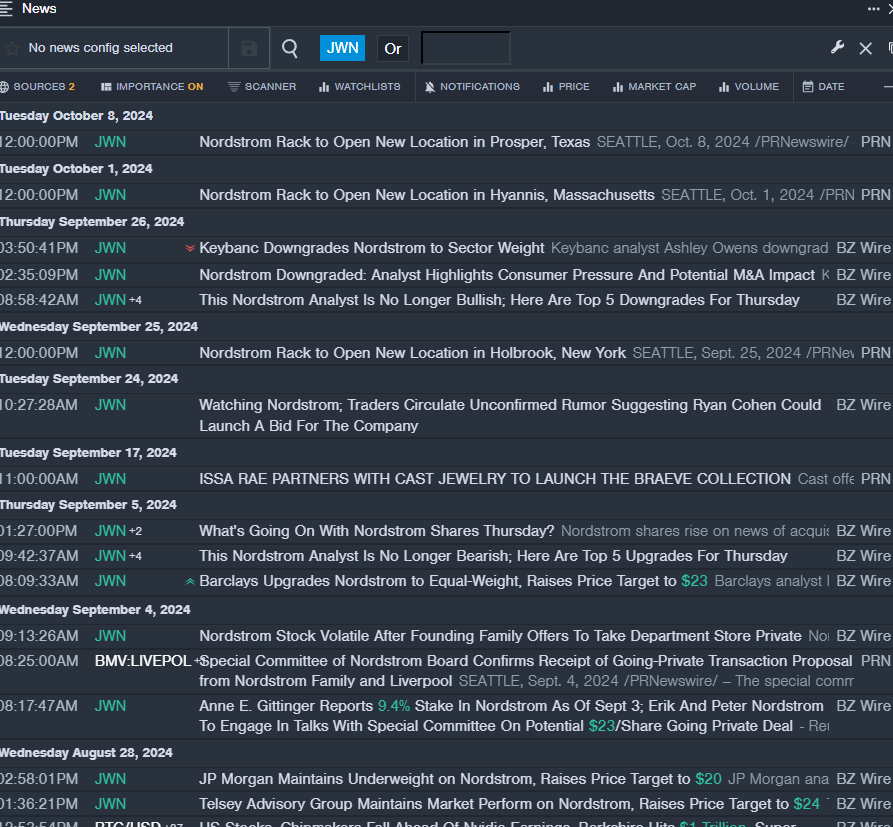

Autoliv Inc ALV

- On Oct. 18, Autoliv announced better-than-expected third-quarter sales. Mikael Bratt, the CEO, shared that global light vehicle production fell nearly 5% due to inventory cuts in the Americas and high prior-year comparisons in China. Nevertheless, Autoliv was able to outperform light vehicle production by 4 percentage points, maintaining stable sales despite facing a $14 million supplier settlement cost. The stock rose about 6% over the last five days, with a 52-week high of $129.38.

- RSI Value: 70.49

- Current Price Action: Autoliv shares closed at $99.52, increasing by 6%.

- Benzinga Pro’s alerts indicated a potential breakout for ALV shares.

