Wells Fargo Upgrades Travere Therapeutics to Overweight Amid Positive Forecasts

On October 21, 2024, Wells Fargo changed its rating for Travere Therapeutics (NasdaqGM:TVTX), moving from Equal-Weight to Overweight.

Analysts Predict Potential Decline in Stock Value

The average one-year price target for Travere Therapeutics stands at $17.56 per share as of September 25, 2024. This estimate varies, with predictions ranging from a low of $9.09 to a high of $26.25. Notably, the projected price indicates a potential drop of 2.99% from its last closing price of $18.10 per share.

Explore our list of companies showing the most significant price target potential.

Strong Revenue Growth on the Horizon

Travere Therapeutics anticipates an annual revenue of $359 million, marking an impressive increase of 102.20%. However, the projected annual non-GAAP EPS is expected to be -2.05.

Institutional Investment Trends

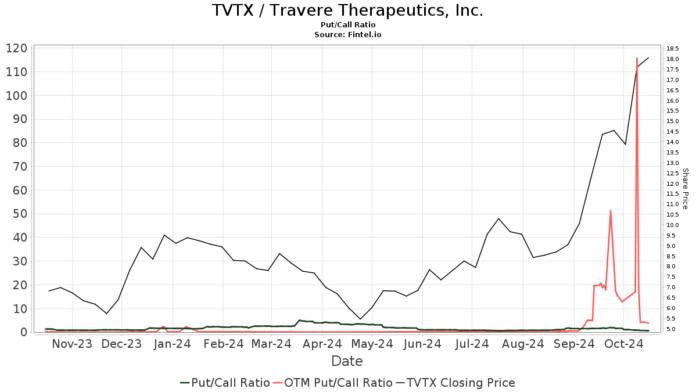

A total of 358 funds and institutions have reported holdings in Travere Therapeutics. This represents a minor increase of two owners, or 0.56%, compared to the previous quarter. The average portfolio weight of these funds is 0.08%, which is up by 5.35%. In the last three months, total shares held by institutions rose by 1.00% to reach 97,064K shares.  The put/call ratio for TVTX is recorded at 0.66, indicating a generally optimistic market sentiment.

The put/call ratio for TVTX is recorded at 0.66, indicating a generally optimistic market sentiment.

Armistice Capital maintains a substantial stake, holding 7,500K shares, which equates to 9.81% ownership, with no changes reported last quarter.

Deep Track Capital also holds 7,370K shares, representing 9.64% ownership, unchanged from the prior quarter.

Rock Springs Capital Management has significantly increased its holdings; currently, it holds 4,482K shares, or 5.86% ownership, reflecting a 23.59% rise from their previous ownership of 3,425K shares. The firm’s allocation to TVTX increased by 65.42% last quarter.

Macquarie Group reduced its stake from 4,613K shares to 4,368K shares, a decrease of 5.61%, although they boosted their overall allocation by 2.08% in the last quarter; they now own 5.71% of the company.

DCCAX – Delaware Small Cap Core Fund holds 3,566K shares or 4.66% ownership, down slightly by 0.76% from 3,593K shares in the previous filing. Their allocation has decreased by 2.63% in the most recent quarter.

About Travere Therapeutics

(Description provided by the company)

Travere Therapeutics is a biopharmaceutical firm that focuses on aiding patients and families affected by rare diseases. Acknowledging the urgent need for effective treatments, Travere collaborates with the rare disease community to explore and develop impactful therapies. The company’s mission emphasizes understanding the unique needs of rare patients to foster new treatment avenues that offer hope for the future.

Fintel offers a comprehensive investing research platform tailored for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, and more. Exclusive stock selections are driven by sophisticated, backtested quantitative models aimed at enhancing returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily represent the views of Nasdaq, Inc.