Micron’s Future: Evaluating Its Stock Potential Amidst the AI Revolution

We often hear the phrase, “looks can be deceiving,” and this holds true for Micron (MU), a semiconductor company focused on memory chip design. At first glance, the stock appears overvalued. With earnings at $0.67 per share over the trailing 12 months, it carries a high price-to-earnings (P/E) ratio of 161. However, this does not account for future guidance and estimates that suggest a more favorable valuation.

For those interested in a deeper analysis of Micron’s prospects, Michael Byrne from Tipranks has provided a comprehensive overview of MU stock, available for further reading.

Key Insights on Micron’s Valuation

- Forward-Looking Valuation: Currently, Micron’s trailing price-to-earnings appears inflated. Yet, investors usually look to future potential. The company’s guidance for the next quarter suggests earnings could surge to $1.74 per share, more than double its present figure. Analysts project an impressive $8.93 per share for Fiscal 2025, lowering the P/E ratio to a much more reasonable 11.8. By 2026, estimates indicate a P/E of 8.2, signaling significant upside potential.

- Comparison to Industry Peers: When examining Micron’s expected valuation, it trades at a lower price compared to industry counterparts like Nvidia (NVDA) and AMD (AMD), which have higher P/E ratios of 46.3. While these companies enjoy greater gross margins—Nvidia reports a 76% gross margin versus Micron’s 22.4%—investors need to keep an eye on future trends. Memory chips are becoming increasingly vital in GPU processors, especially with the growing influence of AI. Micron is well-positioned to meet this demand, particularly as advanced technologies require more RAM, which is its core specialty.

- Technological Advancements: Micron stands out in the memory chip market with its high bandwidth memory offerings. These chips are essential for today’s GPUs, enabling them to process vast amounts of data efficiently. As AI technology evolves, the demand for RAM will only increase, putting Micron in a favorable position to see substantial growth in earnings in the years ahead.

What Is MU’s Price Target?

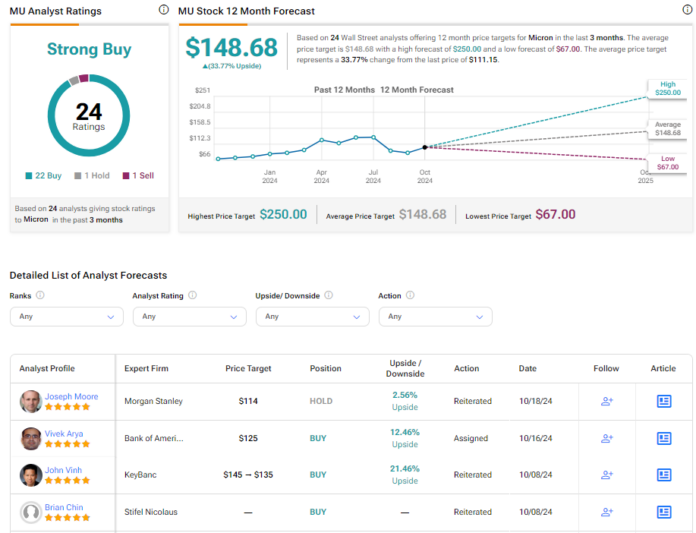

Wall Street has a positive outlook on Micron, rating it as a Strong Buy with 22 Buy recommendations, 1 Hold, and 1 Sell. The average price target for MU stock is $148.68, suggesting an upside of 33.77% from its current levels.

See more MU analyst ratings

Conclusion

Though Micron’s current valuation might seem high at first glance, a closer examination reveals promising prospects. As the company prepares to capitalize on the AI industry’s growing requirements for RAM, it could represent a strong investment opportunity for those willing to look beyond the surface.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.