“`html

Exploring Investment Opportunities in the Booming AI Market

If you want to create huge upside potential for your portfolio, become familiar with the AI industry. According to data compiled by Statista, the AI market is already worth $184 billion. However, by the end of the decade, its value is expected to soar to an astounding $827 billion, representing an average annual growth rate of nearly 30%!

How can you capitalize on this growth? The two AI stocks highlighted below may be your best bets.

Investing Early in AI: A Look at Nvidia

Are you considering investing in the rise of AI? Start with Nvidia (NASDAQ: NVDA).

There’s an old saying: during a gold rush, sell shovels. This implies that those who sell the tools often profit more than the miners themselves. Nvidia exemplifies this concept in today’s AI landscape. Training and operating AI models requires substantial computing power, typically achieved with specialized chips known as high-end graphics processing units (GPUs).

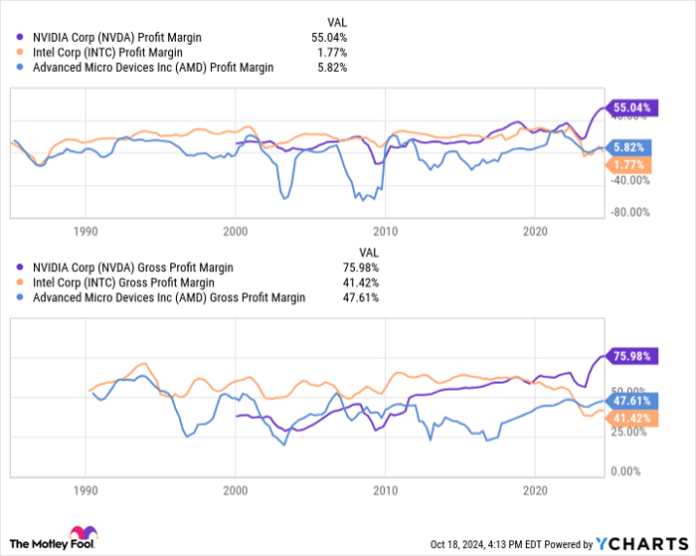

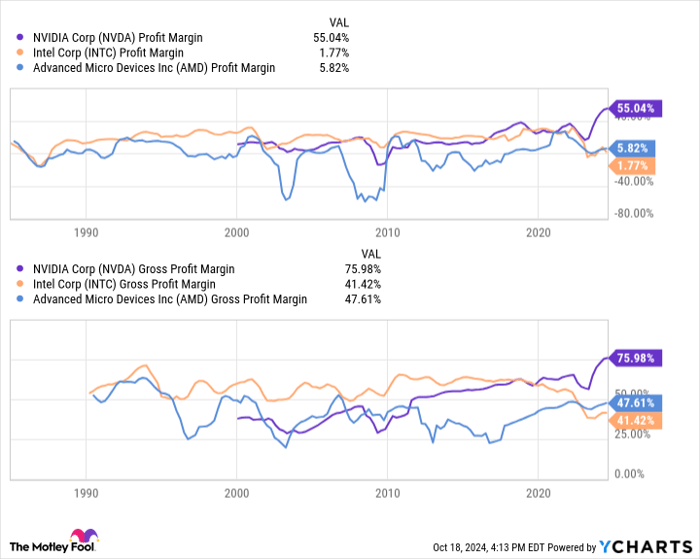

Nvidia currently holds the strongest position in the AI chip market, with estimates showing it commands a 70% to 95% market share. Its impressive gross margins of around 76% significantly exceed those of competitors, who are generating only 40% to 50% margins.

NVDA Profit Margin data by YCharts

The AI spending surge propelling Nvidia’s growth is not expected to be a fleeting trend. Spending on AI infrastructure may quadruple by the decade’s end, growing at a compound annual growth rate (CAGR) of nearly 30%. Although competition will intensify, Nvidia’s substantial advantages—both financial and reputational—allow it to heavily invest in new technologies.

If you perceive a higher risk of Nvidia’s dominance declining, consider stocks like Intel and Advanced Micro Devices as alternative AI hardware investments. For now, though, Nvidia remains the go-to choice for those wanting direct exposure to AI’s growth.

Finding Growth in Smaller AI Companies

While I fully support Nvidia stock, its current valuation at $3.3 trillion raises questions about its potential for future stock price appreciation. Although I anticipate significant sales growth over the next decade, the market has adjusted, valuing it at an impressive 35 times its sales.

For investors aiming to maximize returns from AI stocks, smaller companies like SoundHound AI (NASDAQ: SOUN) present interesting opportunities. With a market valuation of just $1.9 billion, SoundHound is poised to benefit from numerous AI growth drivers. The trade-off is a higher risk but potentially substantial rewards.

As its name implies, SoundHound operates in voice and sound AI. Whether you’re asking your device a question, talking to your car, or placing a food order, SoundHound’s technology aims to enhance your experience while optimizing business operations.

Established for decades, SoundHound has partnered with major automakers, global restaurant brands, and tech companies. However, it faces intense competition from tech giants also working on voice AI systems.

The company’s long-term success remains uncertain as it currently faces losses, and its annual research and development budget of $56 million is notably smaller than rival companies. Nonetheless, investing in SoundHound provides exposure to AI advancements at a price below $2 billion. With evolving technology, there’s potential for remarkable growth ahead.

Is Nvidia a Smart Investment Right Now?

Before purchasing Nvidia stock, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now—and Nvidia was not included. The chosen stocks are expected to yield substantial returns in the years to come.

If you had invested $1,000 in Nvidia when they made this list on April 15, 2005, it would now be worth $845,679!

Stock Advisor offers investors a clear path to success, including portfolio guidance, ongoing updates from analysts, and two new stock picks each month. Since 2002, this service has outperformedS&P 500 returns by more than four times.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and suggests the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`