BAE Systems Plc has secured a significant contract at its Norfolk Ship Repair facility for ship repair services on the USS Laboon (DDG 58), an Arleigh Burke-class warship. The contract was awarded by the Naval Sea Systems Command based in Washington, D.C.

BAE Systems Wins $114.8 Million Ship Repair Contract

Contract Overview

The contract is valued at $114.8 million, with possible options that could raise the total to $117.9 million. Under this agreement, BAE Systems will handle the maintenance, modernization, and repairs for USS Laboon. Specifically, the company will provide labor, supervision, equipment, testing, facilities, and quality assurance needed for these critical projects.

This project is scheduled for completion by February 2026 and will take place in Norfolk, Virginia.

Reasons Behind Increased Demand for BAESY

Several factors are driving up demand for military ship repairs globally. Rising geopolitical tensions and the need for better maritime defense make it essential for nations to maintain and upgrade their naval fleets. In addition, older military ships require consistent maintenance to stay operationally ready and technologically up to date. Also, heightened investments in naval modernization projects and a growing emphasis on cybersecurity enhancements for naval vessels contribute to the rising demand for repairs.

As the need for military ship repairs grows, the naval vessel maintenance, repair, and overhaul (MRO) market expands as well. According to Mordor Intelligence, a 2.1% compound annual growth rate for the global naval vessel MRO market is expected between 2024 and 2029.

This positive outlook is promising for BAE Systems, which is seeing a steady flow of contracts for modernization and repair jobs on warships, reflected in their recent USS Laboon contract. The firm stands as a leading provider of Maintenance, Repair, Overhaul, and Conversion services for the non-nuclear surface ship fleet. Notably, the Norfolk Ship Repair facility spans 109 acres and operates around the clock, every day of the year.

Potential Benefits for Competitors

Several other defense contractors are well positioned to benefit from the growing naval vessels MRO market:

General Dynamics (GD): The NASSCO division, the largest full-service shipyard on the U.S. West Coast, can repair any ocean-going vessel. NASSCO is a Master Ship Repair contractor for the U.S. Navy and serves as a key maintenance facility for its Pacific Fleet ships. The stock is projected to achieve a long-term earnings growth rate of 12.40%, with 2024 sales estimates indicating a 12.5% rise from last year.

Huntington Ingalls Industries (HII): The Newport News Shipbuilding unit has designed, constructed, overhauled, and repaired over 800 ships for the U.S. Navy and commercial customers. For over 40 years, the U.S. Navy has depended on HII for maintenance and modernization of its fleet. The stock shows a long-term earnings growth rate of 6.90%, with a 2.9% 2024 sales increase projected compared to the previous year.

Northrop Grumman (NOC): Northrop Grumman supplies advanced defense systems, including navigation and combat systems for naval vessels. Its Integrated Platform Management Systems (IPMS) provide sophisticated control solutions for naval ships. Increased investment in ship MRO services is likely to boost demand for NOC’s advanced systems. The stock shows an 8.70% long-term earnings growth rate, and 2024 sales estimates reflect a 5.4% improvement from the last year.

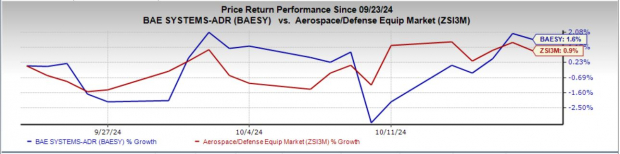

BAESY Stock Performance

In the last month, BAE Systems’ stock has climbed by 1.6%, outperforming the industry growth of 0.9%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Current Zacks Rank for BAESY

BAE Systems holds a Zacks Rank #2 (Buy). You can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Insights on the Semiconductor Market

In an interesting development, Zacks recently highlighted a leading semiconductor stock with significant potential, even after NVIDIA’s remarkable +800% surge since its recommendation. The new stock is set to benefit from the booming demand for Artificial Intelligence and related technologies, with the global semiconductor market projected to soar from $452 billion in 2021 to $803 billion by 2028.

For those interested in the latest investment insights, you can download a report titled “5 Stocks Set to Double” for free.

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

BAE Systems PLC (BAESY): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

To access this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.