Three Resilient Stocks for Steady Income During Economic Uncertainty

The stock market generally carries more risk compared to bonds, high-yield savings accounts, or simply holding cash. However, some stocks are notably safer than others, though none can be considered entirely risk-free.

When looking for stable stocks, key factors include the company’s industry, its robust business model, and a balanced financial statement that can withstand economic downturns. Another important aspect is a company’s potential for earnings growth, which can enhance dividend payouts over time.

Coca-Cola (NYSE: KO), Clorox (NYSE: CLX), and Southern Company (NYSE: SO) represent three investment options with recession-resistant business models and a history of increasing dividends. Investing $900 in each stock can yield an average dividend return of 3%, significantly higher than the S&P 500 index’s average of 1.3%. This approach could generate over $80 in annual passive income, with potential for growth if these companies continue to raise their dividends. Here’s an overview of each stock and why they merit consideration today.

Image source: Getty Images.

1. Coca-Cola: The Pillar of Stability

Coca-Cola exemplifies a safe stock with its status as a Dividend King, boasting 62 consecutive years of dividend increases. Its diverse range of products spans major non-alcoholic beverage categories, from soda and juice to water and energy drinks. This diversity protects the company against downturns in any one product line or region.

The company’s strongest asset lies in its branding capabilities. Coca-Cola effectively develops and markets its products, granting it the flexibility to innovate and take risks. While not every new brand will succeed, the company is positioned to learn from its missteps and capitalize on successful ideas.

Unlike discretionary consumer products like cars or home improvement items, demand for Coca-Cola’s beverages remains relatively stable even during economic slumps. The company offers a dividend yield of 2.8%, making it a solid choice for conservative investors seeking consistent income during retirement.

2. Clorox: A Comeback Story Worth Watching

Clorox faced significant challenges this summer, resulting in a sharp decline in stock prices, but has since rebounded with a 20% increase over the past three months. Despite this rally, the company’s fiscal outlook for 2024 reflects modest growth, with organic sales expected to rise by only 3% to 5%.

The optimism surrounding Clorox may stem more from future potential than current performance. The company has implemented aggressive cost-cutting strategies and divestitures to focus on its strongest brands and markets. This focused approach is likely to enhance profit margins over time.

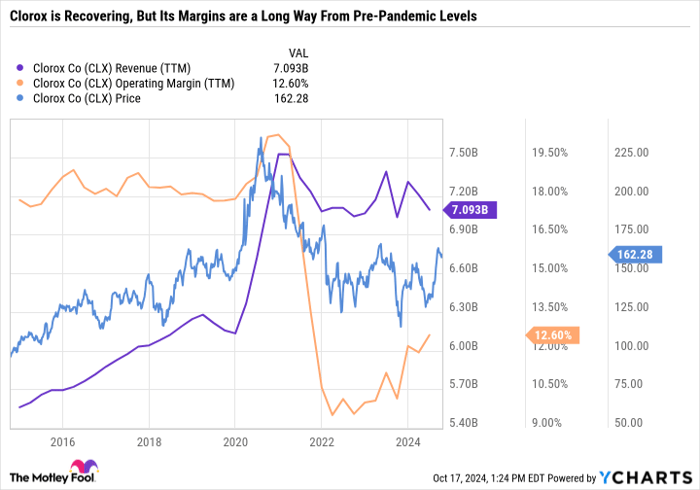

A look at the financials reveals that Clorox’s current price is similar to where it stood five to seven years ago. However, operating margins have seen a significant decline from pre-pandemic levels of around 18% to 20%. Encouragingly, revenue generation is on the rise.

CLX Revenue (TTM) data by YCharts

The silver lining for Clorox is its impressive portfolio of brands, including popular products like Bounty, Glad trash bags, and Brita water filters. The company has raised its dividend for 46 consecutive years and currently offers a 3% yield. While it appears expensive now, keeping an eye on how Clorox strengthens its weaker brand lines will be key to monitoring its potential recovery.

3. Southern Company: Your Source for Reliable Income

This month, Southern Company achieved a historic milestone by surpassing a $100 billion market cap. The utility company operates primarily in the Southeastern United States, earning profits through traditional electricity generation, natural gas distribution, as well as renewable energy projects.

Southern Company is noteworthy for its investment in nuclear energy, recently launching two new nuclear plants through its subsidiary Georgia Power. Named Vogtle 3 and Vogtle 4, these facilities mark the first new nuclear units built in over thirty years, positioning Plant Vogtle as the leading generator of clean energy in America, with an annual electricity production exceeding 30 million MWh.

For perspective, U.S. utilities generated a total of 4.178 billion MWh of electricity last year, with approximately 775 million MWh coming from nuclear sources. Plant Vogtle alone accounts for around 0.7% of the nation’s utility-scale electricity output.

As nuclear power gains traction, especially among tech giants looking for energy solutions, Southern Company’s focus on a diversified energy portfolio—including wind, solar, and natural gas—offers stability and experience. With a dividend yield of 3.2% and 23 years of consecutive dividend increases, it stands out as a strong income-generating stock.

Conclusion: Seize the Opportunity

Do you feel like you missed out on buying successful stocks early on? Take heart; opportunities may still arise.

Our team of experts occasionally issues a “Double Down” recommendation for select stocks they believe are poised for significant growth. If you think you’ve missed the chance to invest, now could be a prime time to consider these recommendations.

- Amazon: A $1,000 investment in 2010 would be worth $21,285 today!*

- Apple: A $1,000 investment in 2008 would have grown to $44,456!*

- Netflix: A $1,000 investment in 2004 is now worth $411,959!*

Currently, we are issuing “Double Down” alerts for three exceptional companies. Don’t let this opportunity slip away.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Suzanne Frey, an executive at Alphabet, is on The Motley Fool’s board of directors. Daniel Foelber does not hold positions in the stocks mentioned. The Motley Fool has positions in and recommends Alphabet. The Motley Fool’s disclosure policy applies.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.