Netflix Stock: A Potential Upswing as it Hits Key Support Level

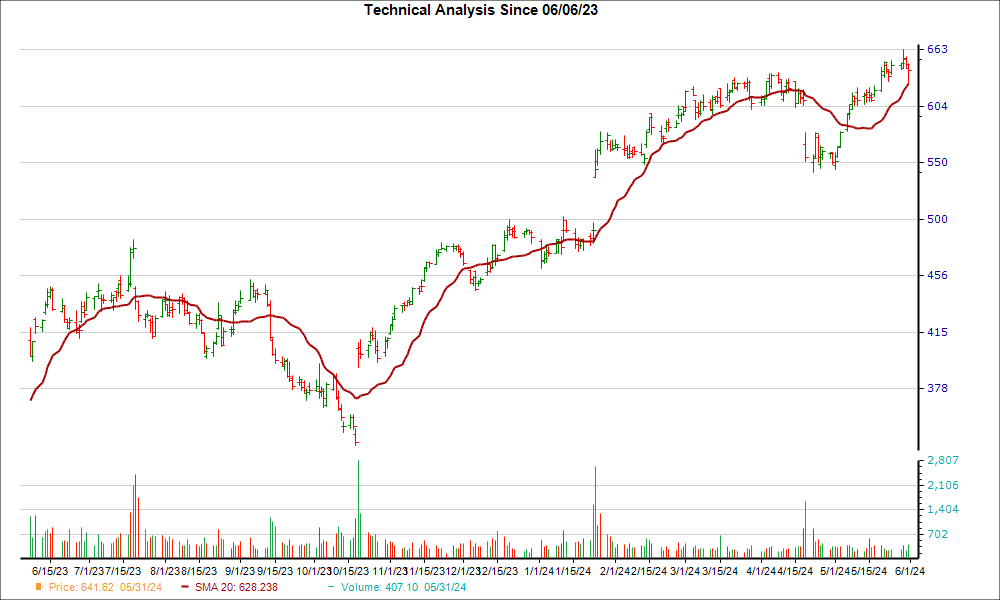

Netflix (NFLX) is showing promise from a technical standpoint, having recently reached an important support level. The stock’s rise above the 20-day moving average indicates a possible short-term bullish trend.

The Significance of the 20-Day Moving Average

The 20-day simple moving average (SMA) is a widely used tool by traders. It provides insight into a stock’s price over a shorter time frame, helping to smooth out price swings. Additionally, the 20-day SMA can indicate trend reversals more effectively than longer-term moving averages.

When a stock’s price surpasses the 20-day moving average, the trend is viewed positively. Conversely, if the price falls below this level, it may signal a downward trend.

Positive Momentum for NFLX

NFLX has seen a 9% surge over the last month, suggesting it may be poised for another rally. Currently, the company holds a Zacks Rank of #2 (Buy), making it an enticing option for investors.

Favorable Earnings Estimates

The bullish outlook for NFLX is further reinforced by positive changes in earnings estimates. Over the past two months, none of the earnings estimates have declined for the current fiscal year, while ten have increased. This uptick in consensus estimates should encourage investors looking for potential gains.

Given the key technical indicators and favorable earnings outlook, NFLX may be well-positioned for further growth in the near term.

Zacks Highlights a New Semiconductor Stock

In related news, Zacks has identified a top semiconductor stock that measures just 1/9,000th the size of NVIDIA, which has soared over 800% since their recommendation. Although NVIDIA remains robust, this new chip stock shows significant growth potential.

With strong earnings growth and a widening customer base, it’s set to capitalize on the growing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor industry is anticipated to skyrocket from $452 billion in 2021 to $803 billion by 2028.

Want cutting-edge insights? You can download the report on 5 Stocks Set to Double for free.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.