Morgan Stanley Adjusts ServiceNow Rating Amid Shifting Institutional Holdings

On October 21, 2024, Morgan Stanley revised its outlook for ServiceNow (WBAG:SNOW), changing it from Overweight to Equal-Weight.

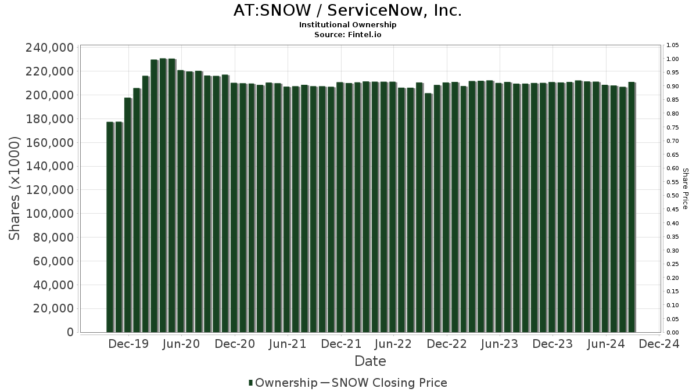

Current Fund Sentiment Towards ServiceNow

There are now 3,166 funds and institutions reporting holdings in ServiceNow, reflecting an increase of 119 or 3.91% since last quarter. The average portfolio weight for all funds invested in SNOW stands at 0.66%, a rise of 0.32%. Institutions collectively increased their shares in the last three months, owning a total of 210,707K shares, which marks a 4.69% increase.

Price T Rowe Associates currently holds 7,712K shares, representing 3.75% ownership. Previously, they reported 8,393K shares, marking a decrease of 8.82% and a 7.43% reduction in their portfolio allocation for SNOW over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares, with 6,480K shares or 3.15% ownership, showed an increase of 0.60% from last quarter when they had 6,441K shares. Their portfolio allocation in SNOW has risen by 0.94%.

JPMorgan Chase owns 5,392K shares, with a 2.62% ownership stake. Their holdings increased by 3.86% from the previous 5,184K shares. However, this fund decreased its portfolio allocation in SNOW significantly by 83.68% recently.

The Vanguard 500 Index Fund Investor Shares own 5,262K shares, which equates to 2.56% ownership. Compared to the previous reporting of 5,166K shares, this reflects an increase of 1.81%, despite a slight decrease of 0.52% in their allocation to SNOW.

Geode Capital Management holds 4,134K shares, representing 2.01% ownership. Their previous stake was 4,036K shares, which signifies an increase of 2.37%. The fund, however, has reduced its portfolio allocation in SNOW by 47.63% over the last quarter.

Fintel is regarded as a leading investing research platform for individual investors, traders, and financial advisors.

Providing comprehensive data that includes fundamentals, analyst reports, ownership information, and much more, Fintel aims to empower users with valuable insights, supported by advanced quantitative models.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.