Nvidia’s Future: Should Investors Hold or Dive In?

The rise of artificial intelligence has catapulted Nvidia (NASDAQ:NVDA) into a top position among global companies. This year, its stock has skyrocketed by 178%, maintaining a strong upward trajectory.

However, prospective investors may be wary, concerned about whether now is the right time to invest given the company’s high stock valuation.

Investor A.J. Button suggests caution; he believes that value investors should consider waiting for a lower price before investing in Nvidia.

According to Button, “$83 is a reasonable price for a conservative value investor to pay for Nvidia.”

While he acknowledges Nvidia’s commanding presence in the market and its solid competitive edge, he also warns of potential threats. Button highlights that advancements in on-device AI and data center options could gradually challenge Nvidia’s leading position.

“We’re not there yet, but it’s wise to keep in mind these two threats to Nvidia’s dominance as they could soon become reality, preventing us from becoming overly optimistic,” Button states.

Looking ahead, he predicts Nvidia’s revenue will increase by 111% year-over-year through the end of 2024, supported by forecasts from Bank of America and guidance from TSMC. However, he anticipates a slowdown, projecting growth to decrease to 70% in 2025 and further diminish to 20% in 2026. By 2028-2030, he expects growth rates to settle between 10% and 6% due to rising competition and other market factors.

This expected deceleration plays a significant role in Button’s cautious price target of $83. He derived this target by estimating Nvidia’s future cash flows and adjusting them for present value, noting that this target is considerably lower than where the stock currently trades.

“Maybe in the event of a recession or a downturn similar to 2022, my target might be reached,” he adds. “Those buying at today’s prices are taking a significant risk…”

Consequently, Button rates Nvidia shares as a Hold. (To view Button’s performance data, click here)

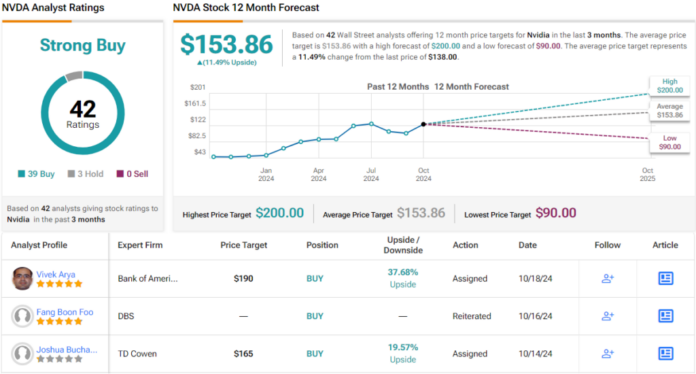

On the flip side, Nvidia continues to be favored on Wall Street. The stock boasts 39 Buy and 3 Hold ratings, leading to a consensus Strong Buy status. Its 12-month average target stands at $153.86, suggesting an upside of approximately 11.5% over the next year. (See NVDA stock forecast)

Disclaimer: The views expressed in this article belong solely to the featured investor. This content is for informational purposes only. Always conduct your own analysis before making any investment decisions.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.