Avis Budget’s Earnings Forecast Dims as Stock Takes a Hit

Avis Budget Group, Inc.’s (CAR) earnings outlook for 2024 has dropped significantly, with the latest EPS estimates falling short of an already negative consensus.

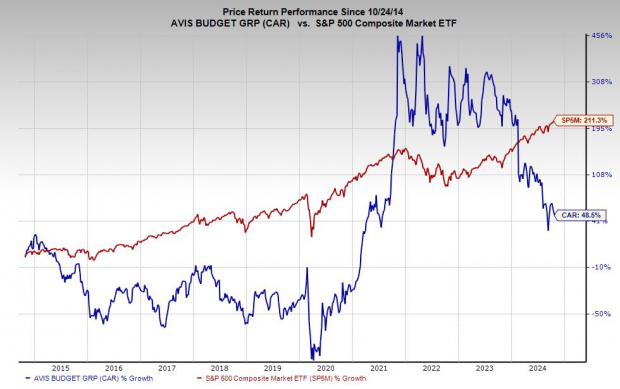

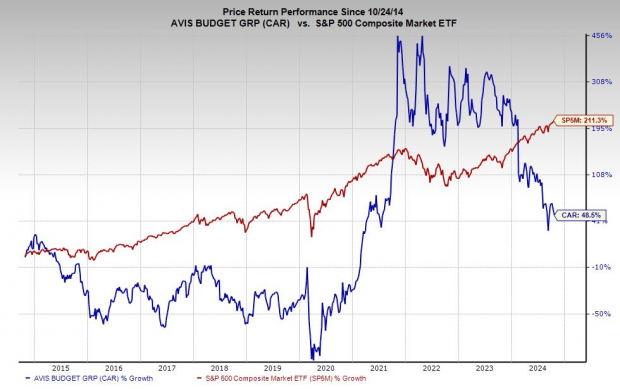

The car rental giant has seen its stock price decrease by 60% over the past two years, raising concerns for potential investors.

Avis Budget Overview

Avis Budget operates about 10,250 rental locations across 180 countries under its well-known brands, Avis and Budget. Most of its operations are concentrated in North America, Europe, and Australasia, while it also works with licensees in other regions.

Image Source: Zacks Investment Research

In addition to its main brands, CAR owns Zipcar, which ranks as one of the largest car-sharing services worldwide.

The car rental industry remains highly competitive, featuring strong price and service rivalry among companies like Enterprise Holdings, Inc. (Enterprise, National, and Alamo brands) and Hertz Global Holdings, Inc. (HTZ) (Hertz, Dollar, and Thrifty brands).

In 2023, Avis Budget’s total expenses surged 20.8% compared to the previous year, and estimates suggest a further 15.6% rise in 2024. High fleet costs have driven these expenses, with monthly per-unit fleet costs up 104% year-over-year during the first half of 2024 (131% increase in the Americas region).

Image Source: Zacks Investment Research

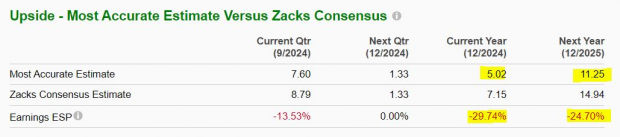

In a concerning trend, Avis Budget fell short of adjusted Q2 earnings per share estimates by 84% year-over-year.

According to Zacks, CAR’s adjusted EPS is forecasted to drop by 83% in 2024, decreasing from $42.08 per share last year to just $7.15 per share. The company’s earnings fell 26% in 2023, and its most current FY24 EPS estimate is 30% below consensus—standing at $5.02 per share against expectations of $7.15.

Caution Advised for CAR Stock

Additionally, the latest estimates for FY25 indicate earnings are predicted to be 25% below consensus. These downward adjustments have resulted in a Zacks Rank of #5 (Strong Sell) for Avis Budget.

The stock has lost 60% of its value in the past two years, erasing a substantial portion of its gains from the post-Covid recovery. Currently, CAR’s price remains well beneath its 200-week moving average, and it has recently dropped below the 50-day moving average as well.

It may be prudent for investors to avoid purchasing Avis Budget stock until a clearer improvement in its earnings outlook is demonstrated.

Anticipated U.S. Infrastructure Investment Surge

A major initiative to address America’s aging infrastructure is imminent, promising bipartisan support. Trillions of dollars will be allocated, creating significant investment opportunities.

The key consideration is whether investors will act quickly to capitalize on the best growth potential in select stocks.

Zacks has prepared a Special Report detailing this opportunity, and it’s available for free. Discover five key companies that stand to benefit most from extensive spending on infrastructure improvements, including roads, bridges, buildings, cargo transport, and energy transitions.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Hertz Global Holdings, Inc. (HTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.