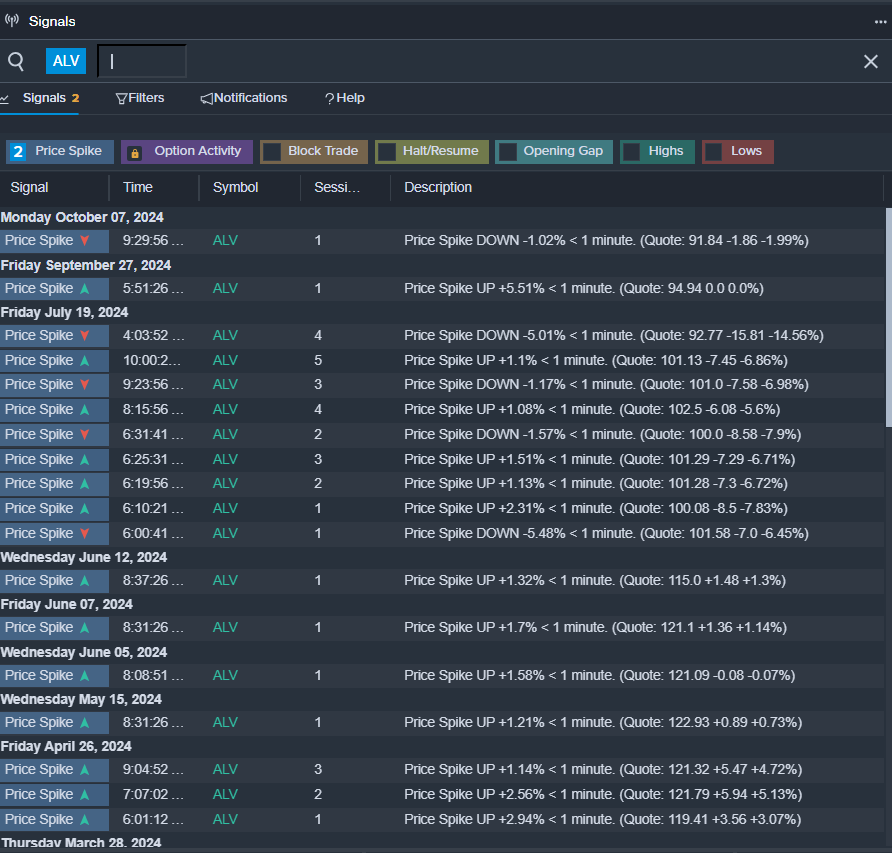

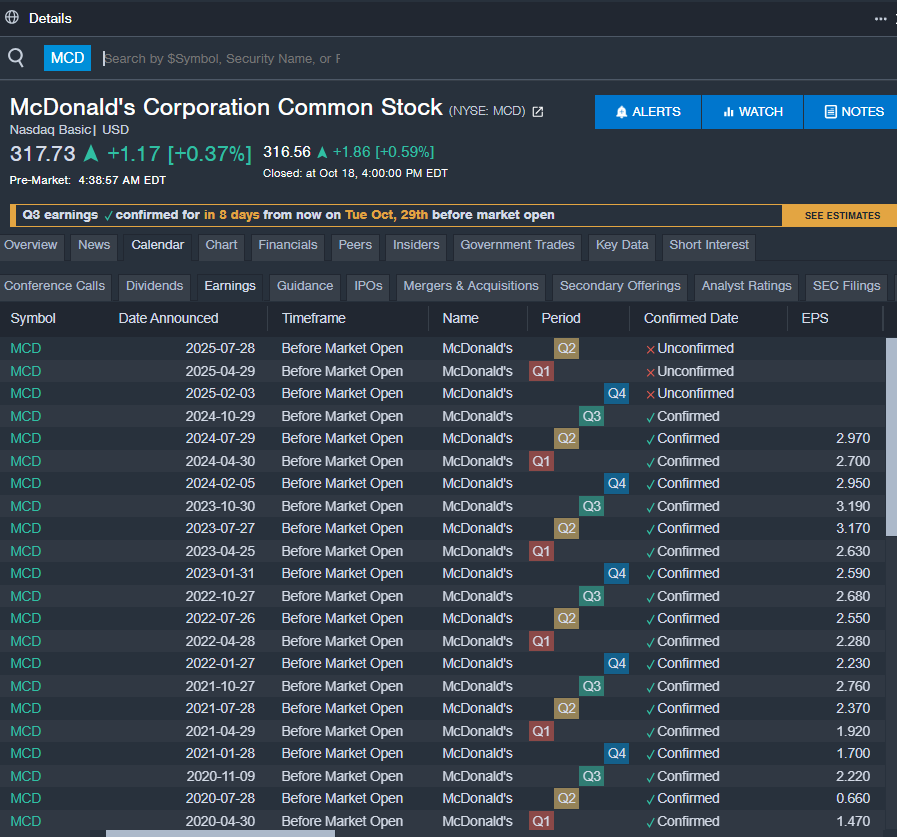

McDonald’s Corp MCD

- On Oct. 16, TD Cowen analyst Andrew Charles maintained a Hold rating for McDonald’s and lifted the price target from $280 to $300. The stock has surged nearly 6% in the past month, hitting a 52-week high of $317.18.

- RSI Value: 82.85

- Current Price Action: McDonald’s shares closed at $316.56, rising by 0.6%.

- Benzinga Pro’s earnings calendar was utilized to monitor forthcoming MCD earnings reports.

Read More:

Market News and Data brought to you by Benzinga APIs

“`